How to Start a Matching Gift Program [For Companies]

Thousands of companies host matching gift programs that encourage and amplify employee giving to nonprofit causes. When an individual works for such a company, they are able to make a donation to their favorite charitable organization and request a corporate match as well. This stretches the impact of their initial gift further, allowing them to make a more significant difference with their dollars.

While these types of programs are continuing to grow in popularity among companies and their employees alike, unfortunately, not all businesses offer gift-matching. But it’s not too late to get started!

If you’re a corporate leader looking to find out how to start a matching gift program for your company, you’ve come to the right place. In this step-by-step guide, we’ll walk through the key actions that, when done right, will enable you to develop an effective matching program for your business. These steps include:

- Setting a budget and goals for your donation-matching program.

- Identifying matching gift threshold criteria.

- Determining eligibility for your matching gift programs.

- Deciding how your company will facilitate matching.

- Establishing your matching gift request process (and deadline).

- Exploring matching gift auto-submission to simplify participation.

- Crafting an employee-facing matching gift policy document.

- Informing employees about your matching gift initiative.

- Ensuring your matching gift program is added to the top matching database.

- Collecting data, tracking impact, and making program improvements.

Companies match gifts for a wide range of reasons. These typically encompass business-related benefits such as increased employee engagement, improved reputation, tax deductions, and more. In fact, employees and consumers alike are now more than ever demanding corporate social responsibility from the brands they support.

Studies show that more than 77% of employees reported a sense of purpose as a part of the reason they selected their current employer, while 2/3 of young employees won’t take a job at a company with poor CSR practices, and 55% of employees would even take a pay cut to work for a socially responsible company. At the same time, 90% of consumers worldwide are likely to switch to brands supporting good causes, while 66% would pay more to CSR-focused businesses.

However, genuine altruism can be another key driver behind matching gifts and other workplace and corporate philanthropy programs. Corporate leaders know they have the opportunity to make a real difference in the world and utilize their businesses to do so. And launching a matching gift program is a particularly impactful way to go.

Let’s dive in with the first step.

1. Set a budget and goals for your donation-matching program.

Before you can (or should) launch any new corporate initiative, it’s important to begin with your budget and goals. The same is true for matching gifts. These two criteria will guide the rest of your efforts—your budget because it allows you to determine your new program’s limits and goals to help prioritize objectives and establish what success looks like.

When it comes to budget, we recommend setting a figure that is on the higher end of realistic for your business. That is because, although not every employee will choose to partake, you want to be sure you have the funding should you end up with higher participation rates than you’d initially expected.

You’ll also need to determine where this money will come from. Keep in mind that, though some companies reallocate funding for their matching gift programs from an existing philanthropic budget, others opt to establish a match reserve that is above and beyond any prior giving.

Now, for your goals; two of the most common types of objectives that a company might set in terms of matching gift program success have to do with dollars donated or employee participation. For example, you may decide that your goal for the first twelve months of your program is to contribute $X thousand dollars through employee matching gifts. On the other hand, perhaps you set a primary objective to incite X% staff participation in your matching gift program’s foundational year.

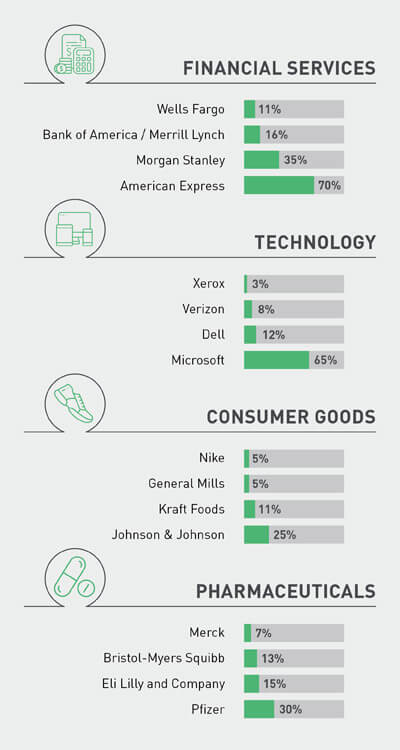

For additional context, take a look at the participation rates from several top matching gift companies in the financial, technology, consumer goods, and pharmaceutical industries:

Regardless, either objective structure works; it’s just a matter of ensuring your team is on the same page.

