Who is sharing nonprofit demographic data with Candid?

Candid

MAY 4, 2023

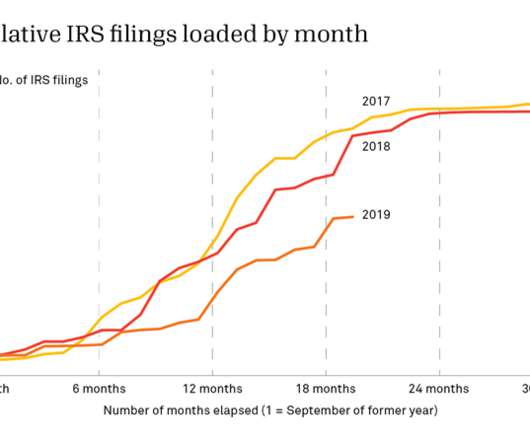

The chart below compares the proportion of nonprofits by subject area overall (in blue) with that of the subset of nonprofits sharing demographic data (in orange). Analysis is limited to 501(c)(3) public charities that filed at least one Form 900 or Form 990-EZ between 2017-2021 and had at least $50,000 in annual expenses.

Let's personalize your content