Gift coding practices can make or break your nonprofit’s fundraising strategy. When it comes to being able to effectively analyze your donor’s giving patterns, and generating accurate fundraising reports, utilizing a consistent and well thought-out strategy of coding the gifts that your nonprofit receives is imperative.

Effective gift coding starts with good gift entry practices

Strong gift entry practices are the gateway to a strong fundraising program, and learning and mastering the fundamentals of proper gift entry are essential. No two fundraising programs are alike. One organization might achieve its fundraising goals through an annual gala, a planned giving program, and a robust annual appeal, while another nonprofit might focus its energies on managing a strong monthly giving program in addition to its year-end appeal.

The one thing that every successful fundraising operation has in common, though, is a commitment to good gift entry. Once you have a grasp of gift entry fundamentals, you’ll be able to create the foundation upon which your organization can plan, execute, report on, and evaluate its fundraising operations.

What is gift coding?

With strong gift entry and gift coding practices, you’ll have the ability to track your fundraising efforts in meaningful ways. Every gift your organization receives is part of the story of its fundraising efforts, and like with any story, you will need to answer some key questions.

The Fundamentals of Gift Entry: Ask Who, What, When, Where, and Why?

Whether you’re using a donor management system like Little Green Light or an Excel spreadsheet to record gifts, tracking these details is essential.

Who made the gift?

Capturing the correct spelling of the name of the person who made the gift (or entity, such as a foundation) is crucial. Make sure the gift is connected to the right constituent. To avoid creating duplicate records, search your database to see if the constituent already has a record. Checking the name and mailing address is a good way to confirm whether the donor already has a constituent record.

What kind of gift did they give, and in what amount?

Did the donor make a financial contribution, an in-kind gift of goods or services, or a pledge commitment, or did they buy non-tax-deductible items such as tickets or other goods? Whatever the type of gift, you need to accurately enter its amount. For in-kind gifts, note that donors can receive a tax deduction for gifts of goods but not for donated time. You can record a tax-deductible amount for in-kind gifts; this amount is $0 unless you have a verified third-party appraisal or the donor provided documentation of the fair market value dollar amount and you should leave that appraisal to the donor (refer to IRS Publication 561 for further details).

When was the gift made?

This may seem like an obvious question to answer, but it can be a bit trickier than you might think. Do you use the date on the check, the date of the postmark, or the date on which the donation is received by your organization? We recommend checking with your organization’s attorney but you can also refer to this document to help you understand how to determine the gift date. This becomes particularly important when it comes to entering gifts received at the end of the calendar or fiscal year.

Where should the gift be directed? If the donor wishes for their gift to be allocated to a particular program or fund at your organization, you need to keep track of that information. You can do this by coding a specific fund to the gift record. If the donor does not indicate a specific intent for the expenditure of their gift, you can code it to your general fund.

Why did the donor make this gift? It’s likely that the donor chose to make the gift in response to a specific appeal or event. When you note this information within the gift record, it gives you the ability to track how much money was raised by a specific appeal or event. Without this data, you won’t be able to report on or analyze the success of your fundraising efforts.

How will the gift be acknowledged? Every donor needs to receive an acknowledgment of their gift that conveys your organization’s appreciation and provides key details such as the amount of the gift, the gift date, and the tax-deductible amount of the gift. When you enter a gift record, you should assign or note the manner in which the gift will be acknowledged. This way you can be sure that every donor is appropriately thanked (which is the first step in retaining and stewarding your donors).

Tip: As you make sure these essential questions are answered for every gift you receive, remember that consistency is key when it comes to gift entry. Document your processes and make that information accessible to colleagues so that everyone understands the standard operating procedures.

Why use gift coding?

An effective gift coding strategy can help your nonprofit organization:

- Produce more accurate fundraising reports

- Better evaluate your past fundraising efforts

- Give you more insight into your donors’ giving patterns

One of the benefits of using a donor management system like Little Green Light is that there are tools to help you to more easily ensure your gift coding is correct and complete.

Gift Coding in Little Green Light

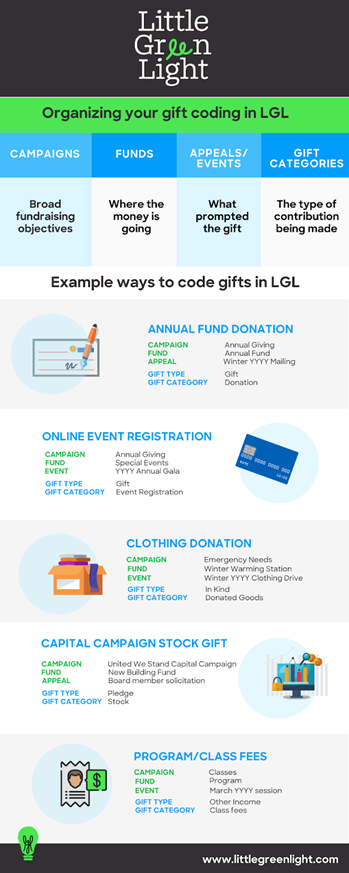

Little Green Light provides a number of key fields for coding your gifts including: Campaign, Fund, Appeal, Event, Gift Category (a subset of gift type), and Payment Type.

Review the infographic below for a detailed description of those gift coding mechanisms:

Examples of using gift coding in Little Green Light:

In this infographic, we provide some examples of ways to code a variety of gifts in LGL including an annual fund donation, an online event ticket purchase, an in kind donation of clothing, a stock gift and program/class fees:

The payoff for coding your gifts effectively

When your gift coding is thorough and accurate, there comes an important and noticeable benefit: clear and actionable fundraising reports.

Here are a few example reports you can generate from LGL that are especially great when your gift coding is complete:

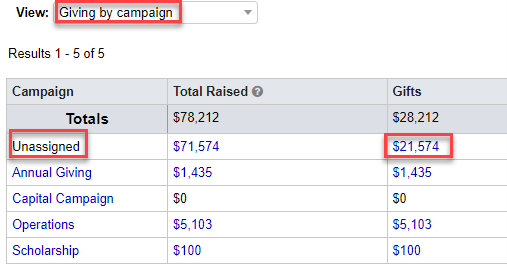

Giving by Campaign This Year

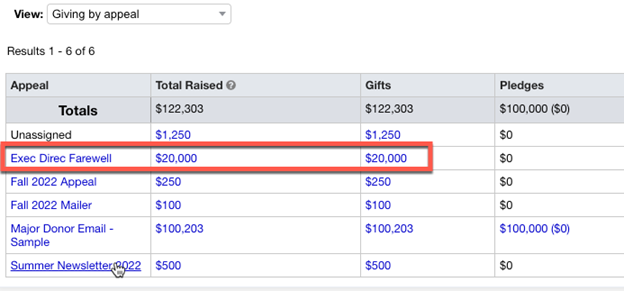

Giving by Appeal This year

Fundraising Totals by Year/Gift Type

The Bottom Line

Gift entry might seem like such a basic component of fundraising that it doesn’t need much consideration. The reality is that without accurate, detailed, and consistent gift entry and coding, your organization’s fundraising efforts will be hindered. The time you invest in mastering the fundamentals of proper gift coding will be well worth it!

About the Author

Little Green Light can transform the way you work. We love people, data and simplicity. Our all-in-one fundraising and donor management system is our way of bringing these passions together. Little Green Light integrates with many of the tools you already use, and lets you manage your data in one central place online, accessible to your team from anywhere.

To see how Little Green Light can help you better manage your fundraising data and more effectively grow stronger relationships with your donors, join us for a free live demo held weekly via webinar.