Is your nonprofit organization ‘grant-ready’?

Candid

MARCH 25, 2024

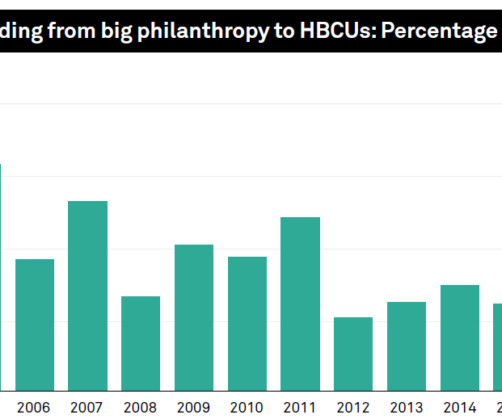

Foundation grants can be one of several revenue streams in a nonprofit organization’s sustainable fundraising plan. In 2022, foundation funding accounted for about $105.21 As a share of all revenue streams, including government funding, program revenue, and investment income, foundation and corporate grants made up 15.3%.

Let's personalize your content