How to Master the Art of Nonprofit Financial Statements

Well-managed finances are the backbone of successful nonprofits. To continue fulfilling your essential role in the community, you must meet IRS reporting requirements, build donor trust, and make informed decisions that contribute to your overall financial sustainability.

While assembling your nonprofit financial statements can seem like a mundane checkbox to mark off every year, they can be highly useful resources for refining your budget, enhancing your fundraising results, and more.

We’ll cover all the essentials about nonprofit financial statements in the following sections:

- The Importance of Nonprofit Financial Statements

- 4 Essential Types of Nonprofit Financial Statements

- How to Prepare Your Nonprofit Financial Reports

- Strong Examples of Nonprofit Financial Reporting

Many nonprofits include these statements in their annual reports to demonstrate accountability. By providing donors, volunteers, corporate sponsors, and other stakeholders with a clear window into your financial activities, you’ll enhance your credibility and increase your chances of securing even more support down the road.

The Importance of Nonprofit Financial Statements

According to a recent Independent Sector study, while most Americans trust nonprofits, 83% indicate that “Nonprofits must earn my trust before I support them” and 80% agree that “I need to see proof of an organization’s impact to continue my support for it.”

With so many pressing causes worth their attention, donors want to feel confident that your nonprofit will put their funds to good use. By sharing your financial statements, you can let them see for themselves just how effectively you’re working to accomplish your mission.

Beyond attracting and retaining donors, nonprofit financial reporting allows you to:

- Improve financial decision-making. With a better understanding of your nonprofit’s financial situation and activities, you can make strategic adjustments to your budget and resource allocation. For example, you might decide to cut down on your event costs next year by investing in registration and planning tools that will allow you to host more virtual fundraising events.

- Secure more major gifts. Major donors can provide substantial funding to power your programs, capital campaigns, or general operations. However, to cultivate these key individuals, you need to convince them that their gifts will make a meaningful difference in the lives of those you serve. Presenting them with your nonprofit financial reports is an effective way to demonstrate your track record and impact.

- Build stronger corporate partnerships. Modern customer and employee expectations have led to a rise in corporate philanthropy initiatives such as matching gifts and event sponsorships. Your financial statements can convince companies that your nonprofit is a worthwhile investment. Plus, you can nurture long-term relationships by publicly recognizing your corporate partners in your annual report.

- Win more grants. When applying for a grant, you’ll frequently have to include detailed financial information alongside your proposal. These statements prove that your organization possesses the fiscal stability necessary to make effective use of grant funding and carry out your proposed project.

- Facilitate board financial oversight. Your board members have a fiduciary responsibility to monitor your nonprofit’s budget and financial health. This doesn’t mean they have to oversee every expenditure, nor do they need to be finance experts. Reviewing your financial statements allows them to ensure that your organization is managing its budget properly and complying with Generally Accepted Accounting Principles (GAAP), which include consistent reporting for every period and honesty from all involved parties.

- Evaluate your nonprofit’s performance. Since nonprofits are legally required to make their financial statements available to the public, you can use these resources to compare your performance with other organizations in your area of focus. In doing so, you’ll be able to identify ways to improve your strategies going forward.

Furthermore, charity watchdogs such as GuideStar and Charity Navigator often consider nonprofit financial reports when rating profiles on their website. Having clear and accurate statements can go a long way toward establishing trust in potential donors looking for new organizations to support.

4 Essential Types of Nonprofit Financial Statements

Nonprofits typically prepare four types of financial statements to visualize their financial health and communicate it to stakeholders:

1. Statement of Financial Position

Your nonprofit’s statement of financial position, or balance sheet, provides a summary of your organization’s financial health at a specific point in time. This document consists of three main elements: assets – liabilities = net assets. Let’s take a closer look at each element:

- Assets. Assets refer to everything your organization owns, including cash, accounts receivable, investments, property, and office equipment. You’ll list these out in order of liquidity, or how quickly you would be able to convert them into cash. Cash requires no conversion, so you would record it first. Since you’d have to take the time to sell your property and office equipment to convert them to cash, these assets would be last.

