A Beginner’s Guide to Nonprofit Financial Reporting

Greater Giving

DECEMBER 19, 2023

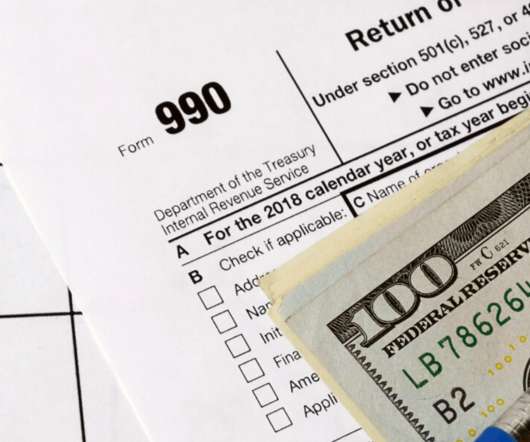

Reporting is a key aspect of nonprofit financial management. Essentially, this term refers to the process of pulling your documented financial data and communicating it to stakeholders. Besides promoting accountability at your organization, financial reporting is legally required according to government regulations for nonprofits.

Let's personalize your content