4 Financial Reports Vital for Nonprofit Accounting

Very few people enter the nonprofit sector to put together financial reports. Those working at nonprofits likely started doing so because they want to make a difference in their communities. However, nonprofit accounting is essential to effective operations at the organization.

Just like

for-profits, how nonprofit organizations manage their finances will dictate the organization’s operational success. Their financial habits, like accurately reporting on their earnings and expenses, are a crucial part of attaining that success.

Nonprofits, however, develop a slightly different set of financial reports and statements than for-profit organizations do. This is because the goals are entirely different. While for-profits are working to earn money that can be taken home as profit, nonprofits reinvest all of their revenue back into the organization to promote growth and pursue their mission.

In this guide, we’ll walk through the four primary financial reports that nonprofits compile on a regular basis, what the reports are for, and the conclusions that can be drawn from them. We’ll cover the following:

- Statement of Activities

- Statement of Financial Position

- Statement of Cash Flows

- Statement of Functional Expenses

Of course, this isn’t the only vital element in

accounting for nonprofits, but it allows accounting teams to make financial decisions that will lead the organization to future growth. Let’s dive in.

1. Statement of Activities

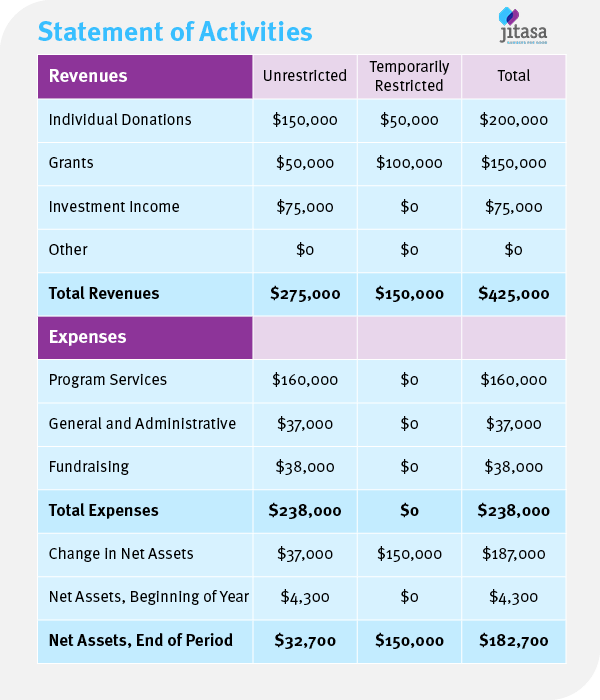

The first statement compiled by your nonprofit accounting team is the statement of activities. The for-profit version of this statement would be the nonprofit income statement. Essentially, this document is used to categorize the various types of revenue and expenses at the organization.

Nonprofits’ statement of activities will look different from the for-profit income statement because nonprofits often encounter restrictions associated with the revenue they receive. For example, let’s say

your nonprofit grant writing team writes proposals for several different grants that all have various restrictions associated. One can only be used for your scholarship program while another must be used for another specific program.

If you didn’t separate these out by restriction, it could be confusing to know how much funding you

actually

have to use freely on other initiatives. In the example below, you can see how different columns show the different restrictions placed on revenue.

The statement of activities also lists out your expenses, breaking them down into general categories. However, this isn’t a total breakdown of expense details. We’ll see that later in the statement of functional expenses.

Below the expenses, you’ll find the organization’s net assets. In this section, you’ll see that you can compare the net assets based on unrestricted assets, those with restrictions, and the total. Without this statement, nonprofits are at a risk of using the “total” assets and assuming it refers to the usable revenue at the organization. In reality, it’s less due to restrictions.

2. Statement of Financial Position

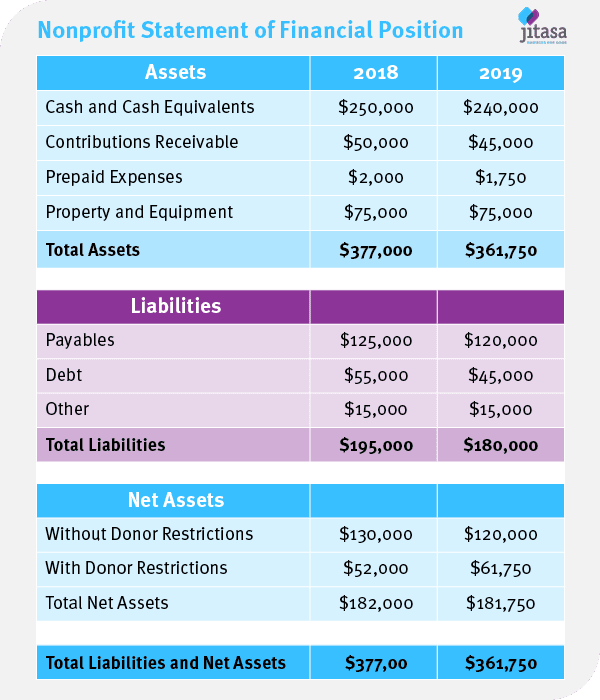

Similar to the statement of activities, your nonprofit’s statement of financial position also has a for-profit counterpart— the balance sheet. This statement is designed to provide a snapshot of the organization’s health at any particular point in time.

