The primary difference between a 501(c)(3) and a 501(c)(7) organization is that a 501(c)(7) exists to serve its own members. 501(c)(3) organizations strive to benefit the public. There are many similarities when comparing 501(c)(7) vs. 501(c)(3) organizations, but the devil is in the details.

This article will explain what 501(c)(3) and 501(c)(7) organizations are, why you might choose one type of nonprofit over the other, and how to set up a 501(c)(7) organization.

What are 501(c)(3) and 501(c)(7) Organizations?

Both 501(c)(3) and 501(c)(7) nonprofits are tax-exempt, according to the Internal Revenue Service (IRS). Still, there are significant differences between the two. You should make sure to fully understand both of these types of organizations when starting a nonprofit.

What is a 501(c)(3)?

Nonprofit organizations classified as 501(c)(3) must be either public charities or private foundations. 501(c)(3) public charities must be organized and operate for charitable, religious, educational, scientific, or literary purposes, or they must test for public safety, foster national or international amateur sports competitions, or prevent cruelty to children or animals. Private 501(c)(3) nonprofit foundations can run like other private foundations but must fund charitable, exempt activities.

Bonus: Looking to register as a 501(c)(3)? Check out this complete guide.

What is a 501(c)(7)?

501(c)(7) organizations are defined by the IRS as social clubs organized for pleasure, recreation, and other similar purposes. Membership must be limited, and the club must offer an opportunity for personal connections between these members.

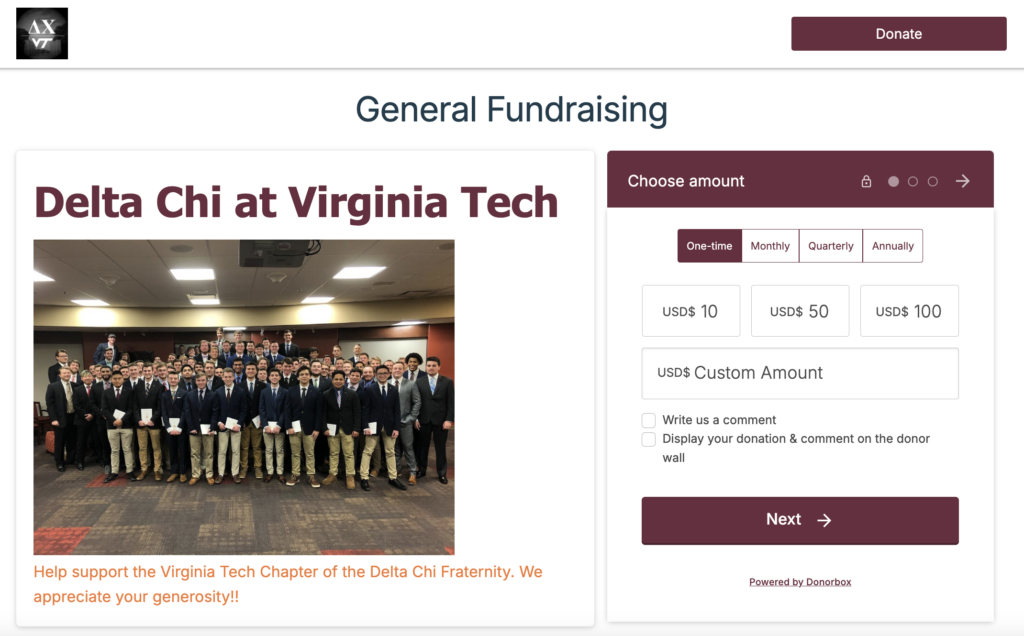

Nonprofit organizations classified as 501(c)(7) can be college fraternities and sororities, country clubs, dinner clubs, hobby clubs (like book clubs and clubs to do with hunting, fishing, chess, gardening, etc.), and more.

The Virginia Tech Chapter of Delta Chi Fraternity uses Donorbox to raise funds online.

Start fundraising for your 501(c)(7)

The Difference Between 501(c)(3) and 501(c)(7) Organizations

The following table breaks down specific differences and similarities when comparing 501(c)(7) vs. 501(c)(3) tax-exempt organizations.

| Similarities |

| 501(c)(3) |

501(c)(7) |

| Tax-exempt from federal income taxes |

Tax-exempt from federal income taxes |

| Income cannot benefit individuals |

Income cannot benefit individuals |

| Cannot discriminate based on religion, race, or color |

Cannot discriminate based on religion, race, or color |

| Must maintain financial records and file annual tax returns |

Must maintain financial records and file annual tax returns |

|

|

| Differences |

| 501(c)(3) |

501(c)(7) |

| Purpose is primarily to benefit the public |

Purpose is primarily to benefit members |

| Restricted from lobbying and political activities for politicians |

No restrictions on lobbying provided it’s related to the organization’s exempt purpose |

| Donors can deduct donations |

Members cannot deduct membership fees |

| Can claim tax-exempt status when filing taxes with Form 990 or file Form 1024 with the IRS |

Required to file Form 1023 with the IRS to gain 501(c) status |

| Must receive most of their revenue from public donations or government entities |

Must be supported primarily by membership fees, dues, and assessments |

| No similar requirement |

Must provide its members with the opportunity for personal contact and connection |

501(c)(3) vs. 501(c)(7): Choosing Your Type

There are benefits to forming both organization types. Before starting your nonprofit organization, it’s vital to view each organization type’s pros and cons.