- Liabilities. Liabilities refer to everything your nonprofit owes to its employees, vendors, contractors, and other organizations. For example, you would catalog your accounts payable, loans payable, and other long-term obligations in this section. You’ll organize your liabilities by their due date, starting with the ones you must pay back first.

- Net assets. To calculate your net assets, subtract your total liabilities from your total assets. While you don’t have to note down every item, you’ll split this section into net assets without donor restrictions and those with restrictions. For instance, a grantmaker might stipulate that you can only use grant funding for a specific project or purpose.

Many nonprofits often include a column for the current year and another for the previous year as a way to compare their financial performance. Feel free to use this template to start constructing your own nonprofit statement of financial position:

The details in your statement of financial position will come in handy when it’s time to file your Form 990. Additionally, you can use this report to learn more about your nonprofit’s liquidity. For instance, by dividing your total current assets by your total liabilities, you can calculate your current liquidity ratio. The higher the ratio, the better equipped you are to pay back all your liabilities.

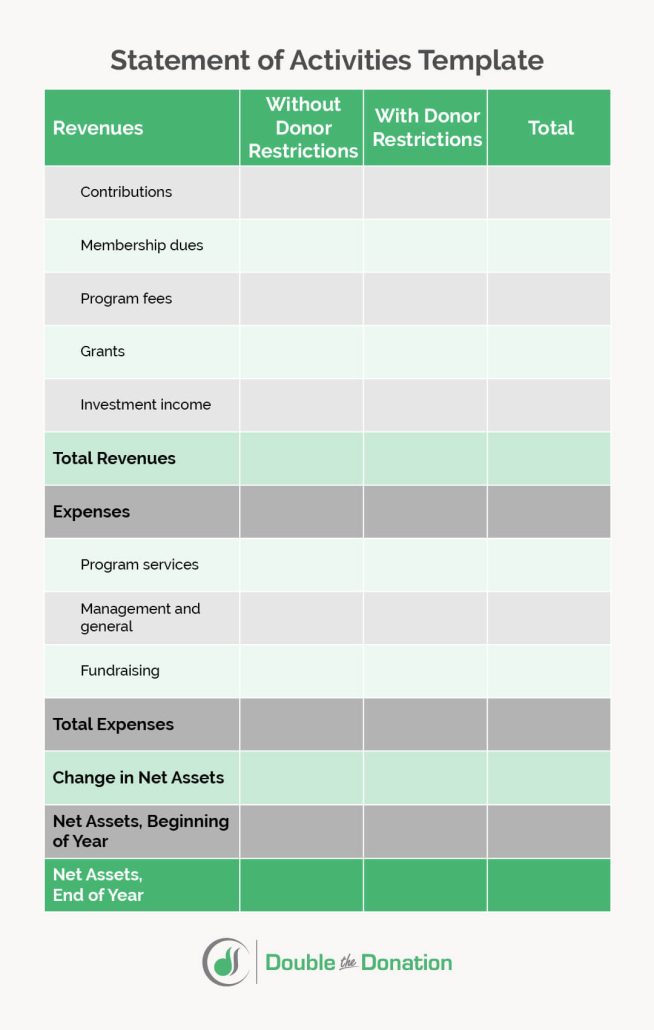

2. Statement of Activities

Your nonprofit’s statement of activities, or income statement, details all your revenue and expenses throughout the fiscal year. Like your statement of financial position, this document contains three main elements:

- Revenues. In this section, you’ll itemize all of your various revenue sources, such as cash donations, in-kind gifts, grants, membership dues, program fees, and investment returns. Your report will commonly include two categories to account for your restricted and unrestricted revenue.

- Expenses. In this section, you’ll specify all the costs associated with running your nonprofit and carrying out your mission. For example, record staff salaries, facility rent, insurance, consulting services, supplies, and program-related expenses.

- Net assets. Subtract your total expenses from your total revenue to calculate your net assets. You’ll typically indicate your net assets at the beginning of the year, your net assets at the end of the year, and your total change in net assets. A positive change in net assets means that your nonprofit is effectively managing its finances throughout the year.