Your nonprofit’s statement of financial position breaks down your finances into the following sections:

- Assets. This section shows what your organization owns like cash assets, accounts receivable, prepaid expenses, and more. They’re listed by the amount of time it would take to make the assets liquid.

- Liabilities. This section shows what your organization owes including your accounts payable, debt, and other expenses. Generally you’ll have listings for your current liabilities (those owed within the year) and long-term liabilities (those paid over multiple years).

- Net Assets. Your net assets are simply your assets minus your liabilities. In this statement, they’re also listed out by restriction.

The following example was taken from

Jitasa’s statement of financial position guide, showing what this form might look like for an average nonprofit organization.

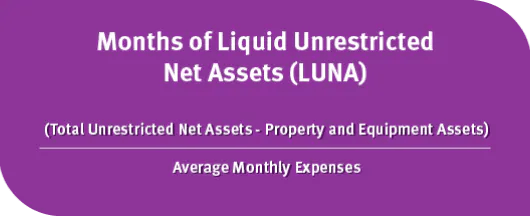

The purpose of this report is to show how much risk an organization can take on. Accountants may use the numbers in this statement to calculate your months of liquid unrestricted net assets (LUNA) using the following equation:

On average, three months of LUNA is a good place for nonprofits to maintain. If it dips below zero, they’ll need to immediately adjust their finances. Meanwhile, if it increases to more than three, the organization has the flexibility to take on additional risk at the organization, such as investing in new growth initiatives.

Consider how you can grow and expand while maintaining a

high engagement rate among your supporters. Over time, this will lead to more funding, additional flexibility, and a greater capacity to work toward your mission.

3. Statement of Cash Flows

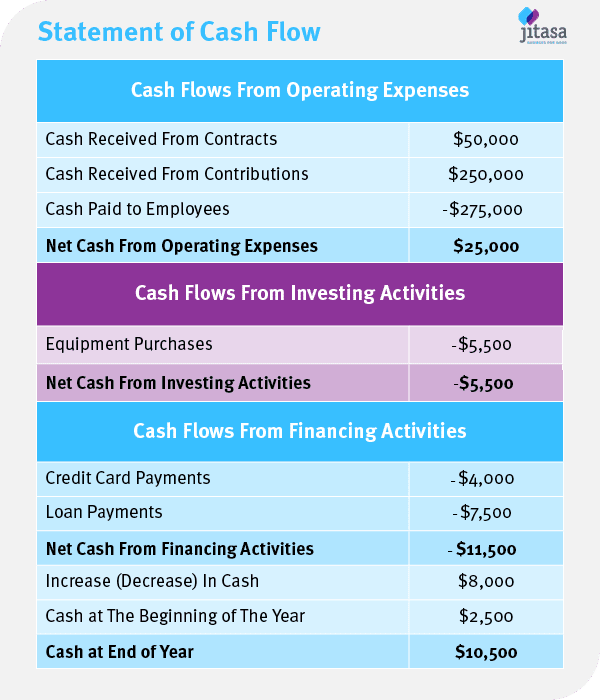

Have you ever found yourself in the position of going out shopping, then realizing you need to check your bank account to be sure your next purchase doesn’t cause you to overdraft? Many individuals have encountered this stress. It’s not the type of stress that you want your nonprofit to encounter. That’s why organizations develop nonprofit cash flow statements. This report shows how cash moves in and out of your organization.

This statement breaks down your cash flow into your operating activities, investing activities, and financing activities. When you track the cash flow over time, you can gain new insights into the spending habits of your organization, helping to create more accurate budgets over time.

Your statement of cash flows will likely end up looking something like this:

If your organization carries any debt, your statement of cash flows can be incredibly helpful in finding out how much cash you have on hand to pay it down. Plus, as we mentioned, it can help you create better budgets in the future. If you know that the majority of your cash received from contributions comes from your year-end fundraising campaign, you can plan to spread out that cash throughout the following year in your budget, slowing down your cash flow.

