What Are Key Event Metrics and Why Do They Matter?

Greater Giving

DECEMBER 19, 2022

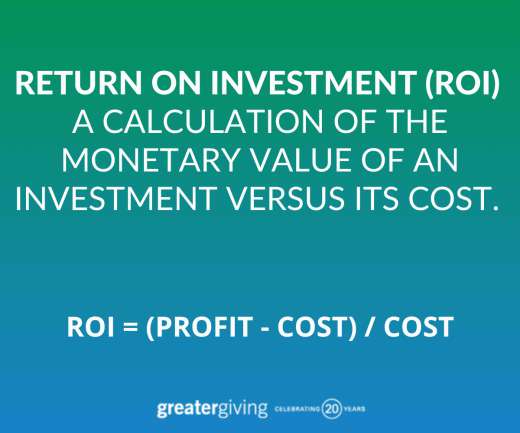

Cost-to-Revenue Ratio. A cost-to-revenue ratio is a slightly different measurement than ROI that can tell you how much profit your event made versus the costs sunk into it, helping you determine whether the event overall showed a profit or a loss. The lower the ratio, the more effective your spending is. . Event Attendance Rate.

Let's personalize your content