Have you ever felt overwhelmed by all the ever-changing hoops your nonprofit has to jump through just to accept donations and keep the lights on? That's what many nonprofits are feeling with the PayPal Giving Fund and Meta Charitable Giving Tool’s recent partnership. Like a chess player staring at an unexpectedly moved piece, your nonprofit is left puzzling over new strategies.

The digital landscape has reshaped how nonprofits work, affecting everything from how donations are processed to fundraiser functionalities on Facebook and Instagram. Many of these changes have made donor outreach and accepting donations easier, But is Meta’s recent change to PayPal Giving Fund a stumbling block or a stepping stone?

Let’s answer that question by exploring key aspects of this change - such as its impact on recurring donations, the cost of processing fees, donation receipts handling, and more.

Table of Contents

- Meta’s shift from Network for Good to PayPal Giving Fund

- Understanding the Partnership Between Meta and PayPal Giving Fund

- What is PayPal Giving Fund?

- Navigating the changes: The good, the bad, the ugly

- Solutions for the future of your fundraising

- FAQs

- Conclusion

- TL;DR

Meta's Shift from Network for Good to PayPal Giving Fund

In a significant move, Meta announced their decision to transition from Network for Good to PayPal Giving Fund as their donation processor. This change directly impacts the use of Meta's fundraising tools by nonprofits.

If your nonprofit currently fundraises on Facebook, it will lose access to Meta fundraising tools, unless you review and accept Meta’s updated Charitable Donation Terms by October 21, 2023 at 5pm PT.

Before you jump to accepting the Charitable Donation Terms and continuing on with Meta, let’s dive into how this partnership will work and the impact it will have on your nonprofit.

Understanding the partnership between Meta and PayPal Giving Fund

The shift in Meta's donation processing will change how nonprofits accept donations through Facebook and Instagram. The idea is to simplify the online giving process by only allowing one payment option.

According to Giving USA’s Giving By Generation report 81% of Millennials and 76% of Gen Z donors make donations online or through their phone. As online giving continues to grow in popularity, it’s important that your nonprofit’s funds are being handled with transparency and integrity.

With a Meta and PayPal Giving Fund partnership, we wonder, “are they working in the best interests of nonprofits?”

What is PayPal Giving Fund?

The PayPal Giving Fund is its own distinct 501(c)(3) nonprofit. Instead of donations going into a PayPal account for each nonprofit, they are technically donated to PPGF.

For example, if a donor gives $100 to your mission, that money is actually donated to PPGF, with an implied recommendation to give that donation as a grant to your nonprofit. BUT PPGF has the right to vet your organization to decide whether they will pass those dollars along.

Let me say that again. PayPal Giving Fund can choose to NOT pass your donor’s gift on to you.

Many nonprofits have received their donations from PayPal Giving Fund with no troubles; however, PPGF has faced legal troubles in the past. And in July 2023 a lawsuit against PPGF was revived.

“[The donor] received emails from PayPal that encouraged her to support her favorite charities through its Charitable Giving Fund. PayPal promised to add 1% to each donation made through its platform during the holiday season. The donor gave a total of $3,250 to 13 nonprofit groups...However, only three of those nonprofits received her donations.”

-The Claims Journal

Navigating the Changes: The good, the bad, the ugly

With Meta's switch to PayPal Giving Fund, there are changes you need to be aware of. Let's dive into how this impacts donations, receipts, and reports.

Changes to donation processing fees

In this new structure, nonprofits will no longer be able to use Meta Pay and all donations will go through PayPal Giving Fund (PPGF). Prior to this change, all donation and platform fees were covered by Meta, so that the entire gift was given to the nonprofit. Going forward, a percentage of each donation will now go towards covering those fees meaning nonprofits will receive less of those donor dollars.

Recurring donations are no longer an option

Meta Charitable Giving Tools will no longer offer recurring donations. Recurring donations are one of the most sustainable methods for long-term fundraising. Unfortunately, through Meta and PayPal Giving Fund, donors will only be able to give one-time gifts at this time.

How donors receive receipts

The change lets PayPal Giving Fund issue receipts instead. So what does this mean? Simply put, once a donor makes a contribution using any of Meta Charitable Giving Tools on Facebook or Instagram, they'll receive their donation receipt directly from PayPal Giving Fund.

This shift aims at streamlining the donation flow, but it also might interrupt your nonprofit’s donor engagement flow. Many nonprofits prefer to use their own software to automatically connect with donors through thank yous and receipts that are tailored to their branding.

Managing your donor data

A huge source of frustration for many nonprofits has been the lack of donor data provided by Meta. PayPal Giving Fund, on the other hand, says it will give this information to nonprofits. So, there’s a chance we’ll see more transparency when it comes to who is giving and how much they are donating.

Impact on Fundraisers on Facebook and Instagram

The shift to PayPal Giving Fund has a chance to have a big impact on your nonprofit’s fundraisers across Meta platforms. The most obvious: the potential loss of access to these tools and your donations.

Losing Access to Donation Buttons

If your nonprofit doesn't accept Meta's updated charitable donation terms, you’ll lose access to Donate buttons. This could mean that any active fundraisers created before the switch might not be able to receive donations anymore through Facebook payments. But there's good news too. Nonprofits who have made the transitions can continue using these features without interruption.

