Nonprofit Operating Reserves: The Key to Financial Fortitude

Imagine this: Your museum must temporarily close its doors while making intensive repairs to the building’s entrance. Or, a decrease in animal adoptions causes a lull in your shelter’s main source of revenue. How do you continue funding your mission?

45% of nonprofits have no emergency fund at all. Of those with cash reserves, more than half of them have less than enough to cover 3 months of their operating expenses for the year. This means that most nonprofits depend on continual fundraising efforts to operate and otherwise have little to no backup plan.

If you’re a nonprofit leader looking to prepare for the unexpected and establish financial fortitude for your organization, this guide is for you! Let’s take a closer look at how you can prepare for times of need with nonprofit operating reserves.

What are nonprofit operating reserves?

Nonprofit operating reserves are funds set aside to sustain an organization through economic uncertainty. These funds serve as a nonprofit’s financial cushion, stabilizing its finances on a “rainy day.”

Financial hardship can crop up almost instantly, such as a roof replacement needed after damage from a storm. These situations can also last for a long time, like the COVID-19 pandemic’s enduring effects years after social distancing mandates were lifted. To prepare for unanticipated costs, your nonprofit must have access to a healthy amount of emergency funding.

How much does your nonprofit need in reserves?

All nonprofits are different, especially when it comes to their funding and operating expenses. Using the examples from earlier, a museum must pay for utilities, but an animal shelter has the added costs of feeding and providing medical services for the animals in its care.

For this reason, no single standard for nonprofit operating reserves applies to all organizations. The key is to have adequate cash resources available to cover time-sensitive expenses, such as payroll, and to account for unforeseen costs or increases.

Some general guidelines include saving three to six months’ worth of expenses, but no more than two years’ worth. At a minimum, nonprofits should be able to cover one full payroll, including taxes.

Where do nonprofit operating reserves come from?

Just like building a savings account for personal finances, nonprofits can develop their operating reserves over time by generating a surplus and designating the excess to be part of a reserve fund. Some organizations include contributions to their operating reserves as a line item in their budget to ensure they’re regularly growing this fund.

Sometimes, nonprofits also receive grants or donations specifically meant to build their operating reserves. This is especially helpful when nonprofits have no surplus and need an extra boost to get started.

What is an operating reserves policy?

Beyond merely growing your operating reserve funds, your nonprofit needs a designated policy to ensure these funds are used properly. An operating reserves policy defines the guidelines and goals of a nonprofit’s operating reserves, including important details such as:

- Rules for building the reserves

- Authorization for using the funds

- Requirements for reporting spending

While these guidelines protect funds from being spent unnecessarily, your policy must be flexible to allow for ease of access in times of need.

How to build your nonprofit operating reserves

Nonprofit operating reserves should be a top priority in every organization’s budget, but how should you begin building this fund? Let’s take a closer look at the steps your nonprofit can take to create an operating reserves policy and start saving.

