Key Findings from the 2022 Blackbaud’s donorCentrics Sustainer Summit

The eighth annual Blackbaud’s donorCentrics™ Sustainer Summit brought together 36 of the nation’s large national fundraising organizations to share results and discuss sustainer growth and retention strategies against the backdrop of the pandemic and other significant events that impacted donors and giving in 2020 and 2021.

This year’s summit included data from a variety of sectors, drawn directly from participant CRMs and standardized to allow for consistent comparisons. The analysis is based on a July – June fiscal year, covering the period of FY2017 through FY2021. The data set included 20 million donors who gave 71 million gifts for a total of $2.9 billion in FY2021. (The donor count is the composite sum of each organization and will count donors multiple times who give to multiple organizations.)

Donor and Revenue Growth in FY2021

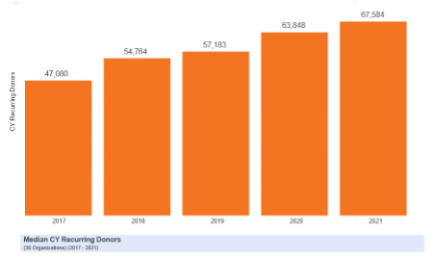

In FY2021, both overall donors and revenue increased at the medians from FY2020. Overall donors increased by 5% and revenue increased by 13%. Though the median share of donors making recurring gifts was essentially flat at 18% from 2020 to 2021, the median number of sustainers increased by 10% over the same period. Over the five-year report period, the median number of recurring donors increased by 44%. (Figure 1)

In FY2021, 67% of all organizations experienced an increase in sustainers. The range in the one year change in the share of recurring donors was from -18% to +31%. After such a tumultuous year, with many drivers for both potential increases and declines in giving, it was no surprise to see mixed trends among sectors and organizational sizes.

Conversion from Single to Recurring Insights

As in FY2020, large scale emergencies and on-going needs created by the pandemic drove an increase in single gift donations, as well as recurring gifts. Converting these donors to sustainer giving was a large factor in 2021 strategies and will be in 2022 and beyond. In FY2021, 61% of organizations increased the number of first-time recurring donors via conversion.

Best Practices and Key Findings for Conversion at organizations with strong conversion metrics:

- The biggest source for conversion in 2021 was digital efforts with the most growth in email and digital ads.

- The share of donors converting via Telemarketing declined for the second year in a row, however many are still seeing value in this channel.

- New donor conversion efforts occurred within 30 days, if not sooner.

- Automated e-mail donor welcome series included a conversion ask.

- In direct mail, the conversion ask is included in most solicitations and as soon as within the gift acknowledgment letters.

- DRTV and other broadcast channels are effective for converting current and former single gift donors when these organizations take the “sustainer first” approach.

New Sustainer Acquisition Trends

In FY2021, new donors increased at the median by 12% with a modest decline in the share of new donors making recurring gifts from 12% to 11%. Over the five-year period, every sector and sustainer program size has experienced a decline in the share of new donors making recurring gifts from a peak year. As with overall donors, often the decline in the share of recurring was driven by a greater increase in the number of donors acquired as single gift donors. Forty-seven percent of the organizations did acquire more recurring donors in FY2021 than in FY2020.

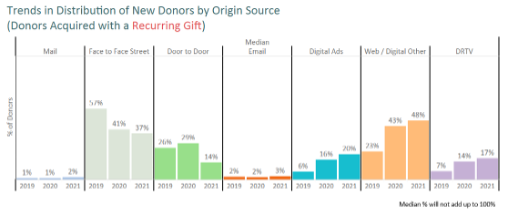

A big factor in the decline in share of sustainers among new donors in FY2021 was the pause in face to face and door to door canvassing brought on by the pandemic. Two-thirds of the organizations that use these channels (fifteen organizations in FY2020) experienced a decline in face to face/door to door-acquired donors in FY2021. Conversely, 21 participating organizations experienced at least some increase in donors acquired via digital channels. Digital channels have experienced the greatest growth both over time and in FY2021 for many organizations. For those that use it, Direct TV has also seen a lift in share of donors acquired in the last two years. (Figure 2)

Key topic of discussion for new donor acquisition

Most organizations are finding that the benefit of defaulting their online donation forms to a monthly gift option outweighs the cancellations that come through from donors who didn’t realize they were signing on for a recurring donation.

