Nonprofit Startups: Apply for 501(c)(3) Status or Secure Fiscal Sponsorship?

Nonprofit Tech for Good

MARCH 19, 2023

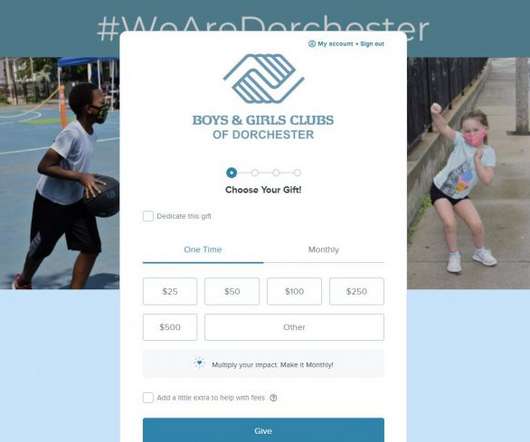

A social entrepreneur, therefore, is a person who explores business opportunities that have a positive impact on their community, in society or the world.” Sponsored groups can always file for a 501(c)(3) status after you’ve proven your concept can gain support from donors and volunteers.

Let's personalize your content