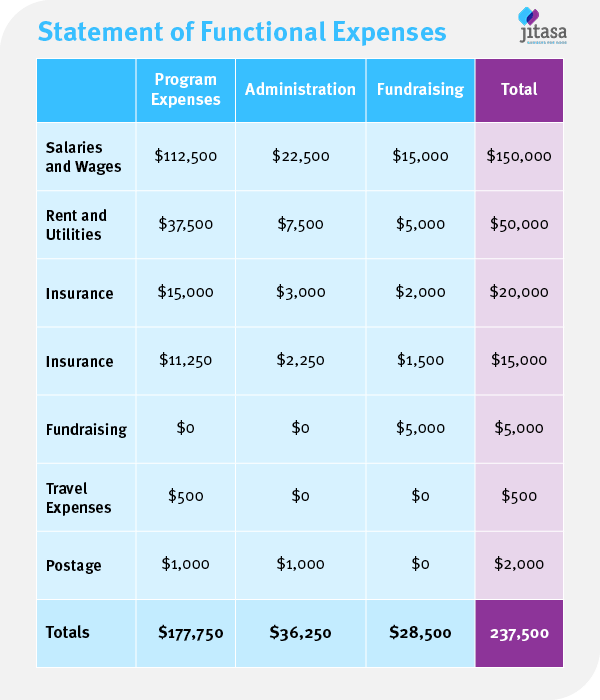

4. Statement of Functional Expenses

Your nonprofit’s statement of functional expenses describes the costs incurred for different areas of the organization. You probably spend the majority of your funding on the various programs and services that your organization provides to the community. But you also need to spend some funding on management and overhead expenses, as well as your fundraising costs. Those are the three main categories that are included on your organization’s statement of functional expenses.

When you compile your statement of functional expenses, it will end up looking something like this:

Individual donors ended up contributing $309 billion in the last year. Almost every one of those donors wants that $309 billion to be used solely for the expenses incurred doing mission-related work at the organizations. However, that’s not the reality of it.

Overhead expenses aren’t inherently bad! That’s why your functional expenses also include management and fundraising categories. It’s from here that you pay your staff, provide office space, and pay your bills. These are all necessary expenses to run your operations and to grow your organization. It’s necessary to strike a balance between your overhead expenses and those for program expenses. In general, try to keep at least 65% of your funding going towards your programs, but you can also recognize the necessity to increase some overhead to achieve growth.

Donors are starting to recognize that overhead expenses are essential for nonprofit growth. And, they can easily find the same information listed in the statement of functional expenses in your

annual tax forms. In fact, your Form 990 also requires your organization to categorize your expenses by general/management, fundraising, and programs. That means that your statement of functional expenses will only make it easier to file this form each year!

Financial reports are vital to understanding nonprofit funding. The information in these four reports can help your organization determine if it’s the right time for your team to expand, to reassess your financial situation, to start a new program, or to launch other growth initiatives.

About the Author

Jon Osterburg

Jon Osterburg has spent the last nine years helping more than 100 nonprofits around the world with their finances as a leader at Jitasa, an accounting firm that offers bookkeeping and accounting services to not for profit organizations.

SPEAK TO AN EXPERT

We will get back to you as soon as possible.

Please try again later.

LET'S TALK

Contact Us

Thank you for contacting us.

We will get back to you as soon as possible

Please try again later

-

📈 Would you like to elevate your mission with video storytelling? Are you looking for tips to create an engaging annual report? Could you use some help moving existing donors through your donor pyramid? 👏 Get FREE advice from nonprofit industry professionals by streaming our on demand webinars: #LinkInBioButton

-

💬 Are your volunteer role descriptions specific? ☑️ Clear descriptions allow volunteers to sign up for the right roles that fit their interests and skills, leading to greater volunteer satisfaction. 👉 Check out these tips for writing better role descriptions: #LinkInBioButton

-

Showing your donors that you appreciate their support is crucial for the long-term success of your organization. Take your donor appreciation to the next level by: ❤️ Setting up instant thank you messages. ❤️ Offering a streamlined giving experience. ❤️ Sending personalized thank you’s. ❤️ Posting social media shoutouts. Learn more: #LinkInBioButton

-

🌺 Happy first day of Spring, nonprofit friends! 👍 It’s a great time to start planning your year-end fundraising campaign. ➡️ Flourish your efforts by downloading our FREE 2024 Year-End Fundraising Planner: #LinkInBioButton

-

"When you think of optimizing your nonprofit’s donation page, you may envision adding an eye-catching image or writing new copy about your organization’s mission. These are good places to start, but there’s more you can do to appeal to prospective donors while they decide whether or not to give." - Karen Houghton, CEO of @infinite.giving ➡️ Explore impactful tactics for improving your donation page: #LinkInBioButton

-

☘️ You’re in luck, nonprofit friends! #StPatricksDay ☘️ We have tons of FREE resources to keep you up-to-date with the latest nonprofit tips, tricks, and trends. Check it out: #LinkInBioButton

-

@georgesnowscholarshipfund is dedicated to helping deserving students within Palm Beach County achieve their career goals through their pursuit of higher education. Since 1982, they have awarded over 26 million dollars in educational grants. In 2023, they awarded over $4,800,000 in scholarships and provided scholar support services to 334 scholarship recipients. We are honored to have built a beautiful new website to help them further their mission - check it out at scholarship.org (#LinkInBio) and support their cause!Button

-

Are you spinning in circles worrying about web design? We can help! We want to help your nonprofit spend less time stressing about website tasks and more time doing good. Contact us today: #LinkInBioButton

-

How can your nonprofit establish strong connections with supporters? 🤝 Use a multichannel strategy. 🤝 Bring supporters into the conversation. 🤝 Recommit to personalization. Read more about fighting digital fatigue on our blog: #LinkInBioButton

-

⏰ Don't forget to spring forward as Daylight Saving Time starts tomorrow! ☀️ Let's get ready to make the most of those longer, brighter days.Button

