How to Craft a Complete Corporate Charitable Giving Policy

As a corporate leader, you know that achieving your company’s goals depends on the collective efforts of your executive team, employees, and other stakeholders. The same goes for your corporate giving initiatives. As philanthropy becomes an expanding priority for companies and consumers around the world, it’s more important than ever to rally everyone in your company to make a combined difference in the community.

While corporate giving programs are appealing to many socially conscious employees, many of them may not participate simply because they aren’t aware of the opportunities. That’s why creating a corporate charitable giving policy is vital to the long-term success of your program.

If your company needs a corporate giving policy, we’ve got you covered. We’ll walk through all the basics and best practices in the following sections:

- What is a Corporate Charitable Giving Policy?

- Benefits of Corporate Giving

- Main Types of Corporate Giving Programs

- What to Include in a Corporate Charitable Donations Policy

- 5 Steps to Create a Corporate Giving Policy

- 3 Stellar Examples of Corporate Charitable Giving Policies

More than 26 million individuals work for companies with matching gift programs, but over 78% of them are unaware that their company offers this program or know any program specifics. Crafting a comprehensive corporate charitable donations policy is an easy and necessary solution to this lack of awareness.

What is a Corporate Charitable Giving Policy?

Corporate giving is one aspect of a company’s corporate social responsibility (CSR), or its role in promoting social good within the community. According to the CSR pyramid, businesses should promote social good in all economic, legal, ethical, and philanthropic areas of their operations. Philanthropic activities like contributing funds, services, and other resources to charitable causes demonstrate that companies are interested in more than just making a profit.

A corporate charitable giving policy outlines your company’s approach, guidelines, and processes for corporate giving. It serves as a source of truth for administrators and participants alike, spelling out essential details such as eligibility criteria and deadlines.

Only 19% of companies include more than a single paragraph on matching gift programs in accessible employee handbook materials or their website. Rather than leaving your employees in the dark, encourage them to embrace your corporate giving efforts by enlightening them about your programs. The more information you provide upfront, the easier it will be for employees to get involved.

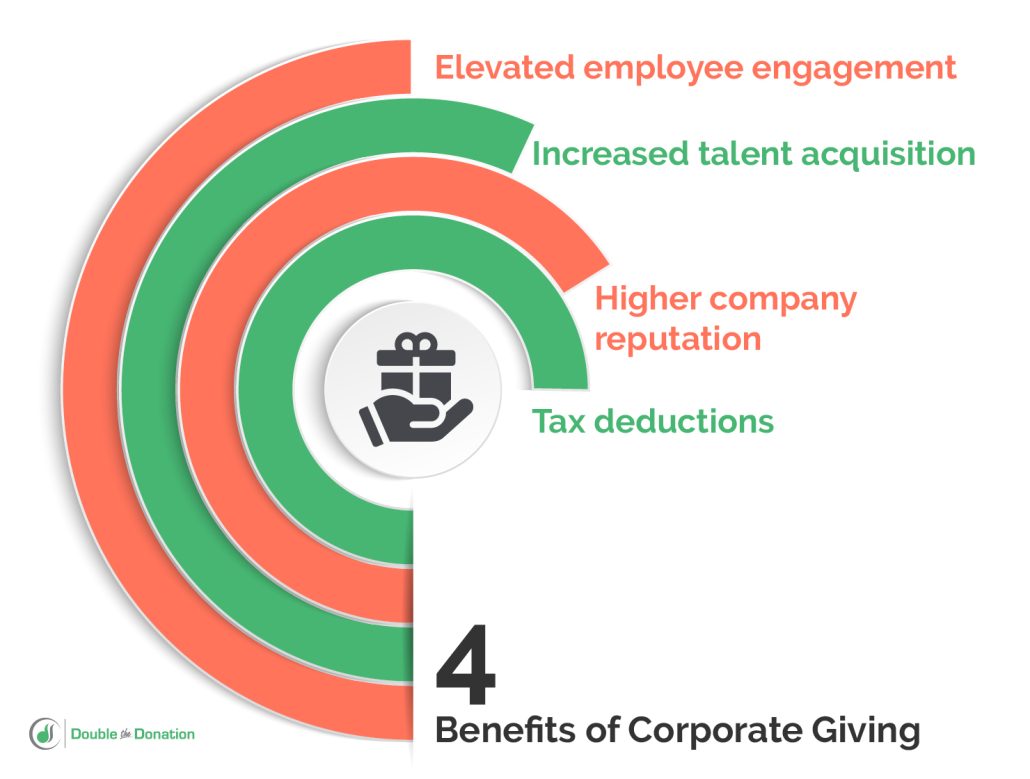

Benefits of Corporate Giving

An official corporate charitable donations policy allows your company to tap into the full benefits of corporate giving. By demonstrating a more serious investment in philanthropy, you’ll be able to:

- Elevate employee engagement. Building a work environment with engaged employees is key to boosting their productivity, encouraging innovation, and maintaining their commitment to your company. A well-defined corporate giving program can produce a sense of pride among employees, helping them feel fulfilled and purposeful in their roles.