2. Identify matching gift threshold criteria.

Once you have your budget and goals set, it’s time to establish the boundaries of your program. Essentially, this criteria determines the total amount of funding that is available to each employee on an annual basis and should include the following details:

- Ratios — Your matching gift ratio is the rate at which you agree to match employee donations. 1:1 is by far the most common match rate, with 91% of companies match donations doing so at a 1:1 ratio. However, some companies (approximately 4%) choose to match at a lower rate, such as .5:1, while others (5%) match at a higher rate, such as 2, 3, or even 4:1. For context, if an employee were to make a $100 donation, a 1:1 match would involve a $100 corporate gift, while a .5:1 match would result in a $50 match, and a 2:1 ratio would produce a $200 match.

- Minimum amounts — Next is the minimum amount that your company agrees to match. Minimums are typically set in order to ensure employees are requesting corporate funds for the organizations they truly care about and support with their own dollars. Overall, 93% of companies with matching gift programs have a minimum match requirement of less than or equal to $50, with the average falling at $34. However, minimums can be as low as $1, and some companies choose not to set minimum gift amounts in the first place.

- Maximum amounts — On the other end of the spectrum, nearly all companies set maximum match amounts that they’re willing to pay. Maximum caps allow corporations to manage their budgets properly and ensure there is funding available for any eligible employee to participate. Our research shows that 80% of companies’ matching gift maximums fall between $500 and $10,000 annually per employee, the mean amount coming in at $3,728.

Some businesses even vary their guidelines depending on an individual’s employment status or job type. For example, executive-level team members may be eligible for a 2:1 match up to $20,000, while all other employees receive a 1:1 match up to $10,000. In the same vein, you may decide that part-time and retired employees can request a particular amount of match funding, while current full-time staff are eligible for a higher level.

3. Determine eligibility for your matching gift programs.

Beyond monetary amounts, many companies also set specific eligibility criteria regarding the employee types that qualify to request matches, nonprofit mission types that qualify to receive matches, and contribution types that qualify as initial donations. Let’s take a look at each in further detail as you decide which kinds of gifts your company is willing to match:

- Employee participants — Most matching gift programs are divided into eligibility status based on employment with the company offering the program. Typically, any combination of current, full-time, current part-time, and retired employees will qualify to get involved. However, some companies take things a step further by offering program eligibility to spouses and other family members of current and former staff members as well.

- Donation types — By this point, you should have already determined the amounts you’re willing to match per employee in a pre-determined period. Now comes the question of which types of donations are eligible for corporate matching. Nonprofit donations can be made through a wide range of channels, including (but not limited to) an organization’s website, online donation tools, peer-to-peer giving campaigns, text giving, direct mail, recurring donations, phonathons, paycheck deductions, event pledges, stock donations and other gifts of securities, and more.

- Nonprofit recipients — Though many companies will match gifts to any nonprofit organizations, others will choose specific mission types to either focus on or exclude from the matching initiative. For example, churches and other strictly religious organizations are some of the most common exclusions from companies’ matching programs. On the other hand, some companies will choose a specific cause type (often educational institutions) to which they will exclusively direct matching gift funds. Overall, companies typically choose from organizations in categories such as higher educational institutions, K-12 schools, health and human services, arts and cultural organizations, civic and community organizations, environmental organizations, and more.

In order to ensure an optimal employee giving experience, experts recommend providing a large number of choices for employees to give and to get their gifts matched. Similarly, your company will likely see significantly increased participation levels should you open the program to as many employees and nonprofits as possible.

However, if your company does not have the budget or the bandwidth to introduce a fully-fledged matching gift program, another option to consider would be a custom matching gifts program. What’s the difference? Rather than matching gifts to any or all nonprofit causes, a custom matching gift initiative involves a more direct partnership with a single fundraising organization. From there, a time constraint is typically established (for example, doubling all staff donations to a breast cancer research center made throughout Breast Cancer Awareness Month). You’ll want to encourage employees to support the selected nonprofit during the span of the campaign, then your company will match the total given to make each dollar go farther toward the organization’s mission.

