Diversifying Nonprofit Revenue Streams: How to Raise More

As a nonprofit professional, acquiring funds to power your mission is one of your biggest responsibilities. With over $300 billion in fundraising revenue donated in 2023 alone, finding reliable revenue sources might seem simple. However, individual fundraising can be a very volatile source of revenue, fluctuating due to economic trends, your donors’ financial statuses, and more.

That’s why your nonprofit should pursue several other revenue streams besides individual contributions from donors. Choosing and implementing new revenue streams can be challenging, but having the right tools and tips in mind helps your nonprofit achieve financial flexibility and freedom. We’ll help you start strong with these tips:

- 8 Top Nonprofit Revenue Streams

- Nonprofit Revenue Stream Diversification FAQ

- Nonprofit Revenue Stream Diversification: Dos and Don’ts

Diversifying your sources of support will ultimately lead to a more reliable future, empowering you to fulfill your mission. Now, let’s explore the different nonprofit revenue streams your organization can leverage.

8 Top Nonprofit Revenue Streams

Before we discuss how to diversify your nonprofit’s revenue streams, let’s review the top options for you to consider and the top strategy for each.

1. Individual Donations

Individual donations is an umbrella term for many types of fundraising that involve individuals donating to your organization. Some examples of fundraising in this revenue stream include:

- Recurring Giving

- Planned Giving

- Major Giving

- Capital Campaign Giving

- Peer-to-Peer Fundraising

How to Secure Individual Donation Revenue: Prioritize Relationship-Building

“Individual donations” is an umbrella term for many types of fundraising that involve individuals donating to your organization. Some examples of fundraising in this revenue stream include:

- Recurring Giving

- Planned Giving

- Major Giving

- Capital Campaign Giving

- Peer-to-Peer Fundraising

2. Matching Gifts

Matching gifts are a form of corporate giving that allows donors to get their charitable contributions matched by their employers. This valuable opportunity allows your supporters to double or even triple their financial impact on your cause. What’s more, your supporters will likely participate eagerly. According to our matching gift research, 84% of survey participants say they’re more likely to donate if a match is offered.

Top Matching Gifts Strategy: Use a Matching Gift Tool

Most donors don’t leverage their employer’s matching gift policy simply because they’re unaware of their program or how to submit a request. However, your nonprofit can empower them with matching gift software. This tool simplifies the process for donors by telling them if their employer has a matching gift program based on their company email address. Then, it provides steps for submitting a matching gift request based on each employer’s requirements.

When looking for a matching gift tool, prioritize solutions that have auto-submission capabilities. This allows your donors to submit a matching gift request straight from the donation form—no extra steps required. You can learn more about auto-submission with this educational video from our team:

3. Volunteer Grants

Volunteer grants are another form of corporate philanthropy that allows volunteers to turn their donated time into funds for your mission. Companies that provide volunteer grants donate to a nonprofit once their employees have spent a certain number of hours volunteering there. For instance, an employer’s policy might be to give $500 for 50 hours of volunteering time.

Top Volunteer Grants Strategy: Leverage a Volunteer Grants Database

Keeping track of all of your volunteers’ employers and their policies can be challenging. Using a volunteer grants database can help your nonprofit quickly determine which volunteers are eligible for grants through their employer. This allows you to provide volunteers with the information and resources they need to submit a volunteer grant request.

The best volunteer grants database will be volunteer-facing so your supporters can easily research their employer’s program. For example, Double the Donation’s nonprofit customers can make its volunteer grants database available to supporters so they can look up their companies whenever they wish.

Want to learn more about real companies that award matching gifts and volunteer grants? Access Double the Donation’s industry-leading database:

