The 990: From Compliance to Communication

Only 10% of philanthropic foundations have a website to communicate their work.

Here at Candid, we’ve been tracking those statistics for the last 12 years as part of our GlassPockets initiative to champion greater transparency in philanthropy. It really needs more champions because that percentage has remained remarkably steady for a number of years now.

What that statistic means is that for 90% of foundations, the 990-PF is often the only means for communicating their work. Yet, at most foundations, rarely does anyone with a communications background ever review the story this critical document shares with the outside world. Largely considered a document prepared for tax compliance, its important role as a principal vehicle of communication is overlooked. And now that the 990s are released as open data by the IRS, it’s more important than ever to rethink the role of the 990 as a communication channel instead of just a compliance requirement.

Candid can attest to the fact that while the 990s have always been “open for public inspection,” access to them was not always so easy, and making use of the data they contained was very costly. All Form 990s had been released as TIFF image files making it both time-consuming and expensive to extract useful data from them.

The Aspen Institute led a collective effort that included Candid, the Urban Institute, the National Center for Charitable Statistics, and others, who together made a strong case to use technology to improve both transparency and efficiency. As a result of these efforts, coupled with legal actions, in 2019, the IRS began mandating the electronic filing of all 990s as open data. They are currently in the process of delivering on this goal.

Open Data Defined

You might think that the 990 has always been open, so what has changed? As defined in the Open Data Handbook, key elements of open data include:

Availability: the data must be available as a whole, preferably by downloading online, at reasonable or no cost.

Access: The data must also be available in a convenient and modifiable format.

Machine readability: The work must be provided in a format that can be processed by a computer and where the individual elements of the work can be easily accessed and modified.

Re-use and redistribution: the data must be released without restrictions on its use, including permitting combining with other data sets.

Universal Participation: Everyone must be able to use and re-use the data without restrictions against any persons or groups. For example, restricting commercial use or favoring only educational use is not permitted.

One of the critical pieces of the definition that changes how the 990 was used in the past, is that the data is digital, machine-readable, and inter-operable so it can be consumed by anyone. Compared to the clunky image files, this means it can be consumed much more efficiently at scale. Once consumed, the data can be used to build statistical analyses, make comparisons, and draw conclusions, all without ever needing to speak with anyone from the foundation. What kinds of use cases are there? A recent report from the Dorothy A. Johnson Center provides insights into the impacts this scale of data is making, and the challenges it is creating.

As a librarian working in philanthropy, I have often helped all kinds of users navigate the 990-PF, including grantseekers, academic researchers, journalists, and prospective employees. Below are the most common types of research needs people use the 990 to find:

- Grants data and patterns of giving

- Demographics data—what do grant recipient and grant descriptions reveal about who benefits from the foundation’s grants?

- Information about the people leading the foundation

- Operating expenses, including executive compensation

- Investment information, including whether stock holdings run counter to the foundation’s programmatic goals

Who’s Funding What and Where, and Who Benefits?

The questions we field most often pertain to the story the grants data tells us about where funding is going, where it’s not going, and who does and does not benefit. Sadly, often the 990-PF falls way short of providing many details that would answer those questions. Sometimes that omission tells an inaccurate story about your foundation.

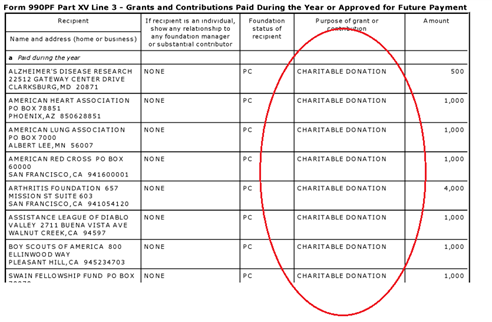

Though Candid does try to use the data you submit to the IRS via the 990-PF, the reality is that due to the limitations of the form and the processing time, it’s not always that helpful. By the time we receive it, the information can be two to three years old, sometimes incomplete due to technical issues, and often completely lacking in descriptive data. Below is an example that is representative of many of the grants lists we receive from the IRS:

A Case Study: Helping Your 990 Match Your Story

In 2017, Martha S. Richards, Executive Director of the James F. and Marion L. Miller Foundation in Portland, Oregon, shared a cautionary tale explaining her hard-won lessons learned about the 990-PF. In 2010, the Coalition of Communities of Color (CCC) released a study defining the disparities facing communities of color in Portland. Building on this analysis, later that same year, Candid and Grantmakers of Oregon and SW Washington (GOSW) issued a report on grantmaking to communities of color in Oregon documenting “that philanthropy was part of the problem.” The report estimated that less than 10% of grants at the time were reaching communities of color.

Richards shares how this sparked a lot of attention on the data and where it comes from, and about the “limitations of using tax returns to tell such important stories. The grant descriptions in our 990s rarely disclose details about the intended beneficiaries of the grants—even if we know them.” This experience prompted Richards and the Miller Foundation staff to improve the grants descriptions to better describe their reach. As a result, their grant reports to the IRS and to Candid were much improved, as the foundation worked to include demographic data. Below is a before/after of this effort:

| Grantee | Before | After |

| Adelante Mujeres | Program support for Chicas Youth Development | To provide support for the Chicas youth development program, which serves low-income Latina immigrant girls in western Washington County. |

| All Classical Public Media | To expand operations | Program support for the Thursdays@Three show, including equipment improvements and promotional materials |

| Business Education Compact | For the Teacher Development Initiative | In support of the Teacher Development Initiatives, helping K-12 educators teach and adopt proficiency practices in the classroom |

Tell Your Story Through Your Grant Descriptions

Writing a good grant description is not unlike writing a news story with a lot of facts to organize and share. Remember, you are writing for an audience who may not be familiar with the work of your institution at all. In general, a good grant description includes the following information:

- WHAT: What is the primary objective of the grant?

- HOW: How will the objectives of the grant be achieved?

- WHO: Which group or groups are meant to benefit from the grant?

- WHERE: What geographic location(s) is the grant meant to serve?

And once you write it, don’t keep it locked away in your grant management system. Use it to report to the IRS and to Candid directly, and on your website. Even with the promise of open data, there are significant IRS processing delays to contend with, extending the sometimes considerable lag between when a 990-PF is filed and when we receive it. Candid partners with Blackbaud to make it easier for you to share your data with us directly, so we are not using a two to three-year old tax document to describe your giving. Learn more about sharing your data with Candid.

Want to learn more about using your Form 990-PF as more than just a compliance requirement? Check out our webinar, What Story Does Your 990-PF Tell About Your Foundation?