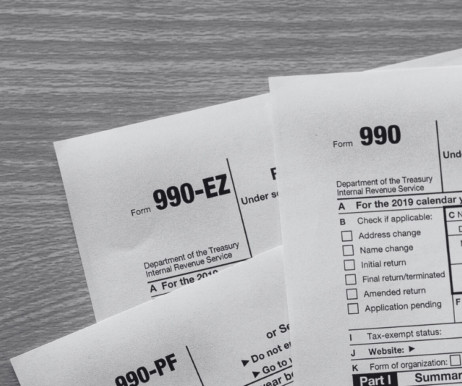

The 990s are here. Why that’s a big deal and what happens now

Candid

JUNE 12, 2023

tax-exempt organizations are requested to file Forms 990 with the IRS annually, sharing information about their organization’s size, location, revenue, grantmaking, etc. Candid uses 990 data as a starting place for our nonprofit profiles and grantmaking databases. Today we have over 800k filings for those years.

Let's personalize your content