Turning Tax Season Tears Into Cheers: Your Chance To Cultivate Donors

Bloomerang

JANUARY 31, 2024

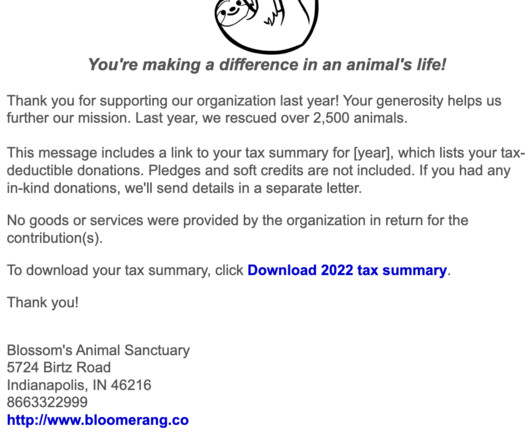

As 2023 has drawn to a close, tax season looms on the horizon, and we nonprofits gear up for a unique opportunity—issuing tax summaries to our donors. Bloomerang refers to them as tax summaries—which they are—but they also summarize each donor’s cumulative giving. What are tax summaries? You can share this link with your donors.

Let's personalize your content