-

Happy International Women's Day! ❤️ Today, we celebrate the incredible strength, resilience, and achievements of women. Consider supporting these nonprofit organizations that are advocating for female empowerment: 🌸 @girlsinc 🌸 @dressforsuccess 🌸 @malalafund Together, let's make strides towards a world where every woman has the opportunity to shine. ✨Button

-

“As you grow older, you will discover that you have two hands - one for helping yourself, the other for helping others.” - Audrey HepburnButton

-

Are you looking for FREE nonprofit resources? Our blog archive has tons of advice from industry experts to keep you up-to-date with the latest nonprofit tips, tricks, and trends. Check it out: #LinkInBioButton

-

💲 Do you know your way around your nonprofit’s finances? 📈 Having a solid understanding of nonprofit financial statements is crucial to successfully plan for the future, build capacity, and prevent loss or fraud. 💻 Check out our FREE on-demand webinar “Know Your Numbers: Your Guide to Nonprofit Financial Statements”: #LinkInBioButton

-

Do you need help engaging recurring donors? Some strategies that are effective for connecting with your supporters include: 🗣️ Personalizing your communications. 👍 Offering multiple engagement opportunities. 💙 Sharing your donors impact. 📈 Making increasing giving easy. Read more on our blog: #LinkInBioButton

-

👀 Do you want to improve your nonprofit’s board engagement? 💙 You can further your mission and make a stronger impact in the community by engaging your board members with: -Fundraising training. -Productive meetings. -Collaborative strategic planning. -Involvement in all fundraising processes. -Feedback solicitation. ➡️ Read more on our blog: #LinkInBioButton

-

Since 1946, Lighthouse for the Blind of the Palm Beaches has been providing direct education and rehabilitation services to people who are blind or visually impaired. Their mission is to assist persons with visual impairments to develop their capabilities to the fullest through their programs: ✨ Early Intervention (birth to 5). ✨ Children (5 to 13 years). ✨ Teens (14 through High School Graduation). ✨ Adult Blind and Visually Impaired. We are honored to have built a beautiful new website for Lighthouse for the Blind of the Palm Beaches. Check it out at lhpb.org (#LinkInBio) and support their efforts!Button

-

As a remote agency, every day is like #LoveYourPetDay. We love our furry coworkers!Button

-

It may only be February, but time flies by super fast, and year-end fundraising will be here before you know it! Our planner will help you create, craft, and execute your year-end fundraising campaign. Download our FREE 2024 Year-End Fundraising Planner today: #LinkInBioButton

-

“Because mid-level donations play an essential role in your nonprofit’s fundraising strategy, cultivating and stewarding strong mid-level donor relationships is vital.” - Shannon Scanlan, Solutions Engineer at Jackson River 🌱 Read more about how your nonprofit can grow a robust mid-level giving program: #LinkInBio 🌱Button

-

🌎 Are you too busy changing the world to update your social media? Help is only a phone call away! 💙 Our digital marketing services are tailor-made for nonprofits (and cost less than you may think). We make your cause our mission. 👉 Contact us: #LinkInBioButton

-

Happy Valentine’s Day, nonprofit friends. ❤️ We LOVE helping you achieve your goals!Button

-

Could your nonprofit website use some love? We can help! Our web solutions are easy to use - and cost less than you might think. Plus, our dedicated support team is always on call to help you. We can even save you time by managing ALL of your website content updates. Contact us today to discuss your website's needs! #LinkInBioButton

-

“Taking the time to improve your public speaking skills allows you to speak more confidently within your team and to eloquently promote your mission to a wider audience.” - Pattie Schutte, CEO, Founder, and Principal Coach of Be Brilliant Presentation Group Learn more about how public speaking skills can help you run your nonprofit: #LinkInBioButton

-

Are you looking for FREE nonprofit resources? We’ve got you covered. Our blogs, webinars, research, and tools will help you plan campaigns, evaluate your success, and more! Check them out: #LinkInBioButton

-

“Ethical and responsible AI use can bring more attention to your mission and ultimately allow you to help more beneficiaries.” - James Barnard, Associate Managing Vice President of Annual Giving and Digital Marketing at @bwfphilanthropy Read more about leveraging AI tools in nonprofit marketing: #LinkInBioButton

-

Are you looking to build a loyal donor base? Engagement is just an email away! Email marketing drives donations so that you can focus on what matters most: powering social good. Read more about emails that are sure to keep your supporters engaged: #LinkInBioButton

-

This Black History Month, you can help make a difference by getting involved with Black-led nonprofits that advocate for equality and justice like: 🖤 @colorofchange 🖤 @bw4wla 🖤 @naacpButton

-

The number one reason Gen X may choose not to donate to an org is an outdated website. Is your website outdated? No need to be embarrassed. We can help! Our web solutions are easy to use - and cost less than you might think. We can even save you time by managing ALL of your website content updates while you focus on changing the world. Get in touch: #LinkInBioButton