Some organizations have also looked to mitigate cancellations by adding a pop-up reiterating the donor is committing to a monthly gift, prompting donors to confirm their monthly gift choice, and/or bold labeling of donate tiles with “Give Monthly” type wording.

The data demonstrates that a Sustainer First strategy is clearly the way to go, but it might be challenging to get buy-in from leadership with the short-term loss in revenue. It’s important to be able to project and quantify the long-term gain.

Sustainer Retention

A concern at the onset of the pandemic was a potential increase in current sustainers cancelling their gifts considering the stay-at-home orders and subsequent economic hardship and uncertainties. As we’ve since learned, these fears were unfounded as donor retention rates were largely stable.

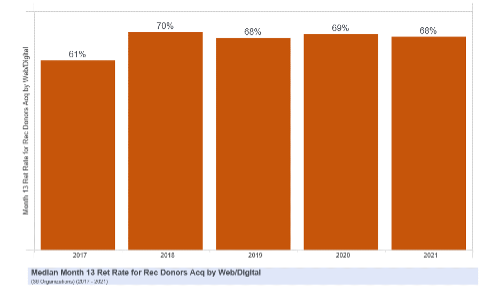

Overall 13th month retention rates for sustainers acquired in 2020 actually increased quite substantially (from 51% to 61%!), however, a closer examination reveals that this was largely driven by the decline in the number of recurring donors acquired via canvassing in 2020. These donors tend to retain at lower levels, so fewer of them in the mix means a lift in overall retention.

A more reliable year to year comparison might be for donors acquired as sustainers via digital channels. For these donors, 13th month retention rates were high and stable at 68%. (Figure 3)

A key take-away of note for sustainer retention was the re-emergence of annual sustainers or auto-renewals. With the improvements in credit card updaters and EFT expansion, these donors are proving to have high retention rates comparable or sometimes better than monthly donors. We will be watching these donors for upgrading and additional gift making trends.

Sustainer Stewardship

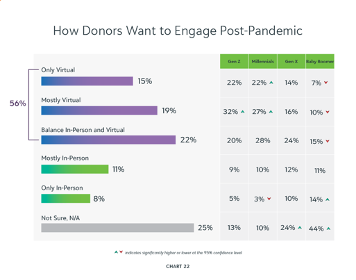

An area that was impacted by the stay-at-home orders was stewardship and the use of virtual spaces to cultivate donor relationships in place of in-person events and meetings. Many summit organizations reported on virtual events and expanded uses of other techniques that they hope to continue in a post-pandemic world in 2022 and beyond. This is in line with findings from the Blackbaud Institute’s Tipping Point: Aligning Supporters with a Changing World report that found that donors want to engage virtually with organizations post-Pandemic. (Figure 4)

Donor Upgrading

Encouraging on-going and deeper engagement will be key for retention of donors, but also for inspiring on-going donor upgrading. In 2021, the share of loyal, single gift donors that upgraded increased for the second year in a row, reaching 39%. This in turn was a key driver for the increase in the revenue per donor for this important segment. In years following extensive upgrading, downgrading is a likely trend. Taking steps to mitigate anticipated downgrades now is key for maintaining donor value in 2022.

Of course, the growth in loyal sustainer populations has also been a key driver for overall growth in donor value. Since 2017, the median number of donors making recurring gifts for 3 or more years in a row have increased by 80% and revenue from this important, loyal group of donors has increased by 117% over the same period.

Summary

The key themes for the 2021 Sustainer Summit are:

- Sustainers helped to create a strong foundation for steady revenue in FY21, due to investments made 3 or more years ago in sustainer acquisition.

- New donor acquisition in FY21 was a bumpy road with significant ups and downs across all organizations but for a variety of reasons:

- Channel disruption

- Channel investment

- Channel re-alignment

- While there were initial concerns in March 2020 that donor retention would drop, this has not materialized. Any shifts in retention are being largely driven by an increase in the number of donors available to retain.

- What to watch? Ongoing digital channel evolution and donor upgrades.