Money talks: Why tuning into the Giving Pledge matters

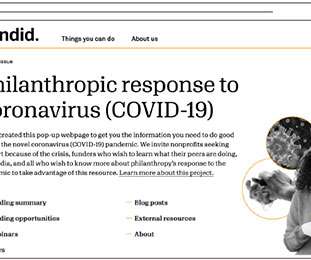

Candid

JULY 18, 2023

As the saying goes, “Money talks,” and there’s no better example of this than the Giving Pledge and its effect on the social sector. To date, 241 individuals with a cumulative net worth easily surpassing $1 trillion have made the pledge—a public commitment to give the majority of their fortunes to charity.

Let's personalize your content