Use our statement of activities template to hit the ground running with your nonprofit financial reporting:

By compiling a statement of activities, your nonprofit can evaluate the sustainability of its programs and determine whether you need to raise more funds to cover your projected expenses in the coming year. For instance, you might decide to focus on marketing matching gifts to generate the revenue you need to expand one of your core programs.

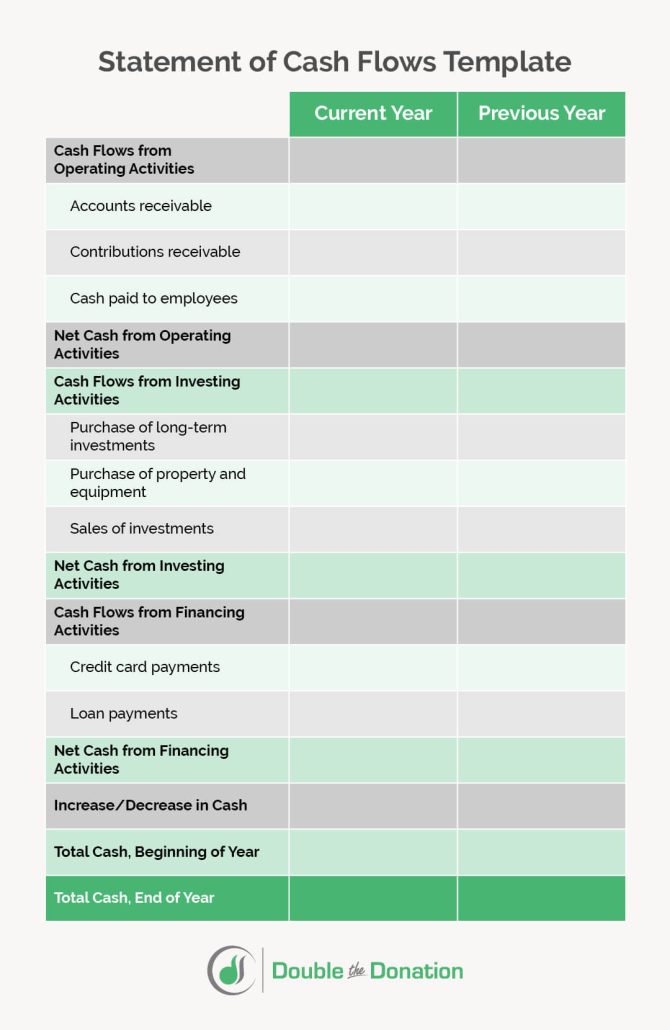

3. Statement of Cash Flows

A statement of cash flows provides your nonprofit with a more minute overview of the cash moving in and out of your organization. Your report will have three main sections:

- Operating activities. These activities refer to the revenue and expenses associated with operating your nonprofit. You’ll log staff salaries, program fees, and donations in this section.

- Investing activities. In your statement of cash flows, you’ll list information such as long-term investment purchases and sales, including property and equipment. Additionally, you’ll note down revenue such as interest earned on your investments.

- Financing activities. Your financing activities refer to any revenue you generate from your savings and financial expenses, like credit card or loan payments.

Like your statement of financial position, it can be helpful to include a column for the current year and a column for the previous year in this report. This way, your leadership team, board members, and other stakeholders can have a better understanding of how your nonprofit generates and spends its cash from year to year.

Start assembling your nonprofit’s statement of cash flows using this template:

By consistently monitoring your cash inflows and outflows, you’ll be able to notice important trends and use them to adjust your financial strategy in the future.

