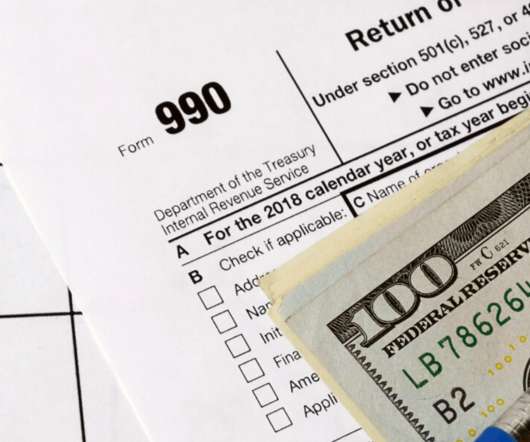

May 16 is Filing Deadline for Many Tax-exempt Organizations

NonProfit PRO

MAY 3, 2022

The Internal Revenue Service reminded tax-exempt organizations that many have a filing deadline of May 16, 2022. Those that operate on a calendar-year basis have certain annual information and tax returns they file with the IRS.

Let's personalize your content