- Increase talent acquisition. Recent research reveals that 54% of U.S. employees are willing to take a pay cut to work at a company with better values, and 56% would not even consider working for a company with values they disagree with. Therefore, having a clear corporate charitable giving policy can attract more socially conscious top talent for your company.

- Boost company reputation. The priorities of modern consumers are changing. According to Accenture, 46% of progressive consumers would pay more to support a retail brand that takes action to improve society. A detailed, public-facing corporate giving policy can go a long way toward demonstrating your company’s social priorities and drawing in more customers.

- Qualify for tax deductions. By engaging in corporate giving, your company can qualify for tax deductions. This means you can retain more overall earnings while retaining employees and generating a meaningful impact in your community.

To access these benefits, you’ll need to set up an effective corporate giving program that employees are enthusiastic to get involved in.

At the same time, corporate giving affects more than just your company. Thanks to these initiatives, nonprofits can raise more funds, find more volunteers, and acquire more resources for their causes. Mutually beneficial nonprofit-corporate partnerships allow both parties to expand their audiences and achieve more.

Main Types of Corporate Giving Programs

In your company’s corporate giving policy, you’ll specify all of the various corporate giving opportunities that you offer. While these will differ from company to company, let’s explore some of the main types you might include in your policy:

Matching Gifts

A matching gift program allows employees to double the impact of their donations to nonprofits. After they make a gift to a cause they care about, they can submit a matching gift request to their employer. As long as they meet all the criteria, the company will typically match that gift amount and make a contribution of its own to the nonprofit.

Whether or not your company already has a matching gift program, staying up-to-date on popular program guidelines ensures that you design a rewarding experience for your employees. Consider these common matching gift guidelines and trends to inform your corporate charitable giving policy:

- 93% of companies have a minimum match requirement of less than or equal to $50.

- 91% of companies match donations at a 1:1 ratio.

- Higher matching gift caps yield higher employee engagement, with maximums above $10,000 seeing an engagement rate of up to 40%.

If your company is looking to increase participation in its matching gift program, think about lowering your minimum match requirement and increasing your match ratio. This way, you’ll inspire employees to make a difference by giving however much they’re comfortable with.

Volunteer Grants

Corporate volunteer grants are another popular type of philanthropy similar to matching gifts. However, instead of matching donation amounts, companies award monetary grants to nonprofits after their employees volunteer a certain number of hours there.

In your corporate charitable donations policy, you’ll explain parameters such as eligibility criteria, restrictions, minimum volunteer hours required, and deadlines. Additionally, you’ll need to include how much funding you’ll award for every hour volunteered.

Beyond volunteer grants, there are a few other ways your company can encourage volunteerism among employees. For example, you can provide volunteer time off (VTO) to empower more employees to get involved in their community or organize corporate volunteer events to promote team-building.

Community Grants

Through community grants, companies dispense financial support directly to nonprofits, usually to address a local need or priority within their communities. To obtain this funding, nonprofits must meet the qualifications for the grant and complete an application process, which involves explaining what they’ll use the money for.

A community grant will typically align with your company’s overall mission and values. For instance, a healthcare company may offer grants for nonprofit programs related to improving the health of community members. You can also engage employees by asking for their input in the community grants you provide, such as by giving them the opportunity to nominate nonprofits or vote on causes to support.

Sponsorships

With sponsorships, companies can construct mutually beneficial partnerships with nonprofits as part of their corporate philanthropy strategy. You’ll fund a nonprofit’s event or project, and as thanks for your support, the nonprofit will recognize your company in its promotional materials. This leads to a win-win for both parties, as the nonprofit receives essential funds to conduct its activities and your company benefits from extra marketing.

In-Kind Donations

Your company can supply nonprofits with more than just monetary resources through in-kind donations. These gifts include various goods or services that can power a nonprofit’s mission. For example, you may contribute office equipment, gift baskets for an upcoming auction, or venue space for an event. Additionally, you could involve more employees by having them volunteer to provide free services to a nonprofit, such as graphic design or legal consulting.

Scholarships

Many companies choose to invest in next-generation talent by starting corporate scholarship programs. High school and college students can apply for these opportunities and secure significant funds to cover expenses such as tuition, educational materials, and other school-related needs. You can even focus your scholarships on areas relevant to your company’s sector to cultivate a talent pool of promising candidates in the future.