1. Calculate your operating reserves ratio.

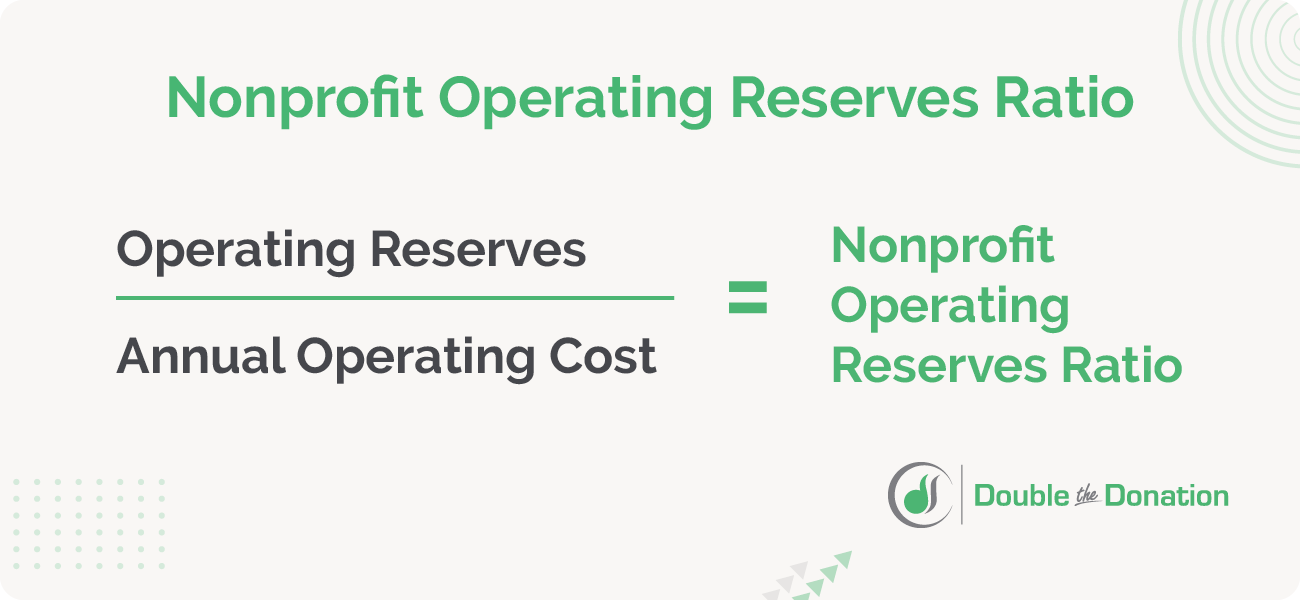

Before creating your policy, determine where your nonprofit’s finances currently stand by calculating your operating reserves ratio. Using either the previous year’s actual expenses or your projected expenses for the current year, divide your operating reserves by your annual operating cost.

As a result, you’ll see what percentage of your annual operating costs could be covered by your savings fund if needed.

2. Set a goal amount.

While there is no standard amount that all nonprofits should adhere to, The NORI Workgroup suggests that 25% of an organization’s annual operating expenses (or 3 months of expenses on average) is a good baseline. To set your target to this amount, multiply your total annual expense by 0.25. For other goals, adjust the percentage as necessary.

The most important element of this goal amount is ensuring it meets your nonprofit’s needs. Rather than choosing a percentage at random, consider the potential uses for this fund and your plan for what to do in such a situation.

For example, even if your museum can’t raise funds through ticket sales during its roof repair, donations from miscellaneous fundraisers might provide extra funding to help your organization get by. Consider any supplementary revenue like this and the intentions for using your operating reserves.

