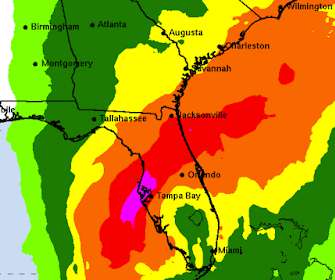

Activating Damage Assessment System for Hurricane Ian

VisionLink

SEPTEMBER 28, 2022

Currently focused on Flo rida’s Gulf Coast, Hurricane Ian’s particular track, combined with the shape of the bay, means that significant storm surges may inundate the Tampa Bay region. This simple, yet powerful tool allows affected households to self-report damage from their smartphone or tablet in less than three minutes.

Let's personalize your content