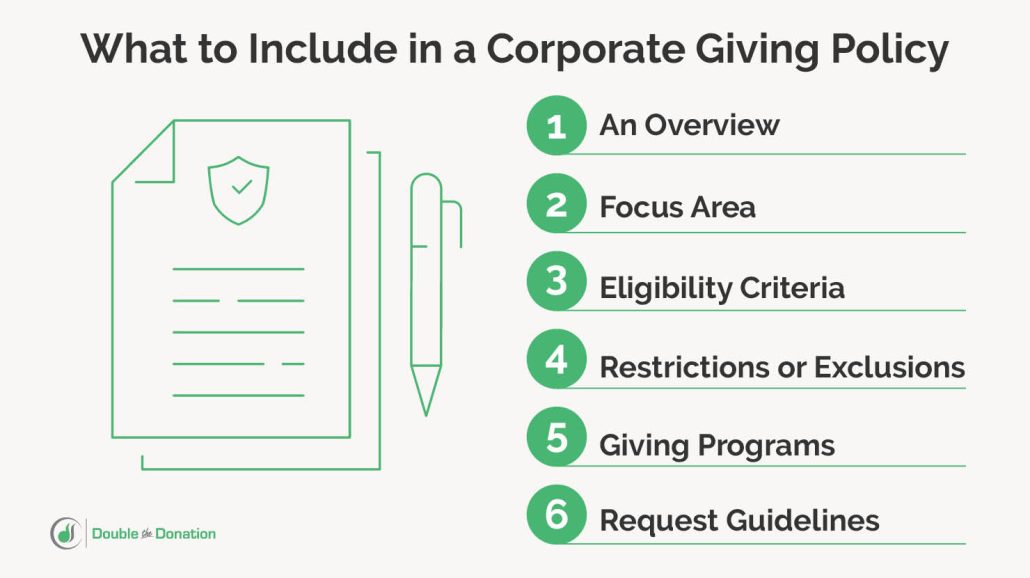

What to Include in a Corporate Charitable Donations Policy

Regardless of the corporate giving opportunities your company offers, the key to a successful program lies in communicating them effectively to your employees, nonprofits, and other stakeholders. A corporate charitable giving policy should be detailed yet concise, so readers can easily access all the information they need.

These are the main elements you should include in your corporate giving policy:

Overview

At the beginning, include a brief overview explaining the purpose of your corporate giving program. Connect these goals to your company’s larger mission and values. This will ensure that employees understand how their participation contributes to the overall success of your company and inspire them to get involved. Additionally, include a point of contact that employees can reach out to with questions.

Focus Area

If your corporate giving program centers on specific causes or areas of focus, specify these in your employee charitable giving policy. This way, your employees will know which types of nonprofits you prioritize supporting. For example, an education software company may primarily direct its corporate philanthropy efforts toward nonprofits with education-related causes.

Eligibility

Outline the requirements that organizations must meet to be eligible for your support. One common condition among U.S. companies is that only 501(c)(3) entities can benefit from their philanthropic initiatives.

Also, clarify which employees are eligible to participate in your program. Some companies limit engagement in their programs to full-time employees, while others allow part-time and even retired employees to get involved.

Restrictions

List any restrictions or exclusions in your corporate giving program. For instance, your company might have geographical limitations on the nonprofits you support. Or, you might opt not to include political or religious organizations, even if they have 501(c)(3) status.

However, it’s important to note that the percentage of Russell 1000 companies offering “unrestricted matching gifts” grew over 48% over the past three years. This means that more businesses are shifting their programs to broaden their support and create a more significant impact in their communities.

Giving Programs

Include all of your company’s corporate giving opportunities in this section, from matching gifts to scholarships. Be specific about details such as:

- Match ratio

- Minimum and maximum match amounts

- Deadline to submit a request

In the case of volunteer grants, be sure to mention if there is a minimum number of hours an employee must volunteer before they’re eligible to submit a request.

Request Guidelines

In this section of your corporate charitable giving policy, walk through the exact steps an employee should take to submit a matching gift or volunteer grant request. The easier the process, the more likely employees will actually participate in your program.

For instance, 96% of employees prefer that their employer matches donations they make directly to a nonprofit, rather than only those made on the company’s corporate giving platform. Having flexible giving options and eligibility criteria allows you to better accommodate varying employee preferences and interests.

5 Steps to Create a Corporate Charitable Giving Policy

Ready to put together your company’s charitable giving policy and start powering change within your community? Use these basic steps as a jumping-off point:

- Clarify your corporate giving goals. Begin by solidifying your corporate giving goals, including the kind of impact you’d like to have on society. Formulate your policy with your overall mission, values, and business strategy in mind. This ensures that all of your efforts contribute to a sustainable, cohesive, and engaging corporate giving program.

- Set your charitable giving budget. Take the time to determine the amount of funds your company will allocate to its corporate giving program. This budget will guide you as you work out specific criteria and other details of your giving opportunities, such as minimum and maximum match amounts.