3. Determine your strategy to build the fund.

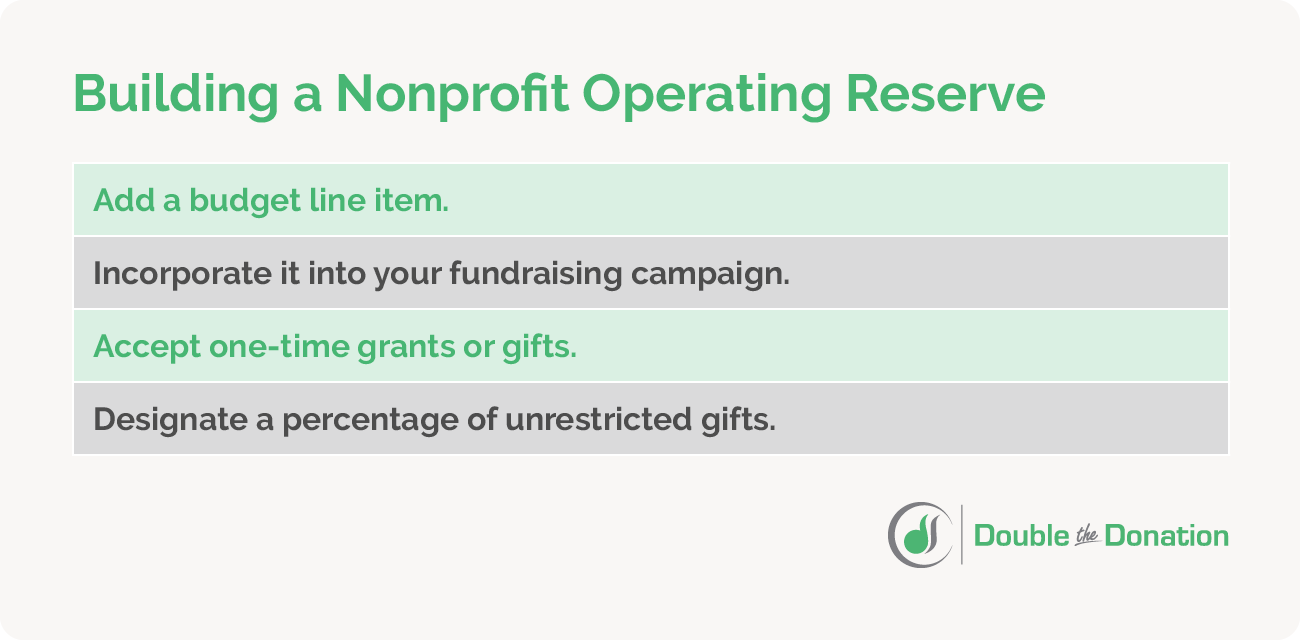

Depending on your nonprofit’s financial situation, some strategies may be more effective than others for building your operating fund. However, there are a variety of ways you can contribute to your reserves, including:

- Adding a budget line item.

- Incorporating it into your fundraising campaign.

- Accepting one-time grants or gifts.

- Designating a percentage of unrestricted gifts.

If you choose to raise funds for your operating reserves through a dedicated fundraising campaign, consider which type of fundraiser will help you raise the most. Then, boost the amount you earn by promoting matching gifts. This corporate giving opportunity can increase not just your nonprofit’s revenue, but donor participation and donation amounts, too.

In fact, 84% of donors are more likely to give and 1 in 3 donors would give more if a match was offered, meaning this fundraising strategy can effectively maximize the amount your nonprofit raises for its operating reserves. For more information on how to make the most of matching gifts, watch the following video:

As the video explains, matching gifts offer twice the funding for the time and effort your nonprofit puts into acquiring one gift. To double the amount you raise for your nonprofit operating reserves, look further into matching gifts and how you can promote them to willing donors.

4. Create rules for using the fund.

While you won’t be able to determine the specific circumstances under which the operating reserves fund may be used, you can establish a distinct purpose for the funding that guides any future usage of it. For example, the fund’s purpose might be to:

- Ensure the stability of the nonprofit’s programs

- Cover an unexpected increase in expenses

- Compensate for an unexpected decrease in funding

- Make purchases to build capacity, such as investing in infrastructure

You’ll want to write out this purpose as part of your policy to ensure everyone is held accountable. Additionally, it could be helpful to mention anything the fund should not be used for to provide extra clarity.

Be sure to also put an individual or team in charge of reviewing and approving requests to use the funds, such as the Executive Director of the board of directors.

5. Assign authority for using the fund.

Along with the circumstances for using the fund, your nonprofit should have a clear chain of command when it comes to who is allowed to access the reserves. Assign authority for using the reserves, including who can request usage and who can authorize it.

In this phase of the process, you should also determine how you’ll report and monitor the fund. Who will be responsible for ensuring the operating reserve is properly used and what accountability measures are in place? For example, a nonprofit operating reserve fund may be kept in a segregated bank account and referred to in financial records by a unique name.

