Venmo has been around since 2009 and quickly grew popular with younger generations. Over 70 million people (most in the US) use Venmo to send funds to friends and family, pay for goods, and make donations to nonprofit organizations. The app processed $230 billion in total payment volume in 2021. Adding Venmo to your nonprofit’s donation system can help you reach younger donors that may have seemed inaccessible.

With this article, we’ll help you understand –

- How Does Venmo Work?

- Benefits of Using Venmo

- How to Use Venmo to Increase Donations

- Venmo Vs.PayPal

How Does Venmo Work?

Venmo is a digital wallet suitable for individuals and businesses. People can download the Venmo app on their Android or iOS phone, create an account, and link their bank accounts, and credit/debit cards to it to start using the payment service. Users can also put money in their Venmo account that they can use to make payments at any point in time. This makes Venmo a more desirable option for users in the US.

For nonprofits, one of the best features Venmo offers is the advantage of social proof. Venmo users can share their payments with their connections on Venmo. The privacy settings can be adjusted on the App – to public, friends, or private. This social-media-style feed also comes with features like emojis and animated stickers.

As a nonprofit, you can set up a business profile on Venmo and share your QR code with donors to help them make a quick donation during events or through your website. However, the best way to use Venmo would be to connect it with your online fundraising system.

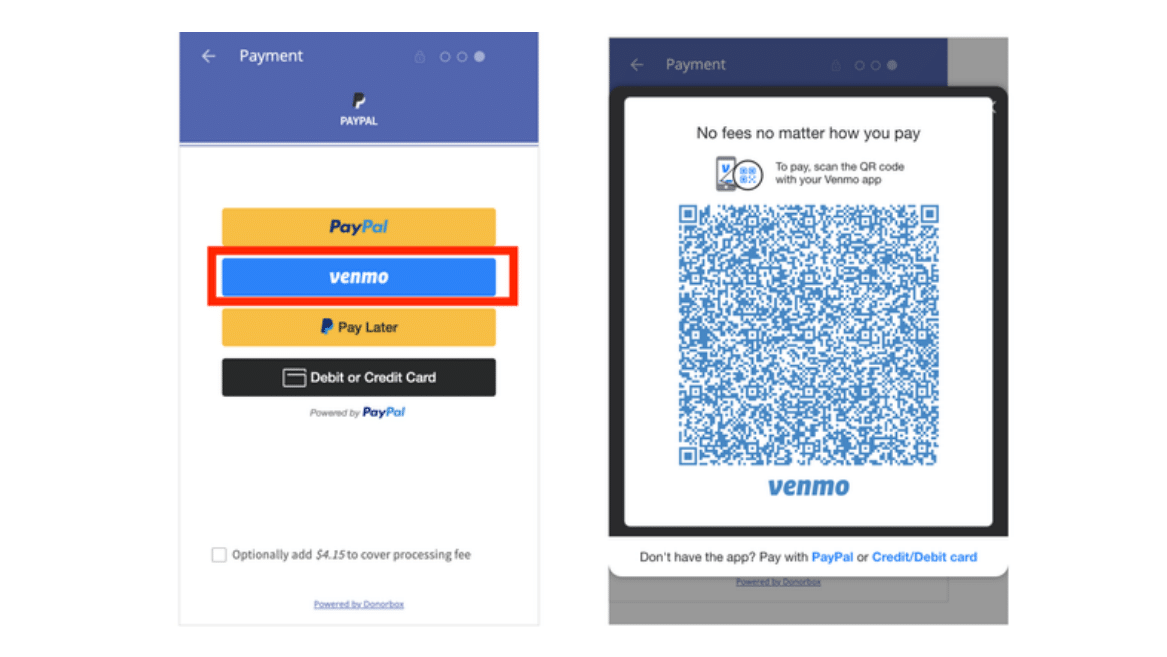

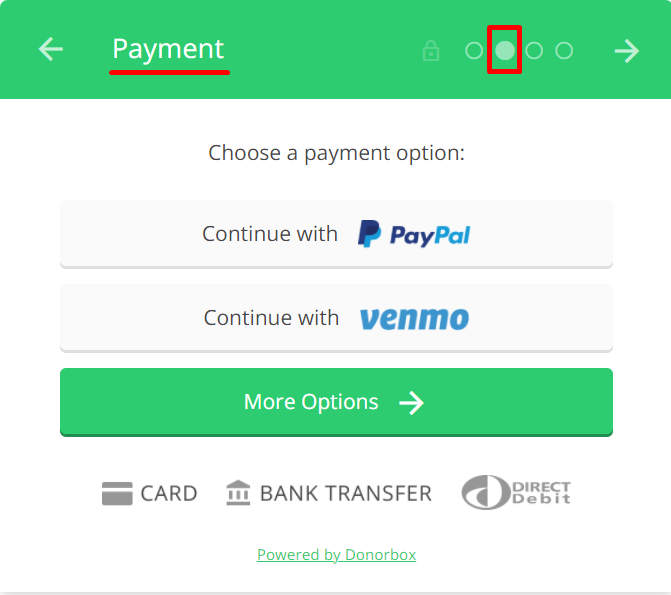

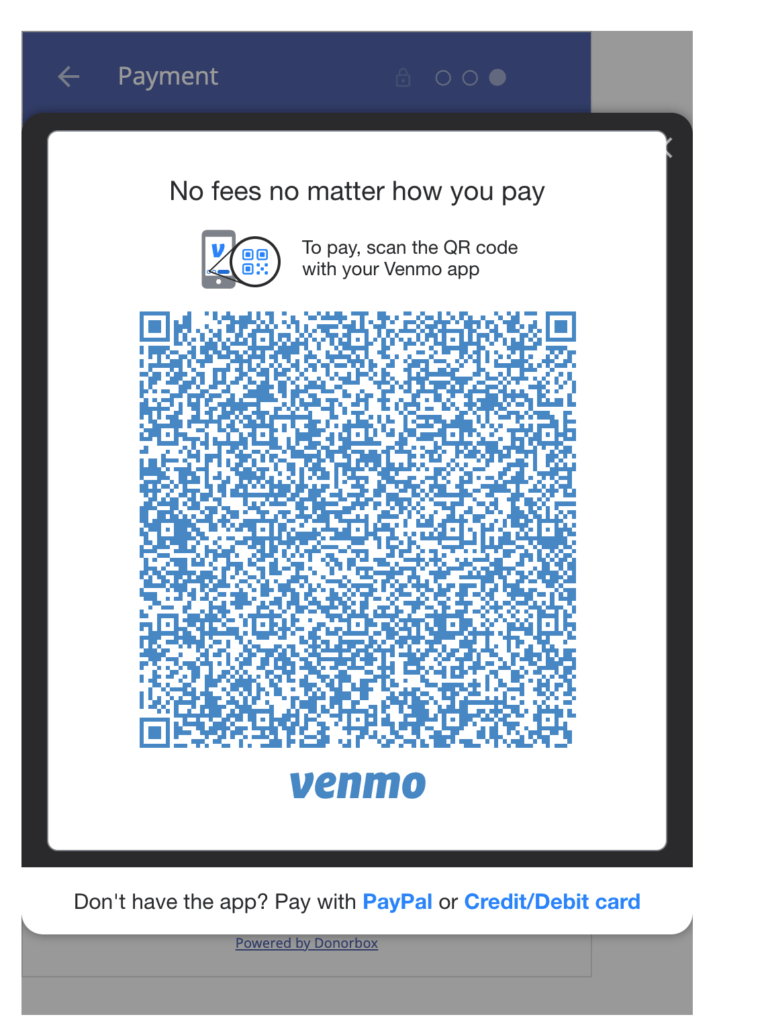

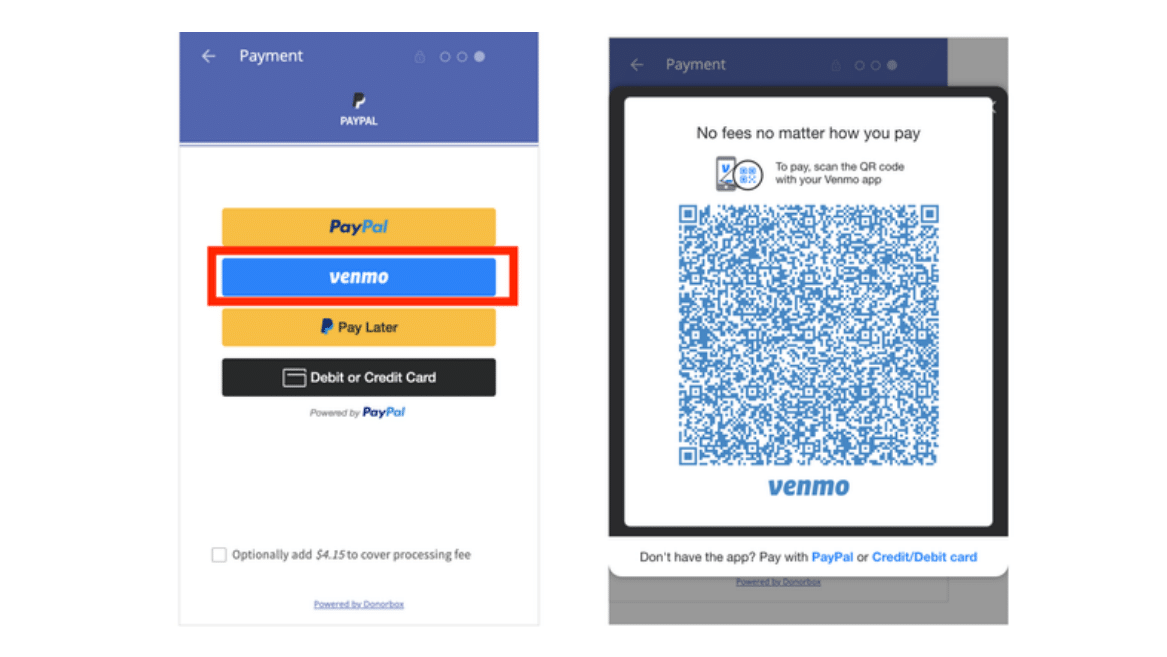

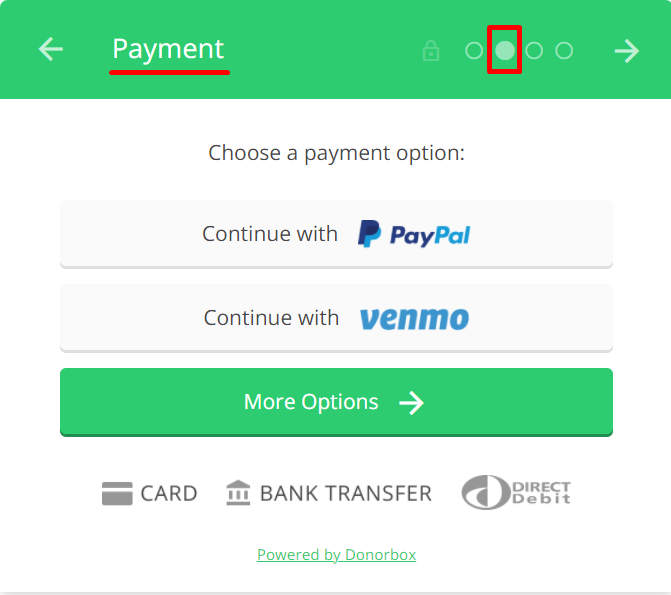

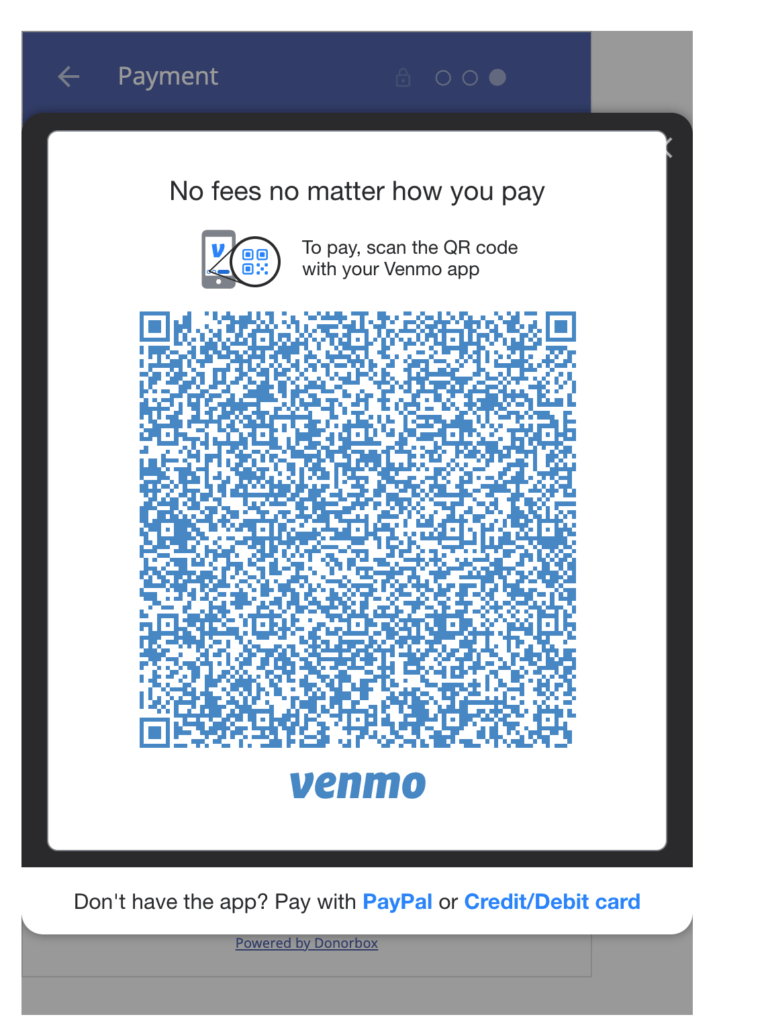

Donorbox makes it super easy for you as well as your donors! All new Donorbox campaigns are enabled with Donorbox UltraSwift™ Pay that automatically adds all digital wallet options including Venmo to your donation form. And if you have existing campaigns (that don’t have UltraSwift™ Pay), just ensure that you have your PayPal business account connected with Donorbox and upgraded to PayPal Checkout. Your donors will be able to see the Venmo option on the payment page of the donation form, as shown below. If your donors are donating from a computer browser, they’ll see a QR code (shown below) to complete the donation by scanning it on their Venmo app on mobile.

Start Fundraising via Venmo

To know more about how Venmo and Donorbox works seamlessly together, continue to read the next section.