-

Are you missing out on fundraising opportunities? Check out our FREE on-demand webinar “The Best Kept Secret for Moving Your Donors up Your Donor Pyramid” to learn how to grow your donations at a rapid pace. Watch now: #LinkInBioButton

-

“At the end it’s not about what you have or even what you’ve accomplished. It’s about who you’ve lifted up, who you’ve made better. It’s about what you’ve given back.” - Denzel WashingtonButton

-

Filing your nonprofit’s tax returns doesn’t have to be stressful. Consider these tips to stress less during tax season: 💲 Maintain good data hygiene 💲 Keep an eye on the calendar 💲 Partner with an e-filing provider Learn more on our blog: #LinkInBioButton

-

📬 Did you know that after receiving direct mail, 44% of people visit the senders website? 💻 Before sending your next direct mail appeal, make sure that your website is up-to-date and mobile-friendly! 👉 If you could use some help managing your nonprofit website, get in touch: #LinkInBioButton

-

🐾 Do you need a helping hand (or paw) connecting with your donors on social media? 📈 We can help you reach your supporters and track ROI! 👉 Get in touch: #LinkInBioButton

-

Today is the day! We’re in Orlando for the @qgiv_team Conference. Join our session “Social Media 101: How to Create the Perfect Content Calendar” tomorrow at 3:15 PM ET. Our Director of Marketing will discuss how to craft a social media content calendar that ladders up to your goals. We hope to see you in the crowd or at our Exhibit Hall booth! 📷: @hyattregencygrandcypressButton

-

“Crowdfunding is a flexible fundraising option that can help nonprofits raise impressive funding without hefty upfront fees. It also takes advantage of existing networks to usher in new donors and leverage connections.” - Missy Singh, Director of Operations, Client Services & Sales at Fundly Learn how to build up your donations with crowdfunding: #LinkInBioButton

-

"True peace is not merely the absence of tension; it is the presence of justice." - Martin Luther King, Jr. In honor of #MLKDay, support nonprofits working toward a more just and equitable society: - @thekingcenter - @theblackinstitute - @eji_orgButton

-

beKidSafe believes all children deserve to grow up safe from abuse. They offer effective prevention education that is easily accessible for: 👍 Teachers in schools 👍 Camp directors and staff 👍 Healthcare professionals Their goal is to create trauma-aware adults within homes, schools, and communities who recognize and stop childhood trauma and abuse in its tracks. We are proud to have built a beautiful new website for beKidSafe. Check it out at bekidsafe.org (#LinkInBio) and support their efforts!Button

-

📈 Are you ready to create social media content that ladders up to high-level goals? 🗓️ Join our session “Social Media 101: How to Create the Perfect Content Calendar” on Thursday, January 18th at 3:15 PM ET at the @qgiv_team Conference. ➡️ RSVP: #LinkInBioButton

-

Your year-end campaign may have just ended, but now is the perfect time to start your 2024 end-of-year fundraising plan. Jump into the new year by downloading our FREE 2024 Year-End Fundraising Planner: #LinkInBioButton

-

Are you aware of the most impactful digital privacy regulations and what they mean for your nonprofit? It’s important to understand the rules that your nonprofit can be held accountable from fundraising legal requirements to digital privacy laws. Learn more on our blog: #LinkInBioButton

-

🎆 Happy New Year! 🎆 💙 We hope your 2024 is filled with fundraising success and lots of good. 👇 What are some of your resolutions for the new year?Button

-

Thank you to our nonprofit friends, partners, and community for making 2023 a successful year. 🎆 Cheers to making 2024 even better! 🥂Button

-

“Recurring donors can provide one of the most sustainable and consistent sources of fundraising for your nonprofit, so it’s important to develop a recurring giving program that appeals to their preferences and experience.” - Philip Schmitz, CEO of BIS Global Learn how to set up a recurring giving program: #LinkInBioButton

-

Do you use an e-filer for your nonprofit taxes? An e-filer can significantly simplify the process and take a burden off of your shoulders. Learn more on our blog: #LinkInBioButton

-

🤜 Did you know sending thank you notes to donors is considered a “high touch” gesture? 😊 In the nonprofit industry, being “high touch” is prioritizing personalization, empathy, and genuine human interaction. 💙 Don’t forget to thank your donors for their support, especially at year-end.Button

-

Merry Happy Everything, nonprofit friends! We hope you have a joyful holiday season. ❤️Button

-

Are you feeling overwhelmed managing your website tasks? We can help! Our web solutions are easy to use - and cost less than you might think. Plus, our dedicated support team is always on call to help you. Get in touch: #LinkInBioButton

-

📱 Do you need help with your text fundraising campaign? ✅ Our friends at @qgiv_team put together a FREE Text Fundraising Success Toolkit packed with resources that will help you reach your donors where they are on their mobile devices. 👉 Get your copy: #LinkInBioButton

-

Will we see you in Orlando for the @qgiv_team Conference? Join our session “Social Media 101: How to Create the Perfect Content Calendar” on Thursday, January 18th at 3:15 PM ET. Our Director of Marketing will provide you with a clear formula for creating social media content calendars that garner interest, ladder up to high-level goals, and deliver real results (ROI)! Register now: #LinkInBio 📷: @hyattregencygrandcypressButton