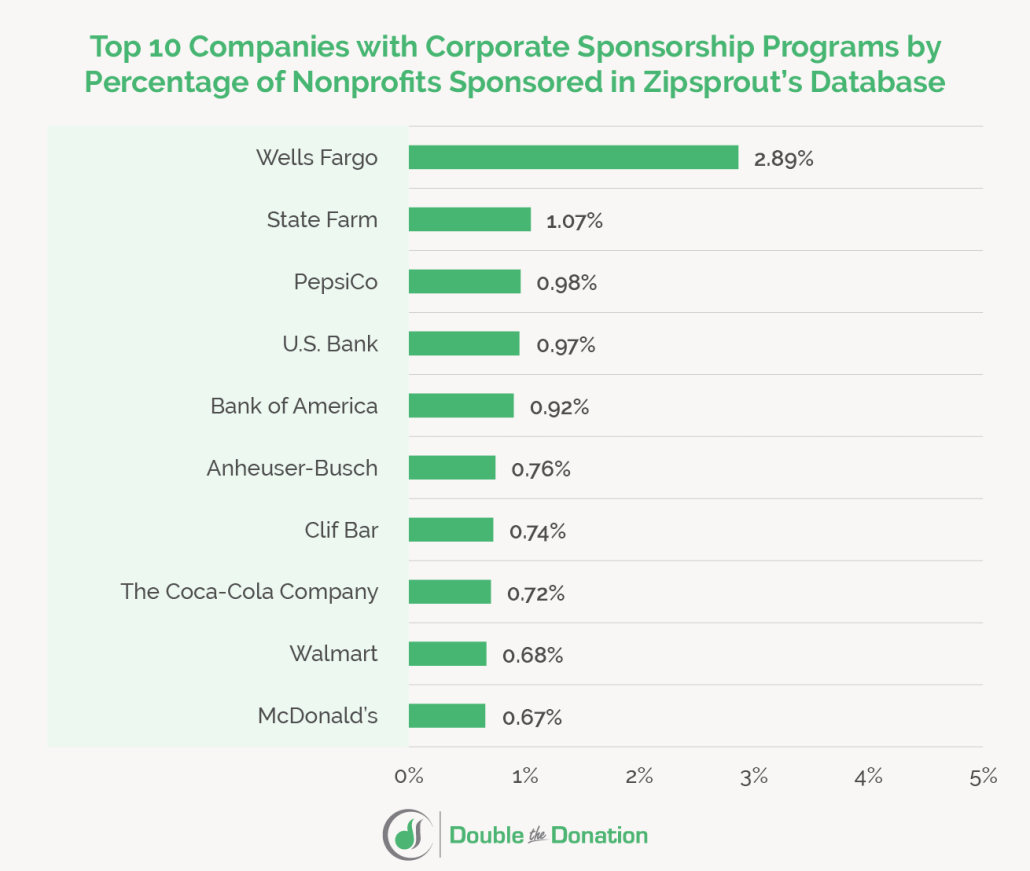

4. Corporate Sponsorships

Corporate sponsorships are when socially responsible companies support a nonprofit partner in exchange for tax benefits or being associated with a charitable cause. The most common types of corporate sponsorships include:

- Cause marketing, in which the corporation uses its platform to spread awareness of the nonprofit’s cause

- Monetary donations

- In-kind resource donations

Our guide to corporate sponsorships shares several companies that are exemplary sponsors. Here are the top corporate sponsors it lists, ordered by the percentage of nonprofits in ZipSprout’s database they sponsor:

- Wells Fargo(2.89%)

- State Farm (1.07%)

- PepsiCo (0.98%)

- U.S. Bank (0.97%)

- Bank of America (0.92%)

- Anheuser-Busch (0.76%)

- Clif Bar (0.74%)

- The Coca-Cola Company (0.72%)

- Walmart (0.68%)

- McDonald’s (0.67%)

Top Corporate Sponsorship Strategy: Create a Personalized Pitch

Like any donation appeal, your nonprofit needs to convince potential sponsors why your organization is worth their support. However, unlike other donation appeals, you need to convince sponsors how they can benefit from your partnership as well. You might use insights such as:

Potential return on investment (ROI) based on the campaign. ROI can vary from campaign to campaign, so you should highlight why your campaign is valuable to their interests. For instance, let’s say you’re hosting a charity golf tournament. GolfStatus recommends highlighting that golfers have a much higher net worth than average, which makes them valuable sales prospects for sponsors.

Past results for other sponsors. If you’ve had corporate sponsorships before, present your key performance metrics to prove your program’s value. Better yet, if you’re trying to recruit past sponsors for a new campaign, pull metrics from their past engagement and estimate how the new campaign will increase revenue.

