Demystifying the Overreliance on Tax Filings as Predictive of Future Results

NonProfit PRO

FEBRUARY 7, 2023

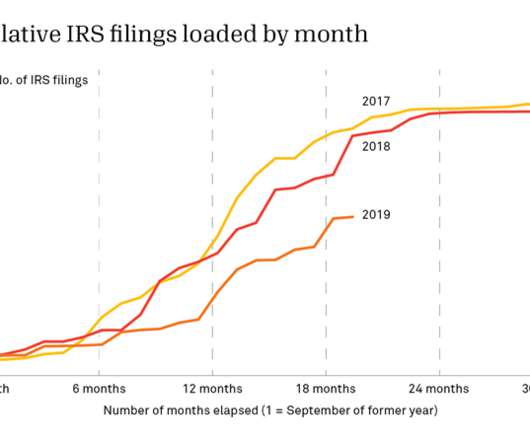

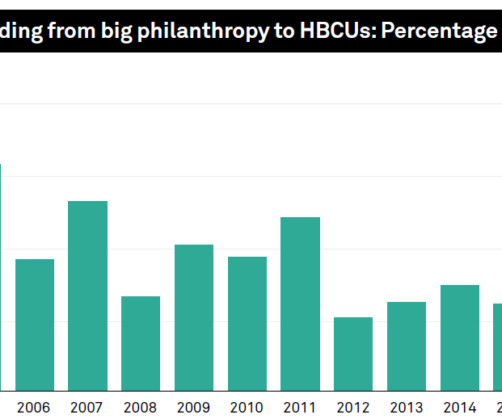

Many nonprofits make a serious error in thinking that the annual reporting of how the sector’s doing is predictive of the future. In reality, external factors such as changes in the economy, donor expectations, and leadership, have a much more significant impact on a nonprofit's future performance.

Let's personalize your content