Venmo and Donorbox

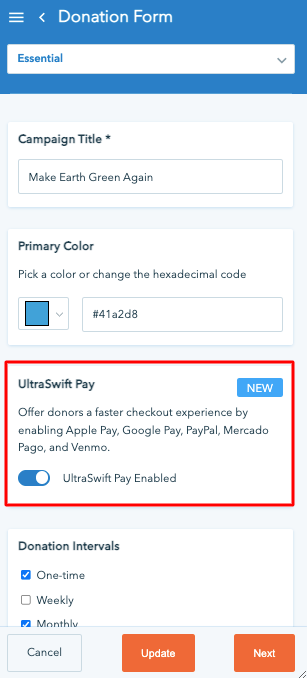

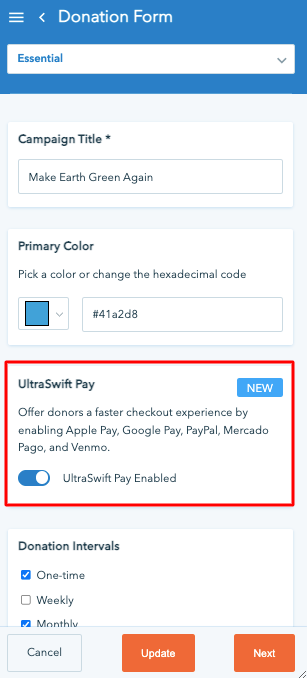

You can use Donorbox UltraSwift™ Pay to encourage your donors to pay with Venmo in addition to other popular digital wallet options. All new campaigns on Donorbox will default to UltraSwift™ Pay but if you have existing campaigns, you can easily switch it on under the “Essential” section of the donation form edit page.

This option makes giving to your organization faster by eliminating the step for inputting personal details. Donors, especially the younger generations, love this ease of making a donation.

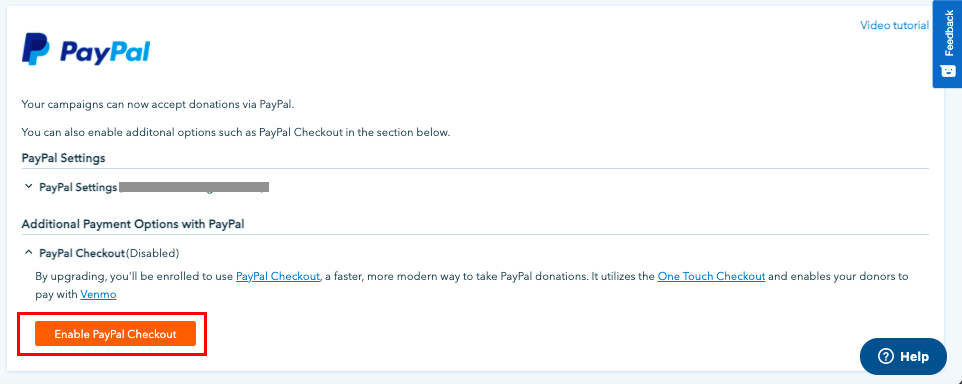

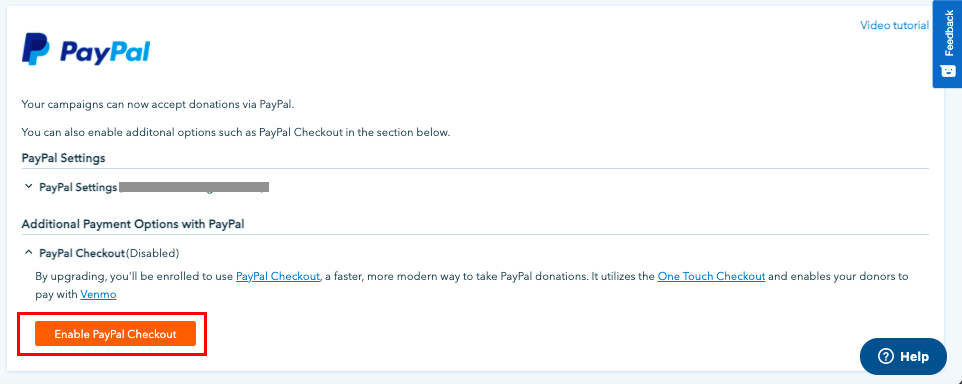

Whether you enable Donorbox UltraSwift™ Pay or not, you can let your donors donate through Venmo. This can be achieved via PayPal Checkout. All you’ll have to do is connect your PayPal business account with Donorbox and upgrade to PayPal Checkout on Donorbox. That’s all.