While more limited in scope, custom matching gift programs can be an excellent way to forge mutually beneficial nonprofit-corporate partnerships, rally employees around a particular cause, and gain critical experience in matching gifts. When you see the impact you can make with a custom program, you might even decide to go all in with a traditional matching gift offering!

*While 360MatchPro offers custom matching gift management functionality, this feature is designed specifically for fundraisers looking to manage custom matching gift initiatives—360MatchPro does not work directly with corporations. If you’re a company interested in creating a matching gift program, contact us, and we’ll share information about our corporate vendor partners.

4. Decide how your company will facilitate matching.

Even after launching your matching gift offering, maintaining an effective program will require some continuous upkeep from company leadership. However, you don’t have to do it all manually if you choose not to.

There are generally two key management methods you can choose from:

- In-house program management — Many companies—particularly small businesses—start by matching gifts on their own. While this can keep program overhead costs low, it will require additional investments of time and effort from corporate management. After employees submit their matching gift requests, there must be a process in place to facilitate the review of employee submissions, verify initial donations meet matching criteria, approve corporate matches, and disburse match funding.

- Outsourcing to third-party solution — The alternative to in-house management is outsourcing aspects of your matching gift program to a third-party solution. Though this path will typically involve paying fees to various software vendors, it ultimately saves your team time, effort, and resources. Working with a matching gift software vendor (we have reviews of several top providers for businesses of all shapes and sizes here) allows your company to take a more hands-off approach to matching gifts while streamlining the processes involved for employee participants.

Either practice works, and many companies find that they begin with an in-house management style but later upgrade with corporate giving technology to elevate their efforts. As you make your decision, keep in mind that CSR is an investment that tends to bring substantial benefits to your business as a whole.

5. Establish your matching gift request process (and deadline).

In order to participate in your newly developed matching gift program, employees need to know how to participate and how long they have after making their initial nonprofit donations to complete the request process. Regarding the latter, most companies set their program participation deadlines according to one of the following schedule approaches:

- Number of months following an initial donation — Most commonly six or twelve months following the date of an employee’s initial donation, this type of matching gift deadline works on a rolling basis. If an employee donated to a nonprofit on a certain day one year, they might qualify to request their match until the same date the following year. Or, they might remain eligible for six, nine, or even eighteen months after their original gift, depending on the company offering the program.

- End of the calendar year — For companies that utilize the calendar year to organize their matching gift programs, it’s simple to determine when a match request is due. Whichever year the initial donation was made, the match must be submitted by December 31st of the same year. This is true regardless of whether the gift was contributed on January 1st or December 1st. However, this can result in employees who give later in the year having significantly less time to submit their matches.

- End of the calendar year + grace period — Similar to the previous type, some companies choose to enact a matching gift deadline based on the end of the calendar year and then add on a grace period. The grace period is typically a few additional months into the next year. This means that an individual’s match request would typically be due by February, March, or April following the year in which the initial donation was made.

- End of the fiscal year — If your company operates on a schedule other than the calendar year, it might make sense for your team to set your matching gift deadline in relation to the end of that year instead. Drawbacks to this method may occur if employees are not aware of the fiscal year the company runs on, so be sure to proactively communicate your deadline to employees if so.

Other common stipulations include that the employee must be gainfully employed by the company at both the time the donation is made and the time the match request is submitted and paid out.

As you craft your submission deadlines, you’ll also want to determine which information you’ll request from employees looking to submit their match requests. Common requirements include the employee’s name, organization name, mailing address, and tax ID number, and donation amount and type. You may also ask for a copy of the individual’s donation receipt, and some companies choose to verify each donation with the organization itself (though that can be a hassle for all parties involved).

You’ll also need to establish and ultimately communicate the way in which employees will go about requesting their matches. If you choose to manage your program with a matching gift software vendor, be sure to direct team members to the company’s online match request portal. If you end up facilitating your program in-house, ensure individuals know how to complete the submission process and have the resources they need to do so.