-

✅ Do you want to learn how to maximize year-end donations, elevate your mission, win more grants for your nonprofit, and more? ⏪ Rewind to our past webinars to learn from industry experts: #LinkInBioButton

-

Are you spinning your wheels trying to post engaging content on social media? We can help you reach your supporters and track ROI! Get in touch: #LinkInBioButton

-

🎁 Are you ready to wrap up this year successfully? 📈 Check out these last-minute year-end fundraising tips: - Clean up your website with simple DIY tips and tricks: #LinkInBio - Remind supporters of potential tax deductions. - Leverage corporate matching gift programs. - Don't forget to plan ways to retain your donors in the new year. 👏 Happy fundraising!Button

-

🕛 Did you miss our webinar last month with Double the Donation? Don’t panic - it’s on demand! 🎁 Check out “Crossing the Finish Line: Corporate Matching Gifts at End of Year” to learn how your organization can make the most of corporate matching gifts. ➡️ Watch now: #LinkInBioButton

-

💰 ‘Tis the season for year-end fundraising! 🤗 December is the “Giving Month" - launch the campaign you’ve been planning to gain support for your organization. 💙 Don’t forget to thank your donors. 👉 Check out our FREE 2023 Year-End Fundraising Planner: #LinkInBioButton

-

“Volunteers do not necessarily have the time; they just have the heart.” - Elizabeth Andrew Celebrate International Volunteer Day by leveling up your volunteer recruitment strategies. Read more on our blog: #LinkInBioButton

-

@pghglasscenter cultivates an inclusive and welcoming environment that encourages everyone, from the casually curious to the master artist, to learn, create, and be inspired by glass. They offer classes to teach others about the incredible beauty, versatility, and science of glass: ✨ Make-It-Now ✨ Workshops ✨ Intensives ✨ Multi-Week Classes ✨ Youth Programs ✨ Private Lessons We are honored to have built a beautiful new website for Pittsburgh Glass Center. Check it out at pittsburghglasscenter.org (#LinkInBio) and support their efforts!Button

-

Did you miss our webinar with Double the Donation? No worries! You can watch it on demand to learn how to leverage corporate matching gift programs. #LinkInBioButton

-

💙 Happy #GivingTuesday, nonprofit professionals! 📈 We hope you exceed your donation goals. 👉 To get a head start on next year’s fundraising campaign, check out our FREE resources: #LinkInBioButton

-

📱 Are you overwhelmed trying to regularly post engaging content on social media? We can help! 👍 Our FREE on demand webinar with our Director of Marketing can help you with a clear formula for self-auditing your current organic social media efforts to ensure you are set up for future fundraising success. ➡️ Watch now: #LinkInBioButton

-

Happy Thanksgiving! We are so thankful for our nonprofit friends, partners, and community. 💙Button

-

#GivingTuesday is one week away! Try these last-minute tips to help you get in on the action this year: 💲 Leverage @Facebook and @Instagram donation tools. 💬 Repurpose Giving Tuesday content that performed well for your organization in past years. 💰 Invest in some paid ad spend to ensure your messaging is being seen. 💙 Send out thank you messages to keep your donors engaged.Button

-

“Social media is an indispensable tool for raising awareness for your nonprofit’s cause, reaching new audiences, and strengthening your relationships with donors.” - Nick Black, Founder and CEO of @goodunited.io Ready to ride the wave of social media fundraising? Read more on our blog: #LinkInBioButton

-

📞 Could your nonprofit website use some love? We’re only a phone call away! 💙 We want to help your organization spend less time worrying about website tasks and more time doing good. 👉 Get in touch to learn more about our web solutions and special nonprofit pricing: #LinkInBioButton

-

🎯 Hit your target on #GivingTuesday this year! 📱 Our friends at @qgiv_team created an eBook full of helpful tips, tricks, and templates to help you set yourself up for success. ➡️ Check it out: #LinkInBioButton

-

📣 Today is the day! 💻Join our FREE webinar with Double the Donation at 12 pm ET to learn: - Matching gift program guidelines and their significance at end of year. - How to implement a successful matching gift strategy in the last few weeks of the year. - How to communicate matching gifts effectively to donors from all throughout 2023. - And more! ✋ You’ll have plenty of opportunities to ask questions in real-time! ➡️ Register now: #LinkInBioButton

-

Want to maximize your year-end donations? Join our FREE webinar with Double the Donation tomorrow at 12pm ET! We’ll discuss how your organization can make the most of corporate matching gifts as you plan to cross the year-end finish line. RSVP: #LinkInBioButton

-

✅ Are you ready to achieve your fundraising goals this year? 💻 Join our FREE webinar to learn about matching gift program guidelines and their significance at end of year with Double the Donation on Wednesday at 12 pm ET. ➡️ RSVP now: #LinkInBioButton

-

On Veterans Day we honor the courageous men and women who have served our country. Show your support to organizations that provide assistance and resources to those who have sacrificed so much for us: 🇺🇸 @foldsofhonor 🇺🇸 @wwp 🇺🇸 @davhq 🇺🇸 @legalaidpbcButton

