Why You Should Do A Cost-Benefit Analysis Before Throwing Your Next Nonprofit Fundraising Event

Bloomerang

SEPTEMBER 7, 2021

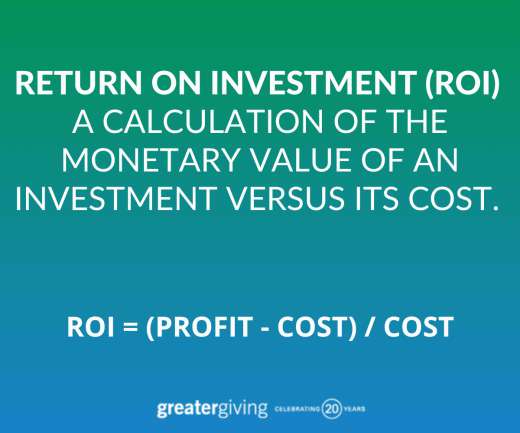

First focus on strategies that develop all those things for you; then consider an event to help the process of transformation to powerful engagement and passionate commitment along. The importance of a cost-benefit analysis for your fundraising strategies. James Greenfield is the guru of fundraising cost-benefit analysis.

Let's personalize your content