Now you can accept donations through Venmo on desktop or mobile. Desktop users will be shown a QR code to complete donations on their mobile app and mobile users will be redirected to the Venmo app.

6 Benefits of Using Venmo for Nonprofits

The Venmo app gives nonprofit organizations an affordable and easy option to reach younger donors. The average Venmo users are from the age of 25 to 34 years old. And the average transaction amount remains between $65 and $75. As a nonprofit organization, you need to tap into this potential to reach out to students and other donor types that prefer giving in small amounts.

1. Free publicity

As we’ve already discussed, younger generations find Venmo’s communication features appealing when sharing payments with friends. The fact that the app automatically shares transactions on its social-media-style feed means your nonprofit can benefit from free publicity each time someone makes a donation.

2. Easy to use

Younger donors love mobile payment services, especially, digital wallets, and Venmo is quick and easy to use. They can either give via their connected bank accounts or cards or by using their digital wallet money. Scanning QR codes and making a donation is another preferred choice for most donors.

Nonprofit organizations that use PayPal as a payment processor can let donors easily give via Venmo (through desktop/mobile) in simple steps using the Donorbox donation form.

3. Affordable for nonprofits

Nonprofit organizations pay a low transaction fee of 1.9% +$0.10. There are no set-up costs or monthly fees. If nonprofits are connecting to Venmo through PayPal Checkout, the processing fee structure will follow that of PayPal. They’ll charge 1.99% + $0.49 for registered nonprofits.

4. Venmo users have a greater ability to give

People who use Venmo often keep extra funds in their accounts if they need them. This means they have access to money not otherwise accounted for in their budget. Thanks to this, nonprofits have a way to remove a primary reason people don’t donate, which is that they don’t have the funds available.

5. Easier to form relationships

Venmo lets people send messages with their donations. They also allow nonprofit organizations to message back and start a conversation with donors when they’re open to the relationship. Once a nonprofit receives a donation, all they have to do is thank the donor immediately, and you’re already on the right track.

6. Venmo is secure and reliable

Venmo is owned by PayPal. That itself means the parent company will ensure utmost payment security and protection on the App. Moreover, if you’re using PayPal Checkout to accept donations via Venmo (on Donorbox), you can rest assured that PayPal’s secure payment system will take care of everything.

How to Use Venmo to Increase Donations

1. Add Venmo to your donation form

Adding Venmo to your donation form means your donors will be able to choose this option and easily make a donation. As we have discussed before, Donorbox makes it easy for nonprofits to accept Venmo donations via PayPal Checkout. Since most nonprofits already have PayPal as a payment processor option, the first step is already done. Just connect your PayPal business account with Donorbox and the Venmo option will be added to your donation form.