-

Is your nonprofit ready for this year's final fundraising push? Don’t panic! Join Grace Green of Double the Donation on November 15th at 12 pm ET for our FREE webinar session to learn: 🎁 Matching gift program guidelines and their significance at end of year. 🎁 How to implement a successful matching gift strategy in the last few weeks of the year. 🎁 How to communicate matching gifts effectively to donors from all throughout 2023. 🎁 And more! Register now: #LinkInBioButton

-

@palmbeachchamber represents the local business community in support of the free enterprise system through programming, advocacy and education. The Chamber’s award-winning Palm Beach Guide is a remarkable reference for showcasing its members and providing a convenient directory of stores and services provided by Chamber members. Residents and visitors have come to rely upon this handy booklet as a primary information source on Palm Beach. We are honored to have built a beautiful new website for the Palm Beach Chamber of Commerce. Check it out at palmbeachchamber.com (#LinkInBio) and support their efforts!Button

-

💰 How's your year-end fundraising campaign coming along? 📚 November is the “Learning Month.” 🌱 Now is the time to start the process of seeding the year-end campaign by helping your constituents learn about the stories you plan to present. 👉 Check out our FREE 2023 Year-End Fundraising Planner for more tips: #LinkInBioButton

-

💰 With #GivingTuesday and December fundraising just around the corner, nonprofits everywhere are gearing up for their final fundraising push. 💻 Join our FREE webinar with Double the Donation on November 15th at 12 pm ET to learn how to make the most of corporate matching gifts. ✋ You’ll have plenty of opportunities to ask questions in real-time! ➡️ RSVP today: #LinkInBioButton

-

We hope you have a safe (and spooky) Halloween filled with yummy treats! 🎃Button

-

Does your nonprofit have a thriving association community online? Giving your members the opportunity to connect with one another outside of your recurring meetings or yearly conferences enables them to make deeper, more meaningful relationships. Check out this guide for creating an online community: #LinkInBioButton

-

✅ Is your nonprofit ready for #GivingTuesday and year-end fundraising? 💻 Join our FREE webinar session with Grace Green of Double the Donation on November 15th at 12 pm ET. 🎁 You'll learn how your organization can make the most of corporate matching gifts as you plan to cross the year-end finish line. ➡️ Register now: #LinkInBioButton

-

❤️ We’ve come to your website’s rescue for fundraising success this season! 💻 Learn simple DIY tips and tricks to improve your nonprofit website design for better engagement and donation conversion from our Creative Director, Meredith Wanner. #LinkInBio 👉 Get in touch with us if you have any questions about web design.Button

-

Would you like to double or even triple your fundraising revenue? Implement matching gift programs to support your employees’ philanthropic interests by matching their donations. Learn more on our blog: #LinkInBioButton

-

📹 Did you miss our webinar "Video Storytelling: Elevate Your Mission & Exceed Your Goals" with Chris Miano, Founder and CEO of @MemoryFoxes last month? No worries! ▶️ You can download the slides and watch it on demand to learn how to use video to elevate your mission and meet your goals. #LinkInBioButton

-

Happy World Statistics Day! Did you know that donors like to give through social media fundraising tools? In fact, 32% have donated through @Facebook Fundraising Tools and 89% of those say they’ll do it again. Do you need help reaching your donors on social media? Contact us today: #LinkInBioButton

-

What if you could double or even triple your fundraising revenue with just the click of a button? Join our FREE webinar on November 15th at 12 pm ET to learn how to make the most of corporate matching gifts with Grace Green of Double the Donation. Register Now: #LinkInBioButton

-

Do you need help announcing your auction? Our friends at @qgiv_team have created a template to help you customize your own auction announcement to boost your registrations and get people excited about your auction. Download your FREE auction announcement template: #LinkInBioButton

-

The world of planned and non-cash giving extends far beyond bequest! By understanding the variety of options available, you’ll be able to provide donors with better experiences and suggest types of gifts that align with their priorities. Read more on our blog: #LinkInBioButton

-

📱 Did you know 99% of text messages are opened? ✅ Text messaging is a quick, easy, and alternative way to reach donors. 🌿 You can easily grow your nonprofit’s text messaging list by: 1. Contacting donors who gave their phone number 2. Including text opt-in on donation, event, and email sign-up forms 3. Converting social followers to text subscribers 4. Asking email subscribers to join your text messaging programButton

-

@yepfl develops the mindset and skillset of challenged youth ages 13 to 22 through engaging mentorship and real-life learning experiences that redirect their path toward a positive future. Their programs build character and habits that lead to success in education and instill lifelong leadership qualities. ➡️ Young Women Who Win ➡️ Teen Leadership PBC ➡️ Young Voices & Advocates We are proud to have built a beautiful new website for Youth Empowered to Prosper. Check it out at ye2p.org (#LinkInBio) and support their efforts!Button

