How to Demonstrate ROI to Your Nonprofit Board Members

Nonprofit Tech for Good

MAY 5, 2022

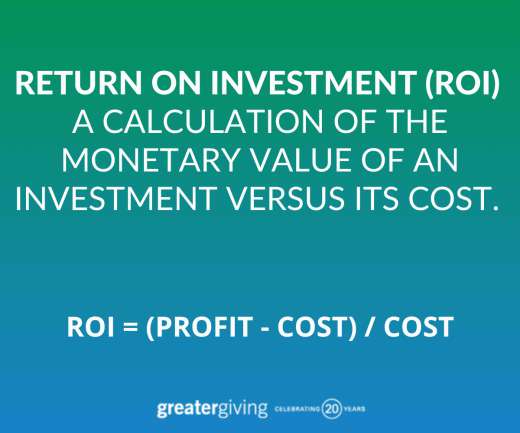

In addition to general business practices, your nonprofit must also be able to accurately track the effects any increases or decreases in fundraising expenses might have on the overall financial picture. . Any number of excellent software solutions and nonprofit tools exist to help with this kind of analysis. About the Sponsor.

Let's personalize your content