990 Forms: Learn the Differences for Your Nonprofit

Achieve

JULY 21, 2022

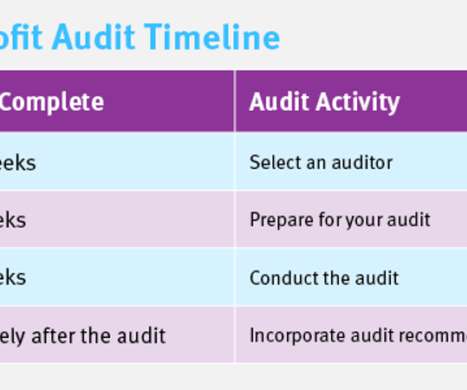

Between the dozens of responsibilities that crop up within the course of running a nonprofit organization—from cultivating donors to event planning—filing tax returns probably isn’t at the top of your list of priorities. Tips to Keep in Mind for Filing Form 990. the differences between each Form 990. We’ll explore: . Form 990-N.

Let's personalize your content