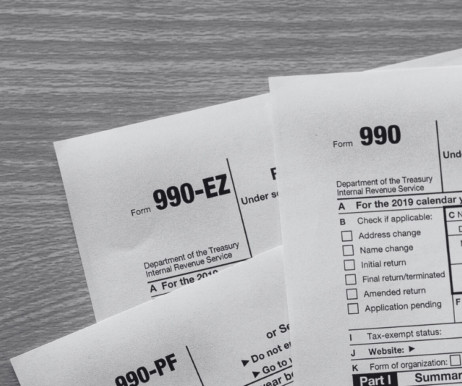

Don’t Make These Common Mistakes When Filing Your Form 990

sgEngage

NOVEMBER 20, 2023

Your tax-exempt status may keep you from having to file traditional tax returns, but maintaining the designation comes with its own labyrinth of forms, requirements, and deadlines. Here are nine common mistakes Nikita and her team at Tax990 see nonprofits make when filing their form 990s.

Let's personalize your content