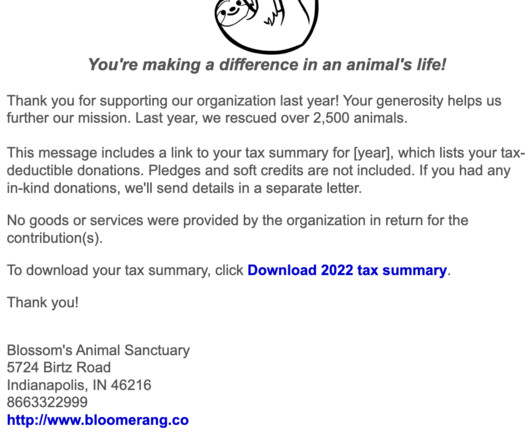

Send Year End Tax Documentation in Minutes!

Bloomerang

SEPTEMBER 19, 2023

Coordinating year-end tax documentation takes precious time—sometimes months. While the IRS requires that donations of $250 or more be acknowledged , it’s a good practice to acknowledge gifts of all sizes. Rest easy knowing donors have the documentation they need for tax deductions. Tax season can be daunting for nonprofits.

Let's personalize your content