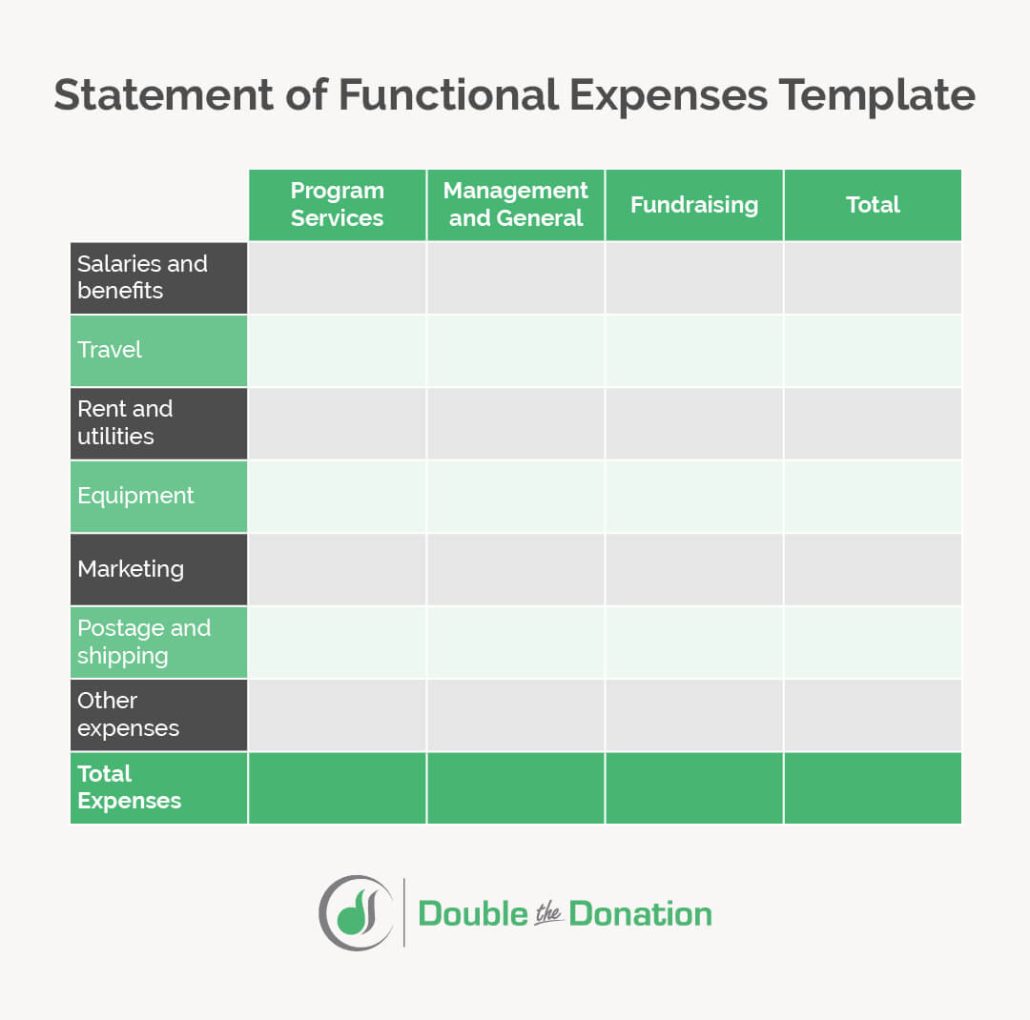

4. Statement of Functional Expenses

A statement of functional expenses recounts all of your spending, categorizing each expenditure by the purpose it served for your nonprofit. You’ll break up this financial statement into three columns:

- Program services. In this column, you’ll enumerate all the funds your nonprofit spent to provide its services and carry out its mission. For example, a hunger relief organization may note travel costs for food delivery while a wildlife rehabilitation nonprofit may include animal care supplies as part of its program expenses.

- Management. Your nonprofit’s management expenses refer to all the costs related to running and managing your organization. Some common management expenses would be employee salaries, office equipment, and rent.

- Fundraising. In this column, you’ll identify all the expenses associated with raising funds for your nonprofit, including the costs of fundraising event planning, new software solutions, and marketing.

