Filing the T3010 Form? Share your feedback with the CRA

Charity Village

FEBRUARY 1, 2024

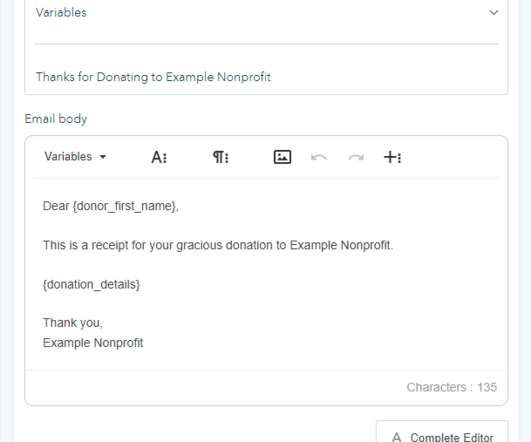

All Canadian charities are invited to provide feedback on Form T3010, Registered Charity Information Return. The Canada Revenue Agency (CRA) is conducting this survey to gather feedback from organizations regarding their experience and method for filing the Form.

Let's personalize your content