No matter which approach you use to pitch your nonprofit to potential sponsors, ensure you use hard facts to support your appeal. For example, you could mention overarching economic trends and the company’s goals to illustrate why sponsoring your nonprofit could be beneficial.

5. Member Dues

For nonprofits with a membership structure, dues are the money members pay regularly to remain part of the program. Nonprofits such as museums offer memberships to secure a reliable source of income.

Top Membership Dues Strategy: Add Unique Membership Perks

Unlike recurring gifts, membership to a nonprofit often comes with special benefits. Add unique perks to your membership package to differentiate your program from similar alternatives. For example, you could add:

- Discounted or free entry. Museums that charge for admission can discount or waive these fees entirely, making membership a worthwhile investment for those who frequent the institution.

- Special events. Some members might join your program to meet new people with similar interests. Host member-exclusive events, such as a monthly dinner party or mixer, to make your membership program feel like a community and incentivize attendance.

- Greater input into nonprofit activities. Your members show significant dedication to your nonprofit by pledging to give regularly, so you could show them your gratitude by involving them in decision-making processes. For instance, the Toledo Museum of Art hosts the

Georgia Welles Apollo Society, an affinity group of members who pool their dues and vote on new art to add to the museum’s collection each year.

Each membership community is unique, so you should base your benefits on their preferences. To formulate ideas for perks, you could survey your most loyal donors to understand what they’d like to experience as part of a membership community. From there, you can compile a list of contending ideas and select a few that align with your budget and goals.

6. In-Kind Contributions

In-kind donations are gifts of non-financial resources to your nonprofit. You can use in-kind contributions to:

- Improve your programs. For instance, an in-kind gift of 20 kennels to an animal shelter would increase capacity and empower you to help many more animals in need.

- Power your auctions. In-kind gifts are popular for charity auctions. Once a donor has given your organization a desirable item, you can auction it off and keep the proceeds as fundraising revenue.

- Support special projects. Your nonprofit might have ongoing projects that require specific resources. For instance, an animal shelter might need construction materials to weatherproof their shelters.

Top In-Kind Contributions Strategy: Create a Wishlist

Chances are, your existing donors have in-kind resources they could donate to your nonprofit. They just might not know that you need anything. Create a comprehensive, detailed wishlist that describes all the in-kind resources your nonprofit needs at a given time. Include information such as:

- Urgency for the item

- Intended use

- Preferred brands or conditions

- Quantity needed

- Impact of the item on your mission

- Delivery and drop-off instructions

- Basic steps for claiming the in-kind gift on tax forms

Once you’ve drafted your list, create a landing page on your website where supporters can easily sign up to donate in-kind items. If possible, integrate your CMS with your sign-up software so the public-facing list remains up-to-date and you don’t get duplicate donations. Also, unless there’s an urgent, unforeseen need for an in-kind resource, only send your updated wishlists once a month, so you don’t overwhelm your donors.

7. Grants

Grants are sums of money awarded to nonprofit applicants who fit certain criteria. They are usually provided by government agencies or foundations with an endowment.

Top Grants Strategy: Use Management Software

Your nonprofit likely juggles numerous grants at a time, some with overlapping requirements and due dates. Staying organized and vigilant about your grant applications is crucial to finding the right opportunities and securing funding. Grant management software can help you:

- Find grants that fit your nonprofit’s needs and niche

- Track application status, from submission to review to the final decision

- Stay on top of deadlines with automated reminders

- Compile required documentation

When picking a grants management software solution, ensure that you consider your volume of grant applications. For instance, if your nonprofit relies on grants for 20% of your funding, investing in a comprehensive solution can help you keep track of more applications, whereas a nonprofit that only applies for a few grants a year can make do with a cheaper solution with fear features.

8. Product Sales

Consider selling products to donors and taking the profit as fundraising revenue. Your nonprofit has a unique brand identity, making it easy for your donors to support you in style. Plus, branded products can spread the word about your mission.

Top Product Sales Strategy: Sell Limited-Edition Merchandise

While selling items with your nonprofit’s logo and slogan is a good start, you can level up your product sales by creating exclusive merchandise for certain events and campaigns. For example, let’s say you’re hosting an auction. You could sell a t-shirt with unique branding for your event to attendees and discontinue it afterward. This creates a sense of urgency for your donors to get your items before they’re gone.