Form 990 includes a “statement of functional expenses” page for 501(c)(3) organizations to fill in. While each nonprofit will have different rows of specific expenditures depending on its activities and area of focus, you can use this basic template as a jumping-off point for your nonprofit functional expenses reporting:

You can use the insights from this nonprofit financial statement to guide your annual budget planning. Plus, this publicly available information can provide current and prospective donors with the context they need to decide whether they’d like to support your nonprofit based on how it employs its funds.

How to Prepare Your Nonprofit Financial Reports

Plan to compile these nonprofit financial statements well before the end of your fiscal year to ensure that you have all the time you need to fulfill your accounting requirements. Follow these general steps to start preparing your reports:

- Assemble your financial data. Since your nonprofit financial statements offer a comprehensive rundown of various aspects of your operations and mission, you’ll need to reference receipts, bank statements, and records of other financial transactions to complete them.

- Use dedicated nonprofit accounting software. Many nonprofit accounting solutions make it easy for your organization to manage its financial data, track real-time performance, and even automatically generate its financial statements.

- Review and audit your nonprofit financial statements. Auditing your financial reports can go a long way toward increasing accountability and transparency in the eyes of your nonprofit’s stakeholders. Furthermore, an audit ensures that all your financial data is error-free, so you can confidently share it in your annual report and use it to inform your future strategies.

- Consider partnering with a nonprofit accountant. With so much that needs to be done to fulfill your nonprofit’s mission, tax season and all its requirements might seem like an overwhelming addition to your to-do list. Fortunately, there are accounting experts with years of experience in helping nonprofits prepare their financial reports. Consider reaching out to these professionals to lighten your workload.

Ultimately, your nonprofit financial statements are snapshots of your financial health and activities that you can use to improve your decision-making and secure more support down the line. A nonprofit consultant can work with your team to interpret your financial data and harness it for future growth.

Strong Examples of Nonprofit Financial Reporting

Assembling your nonprofit financial reports may seem like an intensive process, but it’s perfectly feasible. Let’s take a look at some excellent examples that other nonprofits have produced and shared:

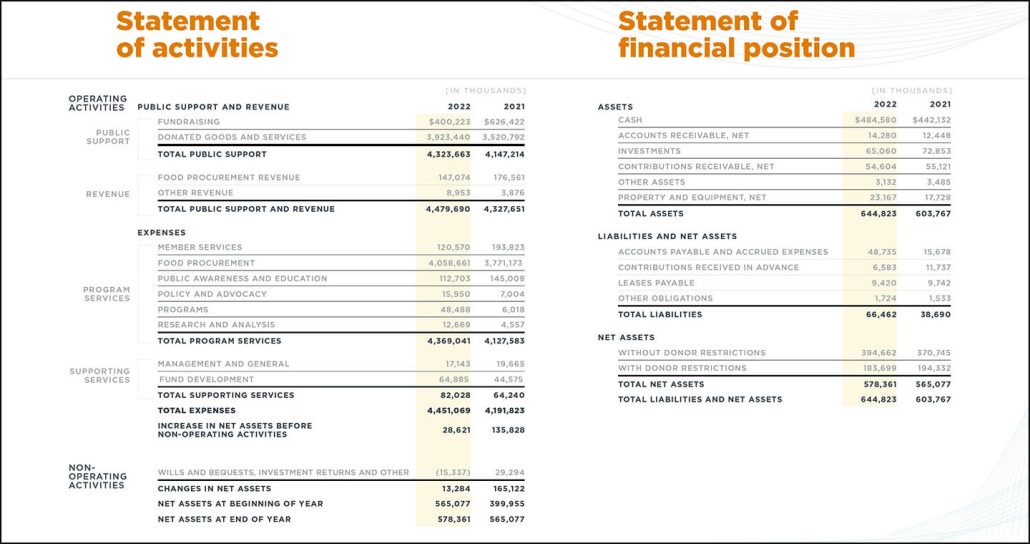

1. Feeding America

Feeding America includes a “Financials” section in its annual report and states upfront that “98% of contributions go directly to programs that serve people facing hunger.” The nonprofit’s statement of financial position and statement of activities provide the necessary details to back up this claim, which can increase trust among donors, volunteers, and other supporters in the community.