-

Did you know that one of the most effective strategies for maximizing year-end donations is leveraging corporate matching gift programs? Join Grace Green of Double the Donation on November 15th at 12 pm ET for a FREE webinar session to learn: 🎁 Matching gift program guidelines and their significance at end of year. 🎁 How to implement a successful matching gift strategy in the last few weeks of the year. 🎁 How to communicate matching gifts effectively to donors from all throughout 2023. 🎁 And more! Register now: #LinkInBioButton

-

We all have mental health! This World Mental Health Day, try these tips to boost your mental health: 💙 Exercise regularly 💙 Eat a brain-healthy diet 💙 Get enough sleep 💙 Spend time with your furry friends 💙 Seek help if neededButton

-

👀 Are you looking for FREE resources? 📚 We have a HUGE library of blogs and on-demand webinars featuring advice from nonprofit industry professionals on our website. ➡️ Check it out: #LinkInBioButton

-

October is Breast Cancer Awareness Month! Let’s raise awareness and support the organizations making a difference for all the strong and brave individuals fighting this disease: 🎀 @livingbeyondbc 🎀 @susangkomen 🎀 @bcrfcureButton

-

“As a nonprofit professional, finding new ways to develop your skills and grow professionally can lead to greater success for your organization as a whole. Taking the time to improve your public speaking skills allows you to speak more confidently within your team and to eloquently promote your mission to a wider audience.” - Pattie Schutte, CEO, Founder, and Principal Coach of Be Brilliant Presentation Group Learn more about the benefits of public speaking on our blog: #LinkInBioButton

-

❓ Have you started implementing your year-end fundraising campaign? 📋 September was the “Creative Month” and October is the “Planning Month.” 📈 During this planning month, your team should present the strategy and approach for the year-end campaign to your organization. 👉 Need more tips? Check out our FREE 2023 Year-End Fundraising Planner: #LinkInBioButton

-

Did you miss our FREE webinar on Video Storytelling with Chris Miano, Founder and CEO of @MemoryFoxes? You’re in luck because it’s on-demand! Check out the webinar recording to learn how to use the power of video to: 📹 Enhance fundraising 📹 Amplify special events 📹 Create a connected internal culture 📹 Build program strategy 📹 Harness program feedback 📹 Execute your mission 📹 And more! Watch now: #LinkInBioButton

-

"Because volunteers are such a valuable resource for nonprofits, it’s important to maximize their engagement by optimizing your website for their experience specifically.” - Allen Kramer, Co-Founder and President of @letsmobilizeus Too busy to worry about web design? We can help! Contact us today: #LinkInBioButton

-

When was the last time you showed your donors you genuinely appreciate them? Our friends at @qgiv_team created FREE donor appreciation email templates to strengthen the connection and loyalty you have with your donors. Check them out: #LinkInBioButton

-

🎁 The world of planned and non-cash giving extends far beyond bequest! 💙 By understanding the variety of options available, you’ll be able to provide donors with better experiences and suggest types of gifts that align with their priorities. 1. Gifts for the future 2. Gifts that pay donors back 3. Other tax-savvy gifts 👉 Read more about planned gifts on our blog: #LinkInBioButton

-

Happy First Day of Fall! Say hello to pumpkin spice lattes, fall decor, and year-end fundraising! 🍁 For a win-win, work #GivingTuesday into your year-end plan as a jumping-off point for the holiday giving season. Use the momentum to invigorate your audience and get them excited about your year-end goals.Button

-

📈 Elevate your nonprofit’s mission and meet your goals with video storytelling! 📹 Join us for our FREE webinar session tomorrow at 12:30 pm ET to learn how to use the power of video from Chris Miano, Founder & CEO of @MemoryFoxes. ➡️ Register now: #LinkInBioButton

-

“It’s no secret that effective marketing helps maximize the fundraising potential of your nonprofit’s events. For events that have a high fundraising potential to start, such as live auctions, being strategic in your marketing efforts can lead to significant revenue generation.” - David White, Director of Nonprofit Sales at @teamwinspire Check out our recent blog for four unique ideas to market your nonprofit’s live auction: #LinkInBioButton

-

@triangle.youth.music is dedicated to educating the next generation in great classical and jazz music through ensemble performance while encouraging appreciation, community participation, and support of these activities. Their programs provide both beginning ensemble training in supportive non-competitive environments as well as top-level groups that inspire serious young musicians selected through a rigorous audition process. 🎼 Full Orchestra 🎼 String Orchestra 🎼 Jazz Ensembles 🎼 Chamber Music We are honored to have built a beautiful new website for Triangle Youth Music. Check it out at triangleyouthmusic.org (#LinkInBio) and support their efforts!Button

-

Does your nonprofit use Instagram Stories? Instagram Stories stickers are a fun and interactive way to engage with your supporters, build awareness, raise funds, and more. Do you need help creating stories and using stickers? Contact us today: #LinkInBioButton

CONNECT WITH US

Join our newsletter for up-to-date Information

Contact Us

Thank you to subscribing to our email list. You can view our most recent posts here.

Please try again later.

All Rights Reserved | Cause Tech dba Achieve Causes