- Collect feedback. Send out a survey to employees and other stakeholders to get a better understanding of their priorities, interests, and preferences when it comes to corporate giving. Identify common insights and take them into consideration as you conceive and finalize the specifics of your company’s program.

- Define specific criteria and focus areas. Based on the corporate giving opportunities you’re planning to offer, map out the criteria for participation and fund allocation. This includes focus areas, the types of employees eligible to get involved, and any restrictions you may have on which organizations can receive your company’s support.

- Verify legal compliance. After you’ve drafted your corporate charitable donations policy, avoid any potential fines, penalties, or losses by verifying that everything complies with local, state, and federal laws. Some points to bear in mind include tax deductions and reporting requirements. For instance, it’s important to understand and communicate that contributions made to organizations without 501(c)(3) are not tax deductible.

Consider creating multiple versions of your corporate giving policy. In doing so, you can share an external, public-facing document that focuses on showcasing your company’s values, devotion to philanthropy, desired impact, and commitment to transparency. Then, you can circulate an internal, employee-facing policy that includes more specific details on eligibility and participation.

Furthermore, once you’ve prepared your corporate charitable giving policy, make sure your company is equipped with all the tools to carry out its program.

For example, workplace giving software that integrates with matching gift tools like auto-submission simplifies the process for employees by automatically submitting requests on their behalf after they donate. This can significantly elevate your corporate giving program’s participation rates and help your company generate more of an impact.

3 Stellar Examples of Corporate Charitable Giving Policies

To set your company’s corporate giving policy and program up for success, it’s best to stay informed about the latest philanthropy trends and best practices. Let’s take a look at well-designed policies produced by other charitable companies.

IBM

As a multinational technology company, IBM considers itself a leader in CSR, detailing numerous charitable giving initiatives in its Benefits Summary. In a dedicated section for CSR, it lists the following opportunities for employees to get involved in, such as:

- IBM Service Corps. Through IBM Service Corps, employees can participate in various pro-bono community projects to improve their leadership skills, contribute to social good, and practice problem-solving. Since its inception, nearly 4,000 IBM employees have completed over 1,300 projects around the world.

- P-TECH and SkillsBuild Mentoring. These two programs allow IBM employees to become mentors, helping students and job seekers through project-based learning.

- IBM Volunteer Grants. Both current and retired IBM employees can secure volunteer grants for the nonprofits they volunteer with, earning $10 per hour after reaching a minimum of 10 hours served.

- IBM Matching Grants Program. IBM provides unrestricted matching grants to eligible nonprofit organizations, contributing up to a total of $10,000 per employee each calendar year.

IBM’s policy stands out due to the variety of engagement options the company provides to employees. This encourages more employees to participate according to their preferences and interests.

Verizon

On Verizon’s corporate philanthropy page, the company shares two separate corporate giving policies for matching gifts and volunteer grants. This allows them to go into more detail about each opportunity.

The matching gifts program policy delves into eligibility criteria, request deadlines, and exclusions. It even includes administrative notes, including when to expect matching payments and where to go for more questions about the program.

Similarly, the volunteer grants program policy covers eligibility criteria and other specifics such as the maximum amount that Verizon will contribute to a nonprofit per employee each year.

General Electric

The GE Foundation offers a comprehensive matching gift policy for employees, featuring General Electric’s logo on every page and even reports when it was last updated.

The company lists everything in clear sections, including:

- Overview

- GE participant eligibility

- Charitable organization eligibility

- Gift eligibility

- Gift matching process

Under each section, General Electric goes into specifics about which types of organizations are ineligible, such as religious organizations, and how the foundation confirms gifts made to nonprofits.

Enhancing Philanthropy with a Corporate Giving Policy

A corporate charitable giving policy sets all of your company’s philanthropy efforts in stone. However, this doesn’t mean that everything is permanent. After you’ve shared the policy with employees and other stakeholders, be sure to collect feedback on both your giving program and the policy itself. Doing so enables you to identify areas to improve, details to clarify, and ways to engage more employees in corporate giving in the long term.

If you’re looking for tips and best practices for embracing corporate philanthropy and building a better workplace at your company, check out these additional resources:

- A Full Guide to Employee Engagement Tools + 20 Top Picks.Corporate giving can effectively engage your employees, but what other strategies can you use to boost employee engagement? Explore essential tools your company can leverage to better engage its employees in this guide.

- Matching Gift Videos | Examples and Best Practices. Encourage more employees to participate in your matching gifts program by learning how to create an educational matching gift video.

- 22 Employee Recognition Platforms To Recharge Your Workplace. Want to thank your employees for their participation in your corporate charitable giving program? Discover game-changing employee recognition platforms for organizations of all sizes in this guide.