6. Explore matching gift auto-submission to simplify participation.

When you offer a matching gift program for your employees, you want them to partake. Otherwise, you limit the benefits of the initiative that you’ve invested your time, energy, and resources into developing.

Thus, in order to boost participation in your program, it’s important that you make the process involved in doing so as quick, easy, and painless as possible. And the best way to do so is by enabling matching gift auto-submission!

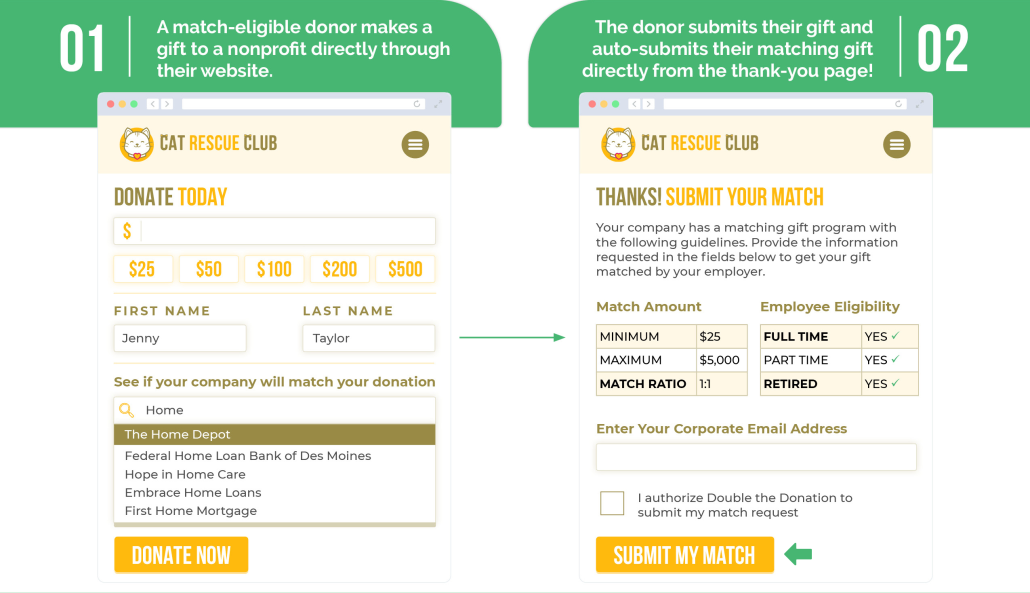

Auto-submission functionality is a trailblazing initiative made available through Double the Donation and its innovative CSR platform partners—including Millie, Selflessly, POINT, and more.

When a company leverages one of these corporate giving solutions to facilitate its matching gift program, they automatically empower employees to get their gifts matched directly from their favorite nonprofits’ websites. Whereas previously, donors were required to complete a separate request process and provide nonprofit and donor information, all they need to do with auto-submission is provide their corporate email address (or another piece of identifying information).

From there, the software systems process the request seamlessly behind the scenes, reducing roadblocks for employees and resulting in elevated engagement in the programming.

7. Craft an employee-facing matching gift policy document.

Some of the biggest reasons employees fail to participate in their companies’ matching gift programs, even if they make qualifying donations, is that they are unaware of their eligibility or lack understanding of the match request process and, subsequently, end up missing the deadline. Therefore, it’s essential that you take steps to communicate your program’s guidelines and instructions for participation to eligible employees.

One of the easiest and most effective ways to do so is by producing employee-facing documentation with all the information your staff will need to get involved. This should include your company’s match criteria, such as:

- Match ratio

- Minimum and maximum donation amounts

- Qualifying employees and nonprofit causes

- Types of donations and submission deadlines

- Matching gift request process and links to online forms

- Participation in auto-submission

Once you have all the information in one place, it’s easy for employees to determine whether their most recent donations are eligible for matching and take the initiative to participate. Keep in mind that, as you make adjustments to your matching gift program, it’s important to ensure your corporate giving policy documentation is as accurate and up-to-date as possible.