Operating reserves policy template

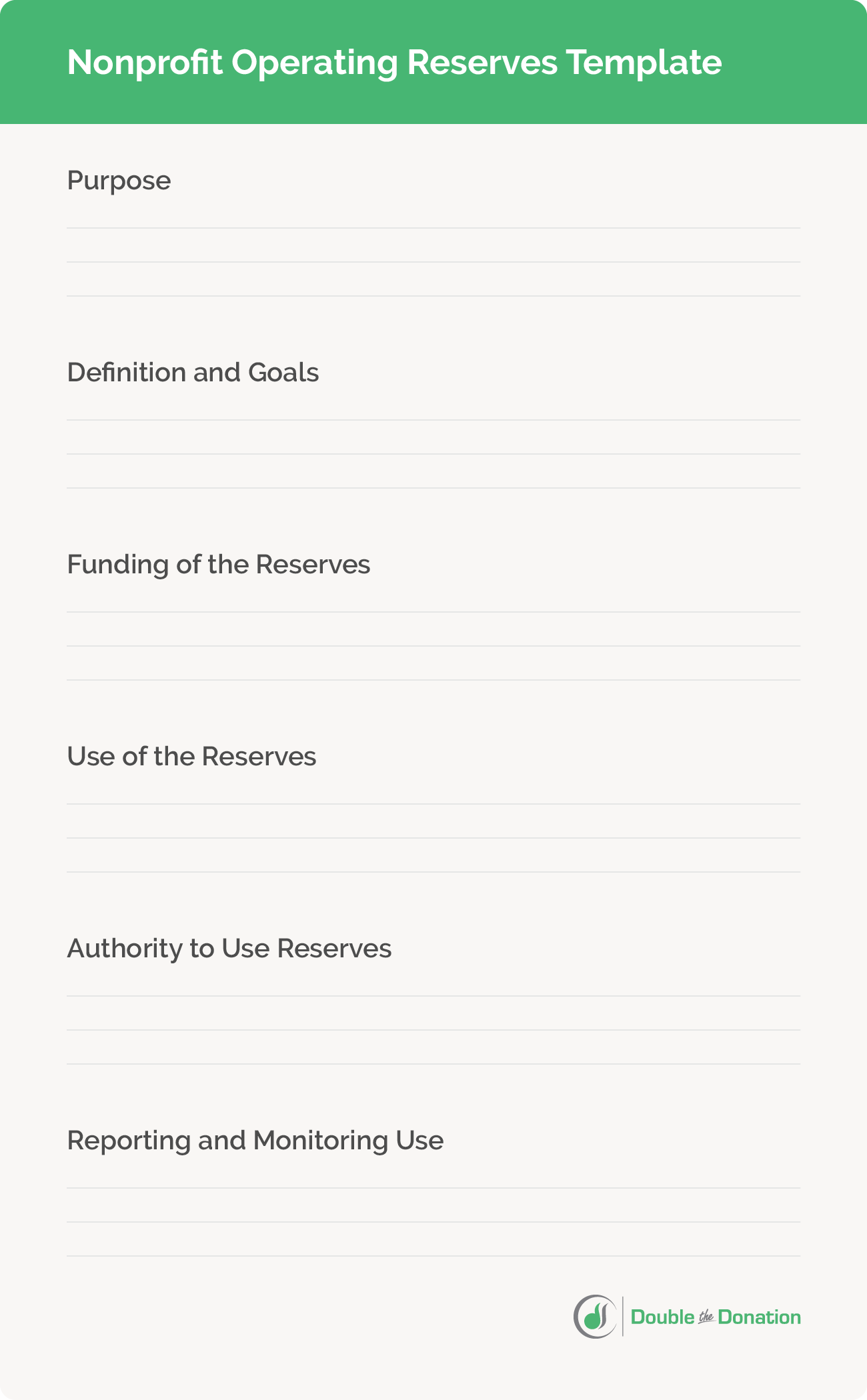

To effectively outline the necessary guidelines and protect your operating reserve funds from misuse, your operating reserves policy should include the following essentials:

- The purpose of the reserves

- The types of reserves and the target amount

- Authority for using each type of reserve fund

- Responsibilities for using operating reserves and reporting use

- Specific policies, if applicable, about investing reserve funds

While these policies are unique to each nonprofit, there are some general guidelines any organization can follow to develop one. For a comprehensive view of what this policy should look like, use this template:

Additional resources for developing an operating fund

It’s no mystery that your nonprofit needs operating reserves. Using the tips in this guide, you can start building an emergency fund to sustain your organization in the most unexpected of situations. For more tips and strategies to maximize your fundraising and build your operating reserves, check out the following resources:

- How to Promote Matching Gifts with the Google Ad Grant. Looking for ways to let your donors know about matching gifts? Maximize their giving by spreading the word through the Google Ad Grant! Learn how in this guide.

- How to Unlock Corporate Sponsorships: Get More Support. Corporate partners can support your nonprofit financially and grow your funding in times of need. Read this guide for tips on unlocking corporate sponsorships.

- Prospect Research: The Ultimate Guide for Nonprofits. Identify your major givers with prospect research to unlock larger gifts and build your operating reserves. Learn the basics of prospect research in this complete guide.