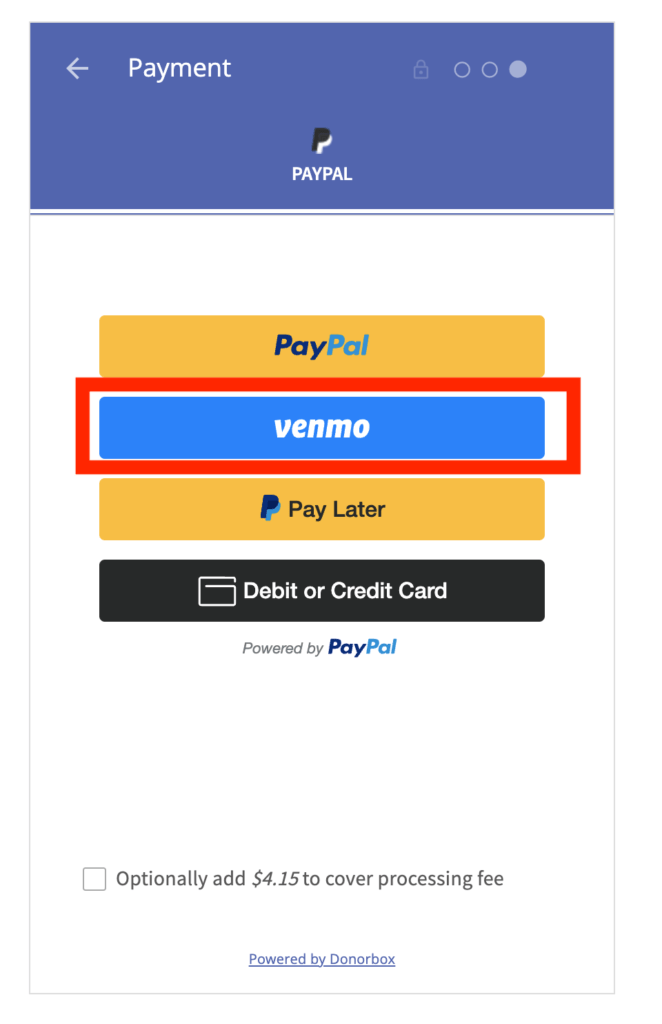

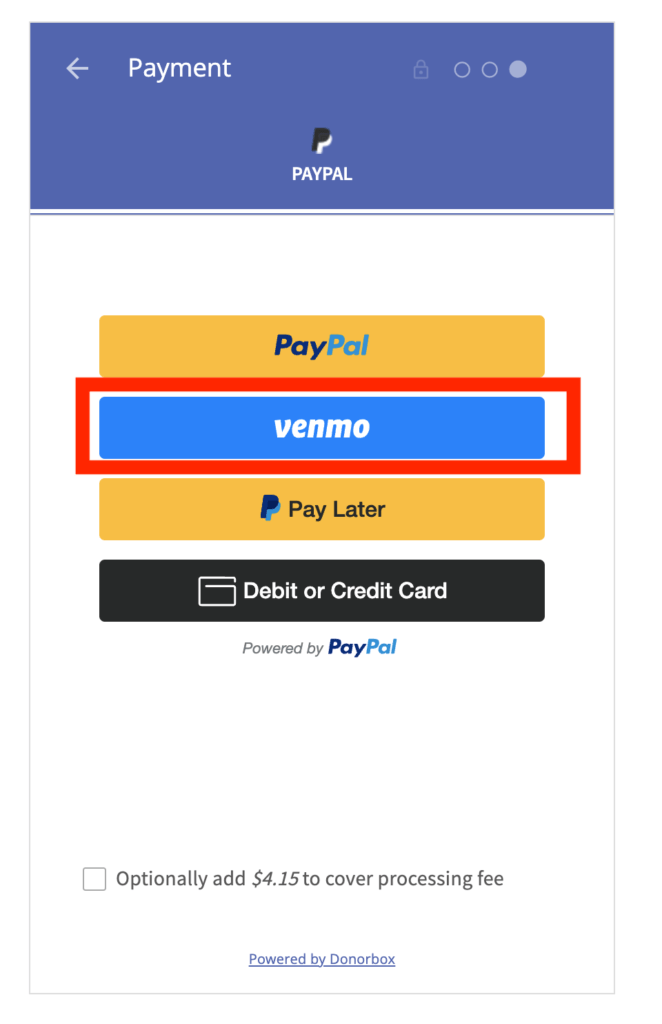

Here’s how it looks on your donation form when donors choose PayPal to complete the donation.

You can also opt for Donorbox UltraSwift™ Pay (automatically enabled for all new campaigns on Donorbox) to let donors pay with super-fast digital wallets including Venmo. It’s highly recommended as this simple and quick donation form makes giving a breeze without your donors having to input their personal details. Plus, you get plenty of other digital wallet options along with Venmo, such as Apple Pay, Google Pay, PayPal, etc.

2. Promote your Venmo QR code

Venmo uses QR codes to make accepting payments easier for businesses. By creating one for each account, they make it simple for nonprofits to encourage their donors to give easily. You should promote this QR code across all possible channels including emails, social media, website, donation pages, and offline/online events.