Plus, at the bottom of the page, Feeding America adds a link to view its audited financials for anyone interested in delving deeper into its financial situation and activities.

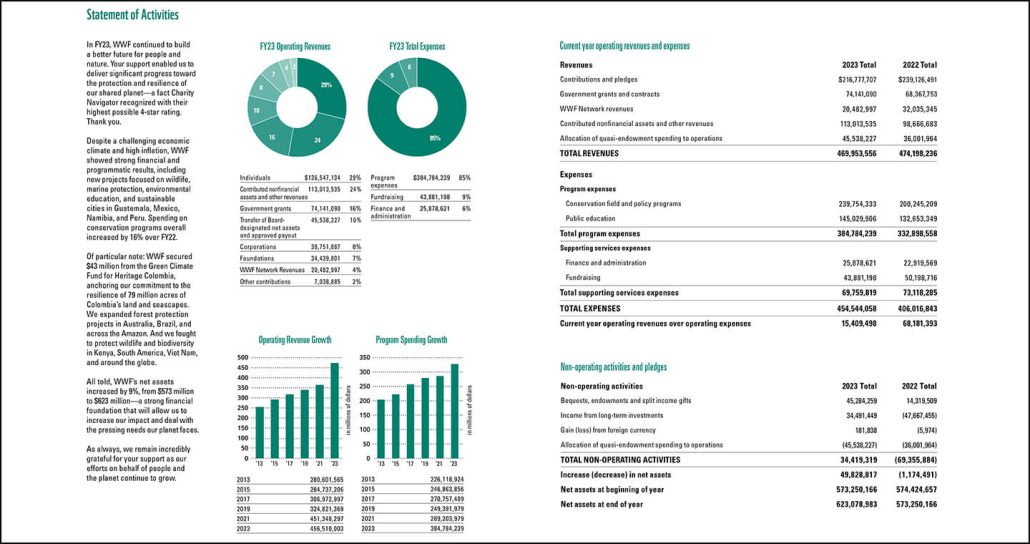

2. The World Wildlife Fund

The World Wildlife Fund (WWF) features graphs alongside its statement of activities to present its annual report readers with a more visual perspective of its revenue and expenses. With just a glance, it’s easy to see that 85% of total expenses were program-related and that the majority (29%) of operating revenue came from individual contributors.

Furthermore, WWF adds graphs that illustrate the nonprofit’s operating revenue and program spending growth over the past decade.

