The data/crisis catch-22: How the pandemic created a social sector data gap

Candid

SEPTEMBER 26, 2022

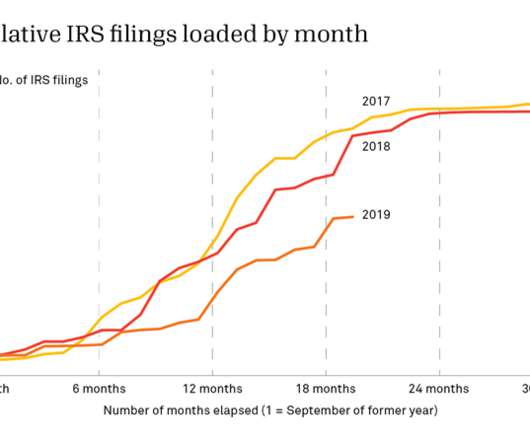

tax-exempt organizations file annually, are a major source of data about nonprofits and foundation grantmaking in the United States. For one, busy and understaffed organizations are requesting filing extensions—the IRS expects roughly 762K tax-exempt extensions for fiscal year 2022. Case in point: 990 data. IRS Form 990s, which U.S.

Let's personalize your content