Multi-Year Gift Agreements: Your Donor Retention ‘Ace-In-The-Hole’

Bloomerang

FEBRUARY 5, 2024

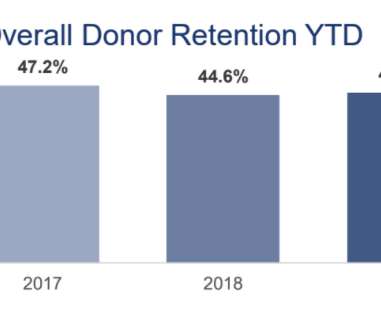

Nonprofits who care about donor retention employ numerous strategies to keep their donors coming back year after year. Personal acknowledgments, impact reporting, and a strong monthly giving program are some of the cornerstones to a high donor retention rate. Savvy fundraisers have always kept donor retention top of mind.

Let's personalize your content