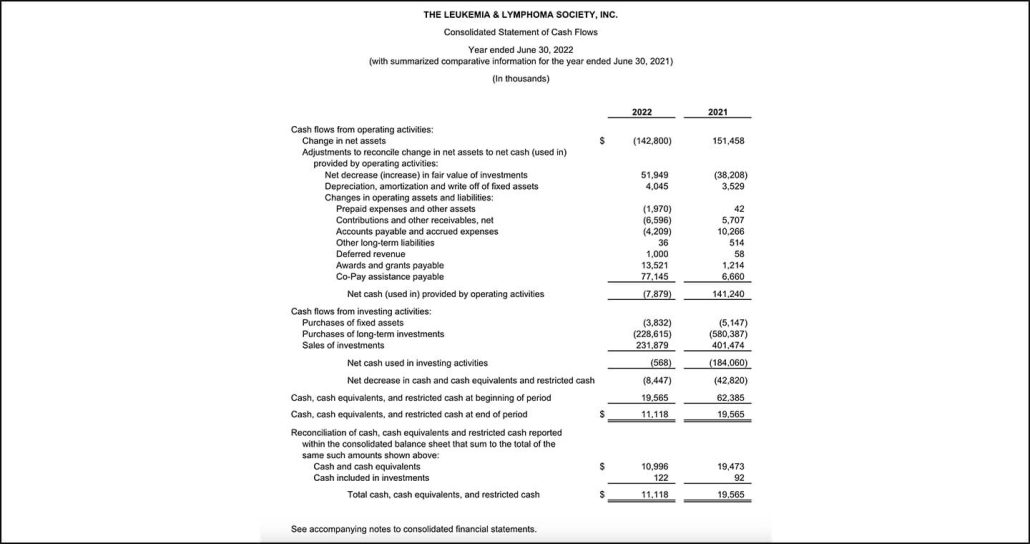

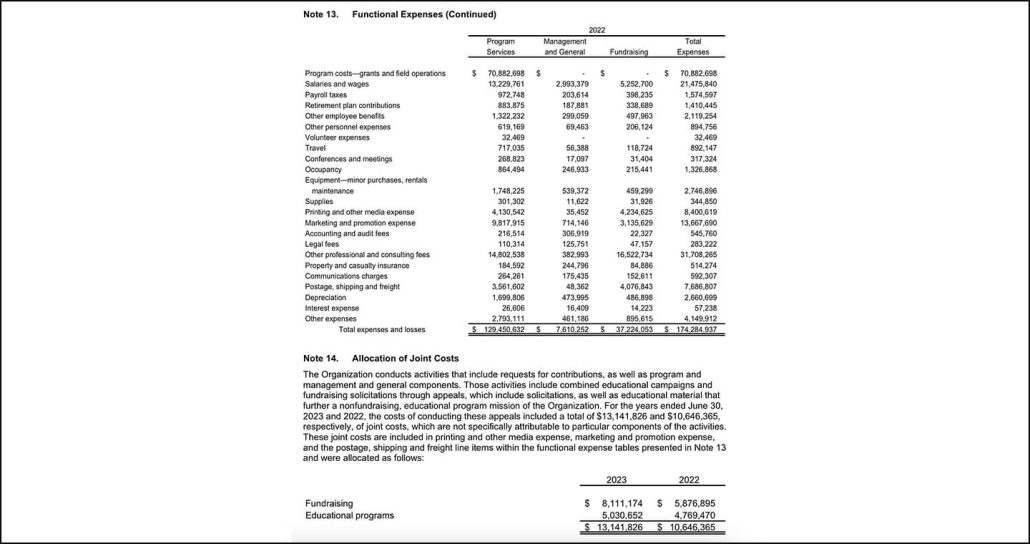

3. The Leukemia & Lymphoma Society

The Leukemia & Lymphoma Society (LLS) shares its audited financial statements for the past five years on its website. Each report comes with a note from the independent auditor stating that they conducted the audit according to the Generally Accepted Auditing Standards (GAAS) to ensure that each document is free from any misstatement.

4. Heifer International

Similar to LLS, Heifer International has an entire page on its website devoted to sharing its financial information with stakeholders, including a graph that maps out its expenses over the fiscal year. The nonprofit even compares its results with the Better Business Bureau standard for charities, stating that it has gone above and beyond by allocating 75% of funds to program expenses and 21% to fundraising activities.

Wrapping Up: Understanding Your Nonprofit’s Financial Health

While preparing your nonprofit financial statements can feel like wrangling a bunch of numbers together, remember that your ultimate goal is to turn these data points into a story that donors, board members, corporate partners, and other stakeholders can understand.

Whether you add graphs to visualize your most important financial details or simply include your audited reports on your website, consider how you can cater to your audience’s interests and preferences. Engaging stakeholders in your financial reporting and providing transparency can turn reporting requirements into increased impact for those you serve.

For more information on how to improve your nonprofit’s financial situation and share better results year after year, check out these additional resources:

- 14 Types of Corporate Philanthropy You Should Know About. Companies are finding more and more ways to support nonprofits and make a difference in their communities. Explore popular types of corporate philanthropy and how to tap into them.

- Matching Gift Videos | Examples and Best Practices. Matching gifts can bring in significant revenue for your nonprofit, at no additional cost to your donors. Discover how you can effectively use videos to promote these opportunities.

- Nonprofit Basics: Google Ad Grants for Nonprofits. Want to expand your reach without straining your marketing budget? Learn all about Google Ad Grants and how you can unlock $10,000 to spend on Google Ads credits every month.