Nonprofit Revenue Stream Diversification FAQ

Now that you know of different nonprofit revenue streams, let’s answer some questions you might have about adding them to your financial approach.

What are the benefits of diversifying your nonprofit’s revenue streams?

There are numerous advantages to intentionally diversifying your organization’s revenue streams, such as:

- Financial stability. Even if you think you have an ironclad revenue stream, anything can happen. Economic factors can impact even the most reliable sources of revenue, so having multiple prepares you for anything.

- Adaptability. As technology advances and the economy shifts, it’s helpful to have multiple funding sources available so you can adapt your approach proactively.

- Expanded impact. More funding sources means more revenue that your nonprofit can leverage for your cause.

There’s no set amount of revenue streams your nonprofit should have, but you should have multiple to support you through any situation.

What are some common challenges in managing multiple revenue streams?

Despite the benefits of having diverse revenue streams, numerous obstacles can dissuade nonprofits from seeking out new ones, such as:

- Resource allocation. Developing a new revenue-acquisition strategy for each stream takes time and money away from your beneficiaries. You might even need to expand your team or outsource labor to specialists who can manage your new revenue streams.

- Compliance with regulations. Your nonprofit needs an in-depth understanding of the legal regulations surrounding each new revenue stream. For example, special in-kind donation tax considerations can impact how you fill out your Form 990.

- Donor expectations. Your seasoned donors are likely used to how your nonprofit currently collects donations, so any change requires maintenance on your part to make additions and transitions as smooth as possible.

Changes can always pose challenges to nonprofits, but as long as you have the right tools and strategy in mind, you can tackle these hurdles. We’ll cover the impact the right software can have in a later section.

What are some key performance indicators (KPIs) for evaluating revenue streams?

Not all revenue streams are feasible for every nonprofit. As you test out new revenue streams for your nonprofit, use these KPIs to decide which are worth developing:

- Total revenue generated from each stream

- Return on investment (ROI)

- Growth rate of revenue streams

- Cost-to-revenue ratios

- Member or donor retention rates

- Grant success rates

- Donor acquisition rates per stream

The best way to collect and leverage this data is by using a CRM with complex reporting capabilities, automated workflows, and field customization. These features allow you to track multiple KPIs simultaneously and form more accurate data-driven insights.

