How Do You Track and Record Recurring Gifts?

NonProfit PRO

NOVEMBER 4, 2021

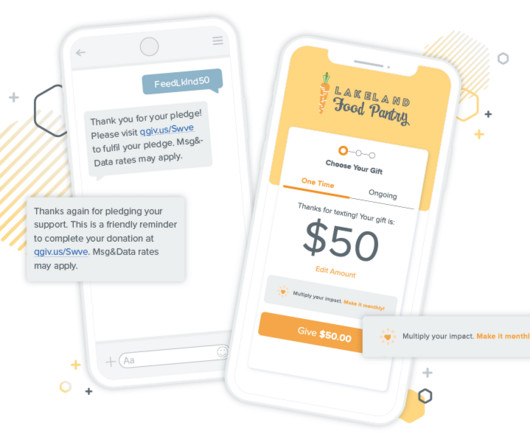

As recurring gifts have no end date, so this is not like your typical major gift pledge where you get big amounts over a limited period. Recurring gifts are counted when received, so only actual payments are measured in the account system.

Let's personalize your content