If online donors are opening your donation form on the desktop and using PayPal to give via their Venmo account, they’ll be shown a QR code to scan from their Venmo app and complete the donation. This way, you’re not just limited to mobile devices for Venmo donations.

3. Target young donors

Venmo’s social media feed shares where people are sending money. Nonprofits using Venmo should be aware and keep track of this feed. When you see a donation, comment on the feed to bring attention to the gift. Younger donors appreciate the recognition and will be more interested in giving again in the future.

Another creative way nonprofits can highlight Venmo donations is by live-streaming the Venmo feed during a virtual or hybrid event. This way, you can promote a different way to give and encourage more donations through social proof.

4. Build relationships

Venmo allows individuals and nonprofits to send personal messages along with their gifts. This feature gives nonprofits another communication tool and opportunity to form a relationship with the donor. When you receive a donation via Venmo, be sure to send a quick personal response. Don’t forget to make it meaningful or funny with stickers and emojis. Young people are quick to notice if it’s just an automated response.

Venmo vs. Paypal

PayPal bought Venmo in 2012, but that doesn’t mean the experience is the same. Both these mobile payment services are easy to set up for nonprofits and donors. It doesn’t cost anything to set up an account, but the fees to send and receive donations are different for each.

PayPal is used in more than 200 countries and with over 25 currencies. Donors can give up to $10,000 each time with a total cap of $60,000. PayPal also offers its nonprofit users a discounted processing fee of 1.99% + $0.49 per transaction. But in most cases, PayPal alone is not the best option for nonprofits due to a lack of customization, branding, and fundraising opportunities.

On the other hand, Venmo doesn’t yet have a dedicated nonprofit program. But it can be seamlessly integrated with donation forms like that of Donorbox. Venmo has a much lower giving limit of $299.99. But Venmo is mostly used for smaller donations, so this limit is generally not an issue. Also, the transaction fee remains low at just 1.9% +$0.10.

Ease of use and sharability are the primary reasons people use the Venmo app. Most users appreciate that they can send money for free as long as it’s coming from their Venmo balance, bank account, or debit card. Venmo is currently only available in the United States.

Final Thoughts

Add Venmo to the fundraising options for your nonprofit organization and watch the magic unfold. Your fundraising platform should have this already added to its donation form.

Explore more ways of fundraising and engaging with your donors on our nonprofit blog. Subscribe to our newsletter to have insightful tips, resources, and guides delivered to your inbox every month.

Donorbox has a plethora of simple-to-use features to offer to nonprofits, along with Venmo donations. Our features range from user-friendly Recurring Donation Forms and Donation Pages to Crowdfunding, Peer-to-Peer fundraising, Events, Memberships, Text-to-Give, Donor Management, and more.

Nonprofits looking to scale their fundraising efforts should opt for Donorbox Premium – an all-in-one fundraising solution offering a dedicated account manager, expert fundraising coaching, high-performance tools, and priority technical support.

Frequently Asked Questions (FAQs)

1. Why use Venmo for your nonprofit organization?

Venmo is an excellent way to appeal to younger donors. The simplicity, fast payments, and shareability make it a popular app that millions of younger people already use.

2. What does it cost nonprofits to use Venmo?

There is no startup fee to use Venmo. Businesses using it to accept payments have to pay a transaction fee of 1.9% + $0.10. But if you’re connecting to Venmo through PayPal Checkout, the charges will be the same as PayPal processing fees i.e a 1.9% + $0.49 fee for registered nonprofits.

3. What does it cost donors to use Venmo?

Venmo doesn’t cost donors anything if they send money directly from the Venmo account, bank account, or debit card. There’s a 3% standard fee for users making payments with credit cards.

![Using Venmo to Increase Nonprofit Donations [Venmo for Nonprofits]](https://donorbox.org/nonprofit-blog/wp-content/uploads/2022/04/Use-Venmo-to-Increase-Nonprofit-Donations.png)