The Impact On Existing Facebook And Instagram Fundraisers

Wondering what will happen with existing fundraisers? They won’t just disappear overnight. If your fundraiser was created before PPGF took over on October 12th, there's no need to panic. All donations made prior will be processed and paid out by Network for Good using your current payout method - whether that is a check or direct deposit.

However, after October, all funds raised via Facebook or Instagram will need an approved payout method linked with PayPal Giving Fund instead of Network For Good. Any donation received after this date will go straight into PPGF’s pipeline.

TL;DR

While there are a few potential benefits, overall, the partnership between Meta and PayPal Giving Fund is not a good choice for nonprofits. It limits how you receive funds and how you can communicate with your donors. Yes, there is potential your nonprofit might see a bit more of its donor data. And, you won’t have to worry about sending out receipts to donors who give through Meta, but this change has a lot of downsides as well.

Most important is that PayPal Giving Fund has a history of not being transparent and clear about their giving structure. Donors are technically donating to PPGF as its own 501(c)(3). On top of that nonprofits will no longer be able to accept recurring donations and they’ll have to start paying processing fees. Basically, you’ll be paying more and getting less.

Alternatives to Meta Charitable Giving

DonorDock

Through DonorDock, your nonprofit can create an unlimited number of online giving pages and share them on social media, in email, via text, or with a QR code. Each donation page can be set to different appeals, campaigns, or funds. You can decide whether donors have the option to give a recurring monthly or annual gift. You can also brand your customizable pages, so your donors trust that their donations are going to your nonprofit.

DonorDock never charges you to create a donation page or to accept a gift. You can read more about our donor-funded fees here. All donations are paid directly into the payment processor of your choice with a full transaction report. So you’ll never have to wonder about your donor or donation data.

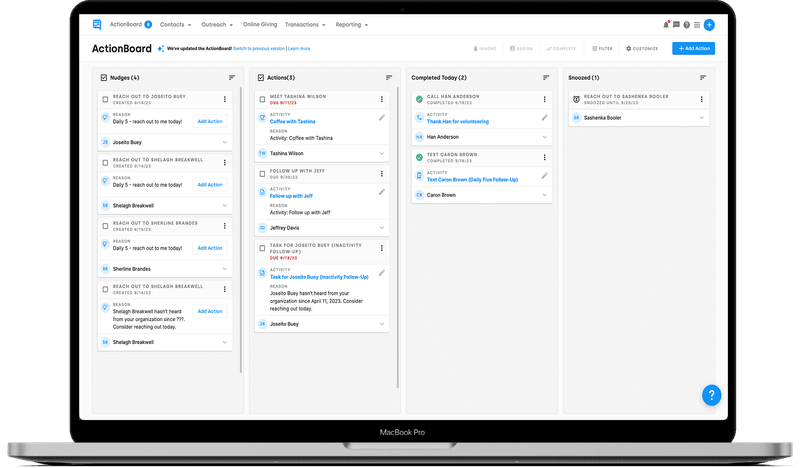

On top of that, DonorDock serves up actionable tasks for you to take to build meaningful donor relationships.

Raise more with beautiful donation pages and build better donor relationships with DonorDock.

OneCause

OneCause is a great solution for the peer-to-peer piece of fundraising. Their peer-to-peer works especially well when paired with an event like hosting a walk/run/ride or an awareness day.

OneCause can also help your nonprofit raise funds through events, auctions, and online fundraising. OneCause integrates well with donor management systems, so your nonprofit can always have a solid grasp on your donor database.

Conclusion

Understanding the new landscape is critical. The shift to Meta Charitable Giving Tools and PayPal Giving Fund means understanding new donation processing structures and updated fundraising tools.

Make sure you understand exactly how this will impact your nonprofit so that you can make the right decisions for you.

Navigating change can be tricky but not impossible. It might be time to take your nonprofit to the next level with a donor development platform that helps you nurture donor relationships and raise more through beautiful online giving pages.

Cultivate your donor relationships with DonorDock. An easy-to-use Donor Management Platform built for nonprofits like yours.

FAQs about Meta Charitable Giving Tools and PayPal Giving Fund

How does the PayPal Giving Fund work?

The PayPal Giving Fund collects donations from donors and passes them onto chosen charities, minus any processing fees. PayPal Giving Fund (PPGF) is its own 501(c)(3) nonprofit. PPGF has the right to vet your organization to decide whether they will pass those donations along.

Can you use PayPal for charity donations?

Absolutely. Nonprofits can receive funds directly through their own accounts or via PayPal. Create an online giving page, connect it to your PayPal account, and you will have immediate access to any donations. Better yet, connect it to a nonprofit CRM and have a clear picture of your donor and donation data.

What is the difference between PayPal and PayPal Giving Fund?

PayPal is an online payment system while its sister service, The Paypal Giving Fund (PPGF) is a registered 501(c)(3) that focuses on charitable contributions. Through PayPal, a nonprofit can create their own account to accept donations directly. But if a donor gives through PayPal Giving Fund, those dollars are technically donated to PayPal Giving Fund.