University of Oregon receives $500 million for Knight Campus

Candid

JULY 9, 2021

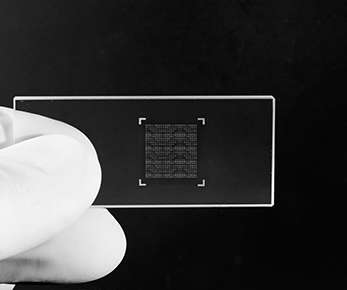

The University of Oregon has announced a second $500 million gift from Penny and Phil Knight in support of the Phil and Penny Knight Campus for Accelerating Scientific Impact. This gift allows us to achieve our larger vision in a very compressed timeline. The Knight Campus enrolls students who are?pursuing

Let's personalize your content