|

Pros

|

| 501(c)(3) |

501(c)(7) |

| Exempt from federal taxes |

Exempt from federal taxes |

| Donations to 501(c)(3) organizations are tax-deductible |

Club members can combine donations to fund a recreational purpose |

| 501(c)(3) status gives organizations credibility |

501(c)(7) status can give clubs credibility |

| Eligible for government and private grants |

May cost money to file an Article of Incorporation with the state,

but the IRS does not require 501(c)(7) organizations to file additional forms |

| Founders, directors, members, and employees are not personally liable for nonprofit’s debts |

|

|

|

|

Cons

|

| 501(c)(3) |

501(c)(7) |

| No financial benefits for founders |

No financial benefits for founders |

| Financial information is publicly available |

Financial information is publicly available |

| Can be costly and time-consuming to start a 501(c)(3) nonprofit organization |

501(c)(7) organizations must maintain administrative records and file taxes |

| 501(c)(3) organizations must maintain administrative records and file taxes |

Social club members cannot deduct membership fees |

Both organization types are exempt from paying federal income taxes. They must both also keep financial records and file annual taxes. Another primary benefit for both organizations is the credibility each gains from its 501(c) status.

Organizations that operate for charitable purposes and require financial donations to fulfill their missions should become 501(c)(3) organizations for a few specific benefits. Donations to 501(c)(3) nonprofits are tax deductible, increasing donations from those interested in the tax benefits. 501(c)(3) organizations can also apply for and receive grant funding from governmental and private foundations. Read this blog for more details about all requirements and best practices for accepting donations as a 501(c)(3).

Social clubs that primarily operate for pleasure and recreation purposes should file as 501(c)(7) organizations because of benefits like exemption from federal taxes. Member fees are not tax deductible, but the credibility gained from 501(c) status may counter that.

How Do I Set Up a 501(c)(7)?

Now that we’ve compared 501(c)(7) vs. 501(c)(3) organizations, you may feel prepared to launch your own 501(c)(7) social club. Starting a 501(c)(7) nonprofit organization is similar to setting up any nonprofit in your state. The process may feel complicated and overwhelming, but it is simple if you follow a step-by-step approach. Social clubs can benefit from tax-exempt status and can raise money in membership fees to pay for perks like a community pool or event.

If your social club meets all 501(c)(7) requirements with the IRS, you can follow the next steps to file with your state as well as for federal 501(c) status.

1. Choose a name

First and foremost, you will need a unique name for your 501(c)(7) organization. Visit your state’s Secretary of State website to see if the name is available and register it as soon as possible.

Pro tip: What you name your nonprofit is critical to your image. Download our free Naming & Branding Worksheet to help!

2. Choose your incorporator(s)

Now, it’s time to move on to your club’s leadership. You must find at least one Incorporator to sign your Articles of Incorporation.

3. Develop your board of directors

Next up, select your board of directors. The number of board members you must have depends on the state of your organization. Some states only require two board members, but your club’s board of directors should ideally include a president (also known as a chair), vice president or co-chair, secretary, and treasurer.

It’s crucial to develop a process for recruiting and onboarding board members. Be transparent about this process and include it in your organization’s bylaws.

4. Find a Registered Agent

Most states require organizations to find a Registered Agent to receive legal notices for the club. Registered Agents must be individuals or businesses located in the state and be open during regular business hours.

5. Create your club’s Articles of Incorporation

Then, your social club should file an Articles of Incorporation with your state and include information like:

- Corporate name

- Registered name and address

- Names and addresses of board members

- The organization’s purpose

6. Get an Employer Identification Number

After filing your club’s Articles of Incorporation, you can sign up for an Employer Identification Number (EIN) from the IRS. This nine-digit number lets you file for tax exemption with the IRS, start a bank account, and make payroll if you grow large enough.

Fill out IRS Form SS-4 online to apply for an EIN. Print and keep this form safe with your organization’s files.

7. Hold your first board meeting and develop your club’s bylaws

Now, your board members must become leaders immediately and hold their first meeting to develop and approve the organization’s bylaws, create a conflict-of-interest policy, and elect your board’s officers.

8. Apply for tax-exempt status with the IRS

The IRS does not require social clubs to file for tax-exempt status, but these organizations do need to file taxes with Form 990 and identify as a social club. If you apply with the IRS formally, you can file Form 1024.

9. Start a nonprofit bank account

Once you have an EIN, you can set up a bank account for your social club. Finding a bank that offers good benefits and meets your group’s ethical standards is vital. You must also remember to bring the following items when opening your account:

- Nonprofit’s bylaws

- Articles of Incorporation

- EIN

- List of officers, along with their ID cards

10. Find an online membership collection tool

Next, making it as easy as possible to collect membership dues will benefit not just you but your members as well.

Donorbox is an affordable online donation tool that makes collecting membership fees quick and simple. Sign up for free in minutes. Then, start collecting monthly and/or annual memberships and let your members manage their own accounts.

Learn more about Memberships

11. Promote your organization and find members

The IRS has few requirements for membership in 501(c)(7) social clubs. The only rule is that you cannot limit membership based on color, race, or religion.

Now that you’re done setting up your social club with the IRS and your state, you’re ready to promote and recruit members online and in person.

Your Turn

Choosing the right organization type for your organization depends on your mission. When comparing 501(c)(7) vs. 501(c)(3) organizations, it’s easy to see there are several similarities and differences between the two. 501(c)(3) nonprofits must organize and operate for charitable, educational, or scientific purposes. 501(c)(7) organizations are created as social clubs for pleasure and recreation.

If you’ve recently formed a 501(c)(7) organization, visit Donorbox’s website to learn more about the tools and services available to help you raise funds and establish memberships.

Plus, check out our Nonprofit Blog and sign up for regular tips and resources to help you help others.