Form 990: Essential Information to Know Before Filing

Greater Giving

APRIL 18, 2023

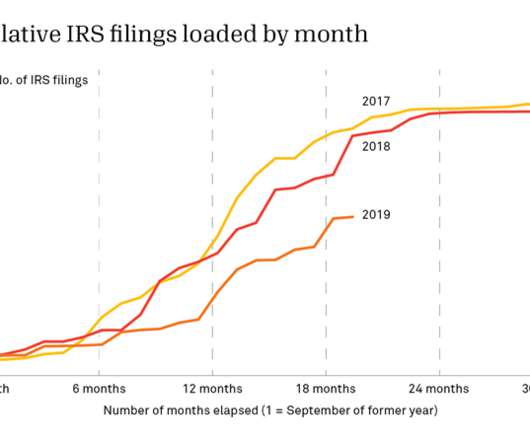

To preserve your status and make the most of your donations , your nonprofit has to file tax forms on an annual basis. The form that most nonprofits need to file is the IRS Form 990. Organizations that miss the filing deadline face penalty fees and the eventual loss of their 501(c)(3) status. Why is filing Form 990 important?

Let's personalize your content