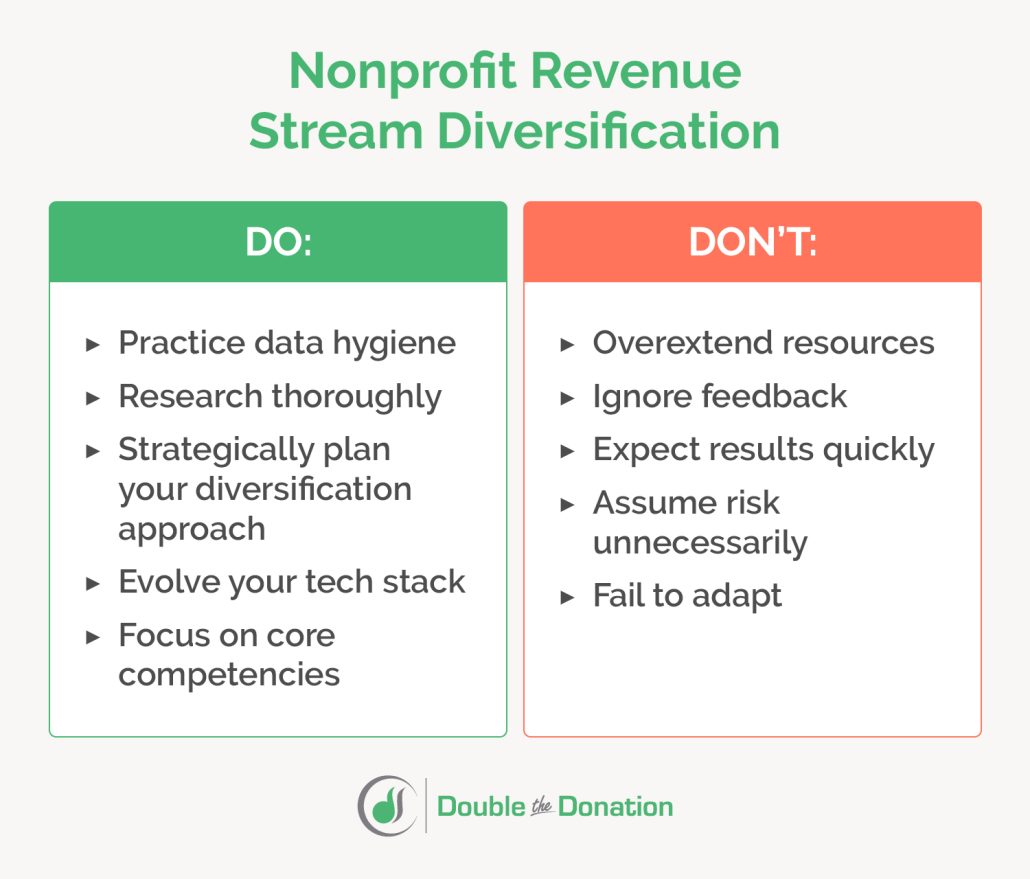

Nonprofit Revenue Stream Diversification: Dos and Don’ts

Do:

- Practice data hygiene: Practicing data hygiene fundamentals helps ensure accurate reports and decision-making. NPOInfo’s guide to data hygiene suggests creating processes for standardizing data formatting, scheduling regular data back-ups, and appending missing data.

- Research thoroughly: Picking new revenue streams involves big decisions, so you should be convinced they’re worth pursuing before investing the resources. Consider consulting with a professional to get an external, unbiased opinion.

- Strategically plan your diversification approach: Build time into your staff’s calendars during the strategic planning process so you have the time to chart an informed, detailed path forward. Each nonprofit has a unique timeline, but you should expect to spend a few months cementing your strategic plan.

- Evolve your tech stack: You can probably manage any new revenue streams with tailored software solutions. Research options on the market and pick one that aligns with your budget, tech experience, and existing solutions.

- Focus on core competencies: Prioritize expanding into revenue streams that leverage your team’s strengths. For example, if you have multiple local corporate connections, leveraging corporate social responsibility programs would be a natural addition to your strategy.

Don’t:

- Overextend resources: Understand and work within your organization’s resource constraints from the outset as you decide which new revenue streams to add. For instance, if you can only afford to add three revenue streams, don’t push the limit by attempting four or five, as you might burn out your team.

- Ignore feedback: Remember to collect feedback from numerous stakeholders at all phases of implementation. This might include team members, donors, and beneficiaries. They can provide well-rounded suggestions from perspectives you might not have considered.

- Expect results quickly: As with any major fundraising shift, it takes a while for all the facts to come together. Be patient until you have all relevant information before proceeding or cutting out revenue streams.

- Assume risk unnecessarily: While it can be tempting to jump on a hot fundraising strategy or economic trend, consider all angles before adding it to your strategic plan so you know it’s truly a good choice.

- Fail to adapt: While your strategic plan should be the main guide for your revenue stream adoption, it shouldn’t be set in stone. Build flexibility into your approach so you can pivot if necessary, either to implement a new strategy or to rethink one that isn’t working.

Wrapping Up + Additional Resources

Pursuing new nonprofit revenue streams isn’t only a financially sound strategy, but it also helps your team innovate and stay relevant over time. As long as you assess each option in detail, record results, and keep your core competencies in mind, you can shake up your organization’s current fundraising approach without significant risk. Plus, your donors will love having new ways to give back to your nonprofit!

- Developing a Matching Gift Program: A How-To Guide. Looking to start a matching gift program or help a corporate partner start their own? This guide will help you start strong.

- Nonprofit Basics: An Overview of Feasibility Studies. Adopting a new revenue stream is a lot of work, and feasibility studies can help streamline the process. Learn more with this guide.

- Matching Gift Eligibility: Which Nonprofits Qualify? This guide will help your nonprofit understand if it’s eligible for matching gifts (and, if not, how to become eligible).