How to File For an Extension Using Form 8868

Donorbox

SEPTEMBER 28, 2021

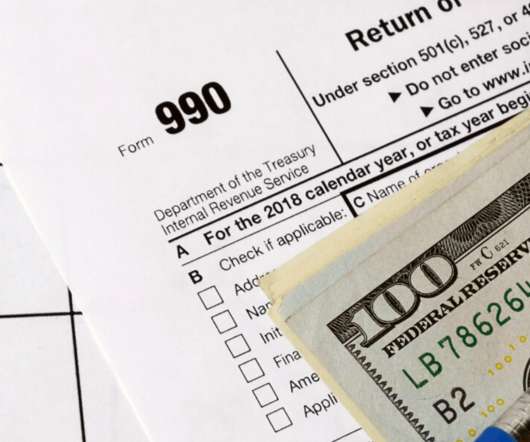

Whether your organization follows a fiscal or calendar year, the timing may not always be convenient. Luckily, the Internal Revenue Service (IRS) gives nonprofits the option to extend this deadline by filing Form 8868. Nonprofits usually file form 990 on an annual basis with the IRS before the 15th day of […].

Let's personalize your content