8. Inform employees about your matching gift initiative.

Once your program is live, it’s time to begin promoting the opportunity to your employees. This is an essential, though often overlooked, step in the process. In fact, our research shows that despite 26 million individuals working for companies that match gifts, more than 78% of the group has never been made aware of the programs.

Unfortunately, many of those individuals never go to request corporate matches regardless of their eligibility to participate. In the end, that means companies are not reaping the maximum benefit of the programs they worked to establish.

Thus, in order to make the most of your business’ match initiative, it’s imperative that you take the time to ensure your workforce is aware. What this looks like specifically can vary from company to company.

You might:

- Send out a team-wide email;

- Announce the inception of your program at a meeting;

- Add a section to your office policy handbook;

- Incorporate matching gifts in your onboarding process going forward;

Or even all of the above.

The bottom line is that your employees should know about the program and be reminded of the opportunity multiple times throughout the year.

9. Ensure your matching gift program is added to the top matching database.

Directly informing your staff about your newly developed matching gift program is critical. Now your team should be aware of the initiative and ready to get involved. But you also want to ensure that employees are reminded of the program opportunities directly after making eligible nonprofit donations—ideally from the organizations themselves.

For that to occur, you’ll need to first confirm that your matching gift program is added to the leading database of corporate matching gift program information: Double the Donation. Once added, employees will be able to search your company and receive program-specific details straight from the organizations they support, often within a donation confirmation screen widget or follow-up email.

From there, employees can navigate to your company’s matching gift request forms online and complete their submissions while leveraging their post-donation momentum. It simplifies the process involved for team members and results in significantly more matches being completed—meaning more nonprofits receiving funding and increased benefits for your company.

To add your company, follow this link and provide the information requested. This includes your company name, submission materials (such as links to online forms, PDF uploads), and eligibility criteria.

(Hint: the more information you share, the easier it will be for employees to participate in your program.)

10. Collect data, track impact, and make program improvements.

This last stage of the matching gift development process involves taking a look at the program you’ve created and determining whether it meets the criteria previously set in place during step #1. You should be collecting and analyzing data throughout the process (made particularly simple when utilizing program management software). Now, this data comes in handy to help determine program success.

For example, did you meet or exceed your goals? If so—what happens now? Will you set loftier goals for the future and continue matching? If not, how will you adjust your program strategy to ensure your team is on track to reach your goals this time around?

You can also take a closer look at your company’s data to determine and communicate program impact. This should answer questions like how many and to which nonprofits did your company give? What amounts were donated through both employee gifts and corporate matches?

Finally, you’ll want to explore ways to continuously improve your matching gift program in the months and years to come. Consider ways to drive employee engagement in your programming. Elevate giving by increasing your match ratio or maximum donation cap. Or simplify participation in your program by enabling matching gift auto-submission for your employees! You can even use dedicated employee recognition platforms to call out those who participate. As your company grows, your matching gift initiative should grow alongside it.

It doesn’t have to be difficult to get started with matching gifts, and your company’s programming doesn’t have to be the most built-out initiative before you can make it available to employees. Everyone has to begin somewhere, and following the nine steps above will allow you to build a solid foundation for your workforce.

Good luck, and happy matching!

Interested in learning more about matching gifts and developing optimized employee giving initiatives? Check out these other educational resources for companies here:

- How to Offer the Ultimate Employee Giving Experience. Find out what your employees want in a workplace giving program with this insightful guide! Follow the provided tips and suggestions to develop a top-notch philanthropy initiative.

- The Impact of CSR on Businesses: A Guide For Corporations. Why do companies match gifts, let alone participate in any CSR efforts? Explore this resource and dive into the key benefits of corporate giving to businesses like yours.

- Why Workplace Giving Matters for Nonprofits + Companies. Learn more about workplace giving programs, the benefits of these initiatives, and how they help build mutually beneficial relationships between nonprofits and corporations.

![How to start a matching gift program [for companies]](https://doublethedonation.com/wp-content/uploads/2022/08/DTD_How-to-Start-a-Matching-Gift-Program-For-Companies_Feature.jpg)