A Beginner’s Guide to Nonprofit Financial Reporting

Greater Giving

DECEMBER 19, 2023

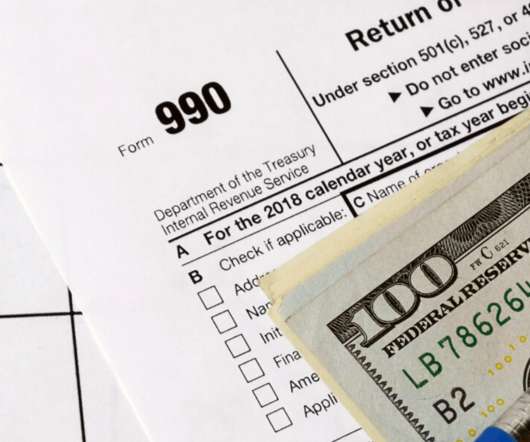

By referencing detailed but understandable summaries of your organization’s financial data, you may be able to identify risks that could lead to noncompliance or accidental fraud and proactively prevent them from impacting your nonprofit. Only some states require nonprofits to file additional tax forms with the state government.

Let's personalize your content